State Sales Tax Breadth and Reliance, Fiscal Year 2021

The sales tax is too important a part of states’ revenue toolkits to be permitted further erosion, making sales tax modernization a vital project of the 2020s.

17 min read

The sales tax is too important a part of states’ revenue toolkits to be permitted further erosion, making sales tax modernization a vital project of the 2020s.

17 min read

This legislative session, the sales tax on food has garnered a great deal of attention in Kansas, with policymakers on both sides of the aisle proposing the removal of groceries from the sales tax base.

7 min read

In times of inflation, a review of the tax code shows that some provisions are automatically indexed, or adjusted, to match inflation, while others are not. And that creates unfair burdens for taxpayers. But it’s not always as simple as just “adjusting for inflation.”

4 min read

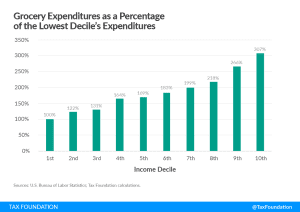

Exempting groceries from the sales tax base reduces economic efficiency without achieving its objective of enhancing tax progressivity.

19 min read

Kentucky is making commendable progress toward a more modern and competitive tax code, but more work on comprehensive tax reform should be prioritized next session.

7 min read

After a whirlwind of cuts and reforms in 2021, it looks like 2022 might be an even bigger year for state tax codes. Republican and Democratic governors alike used their annual State of the State addresses to call for tax reform, and there is already serious momentum from state lawmakers nationwide to get the job done.

3 min read

Tax relief can take many different forms, but not all tax cuts have the same effects. Ultimately, maintaining broad tax bases while reducing tax rates is a more neutral and less complex approach than further narrowing an already-narrow sales tax base.

Before declaring victory, it is imperative to get the details right. The latest proposal is a drastic improvement over the last one, but there is still more work to be done if the Magnolia State is to sustain the intended transformation.

7 min read

The Nebraska legislature has an excellent opportunity to make progress toward a simpler, stabler, less burdensome, and more competitive tax code.

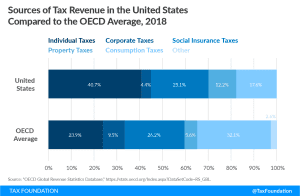

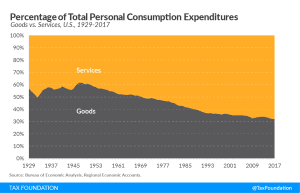

By failing to keep pace with modern consumption patterns, sales taxes have become less neutral, less equitable, and less economically efficient over time.

16 min read

We identify 13 of the highest tax reform priorities Nebraska policymakers should consider in their effort to create a more growth-friendly tax code. We also offer a sample comprehensive tax reform plan to show one way policymakers could begin tackling these objectives over the next couple legislative sessions, with further progress to be made in the years ahead.

8 min read

As states look for a path out of these fiscally troubling times, Louisiana has several options for aspects of its tax code to promote economic recovery and growth. The Pelican State’s federal deductibility, Corporation Franchise Tax, and sales tax structure present opportunities for beneficial tax reform in the wake of the coronavirus crisis.

3 min read

We examine whether excise taxes are a solution to budget deficits, and while the short answer to that question is no, there are of course nuances. Excise taxes can play a role in state revenues even as policymakers appreciate that excise taxes are not viable long-term revenue tools for general spending priorities.

21 min read