Budget Reconciliation: Tracking the 2025 Trump Tax Cuts

President Trump signed the One Big Beautiful Bill Act into law on July 4, 2025.

16 min readExplore our latest tax policy research, analysis, and commentary of the One Big Beautiful Bill Act (OBBB).

President Trump signed the One Big Beautiful Bill Act into law on July 4, 2025.

16 min read

We estimate the One Big Beautiful Bill Act would increase long-run GDP by 1.2 percent and reduce federal tax revenue by $5 trillion over the next decade on a conventional basis.

11 min read

The One Big Beautiful Bill Act makes many of the individual tax cuts and reforms of the TCJA permanent. It improves upon the TCJA by making expensing for R&D and equipment permanent. However, for the most part, it does not include further structural reforms, and instead introduces many new, narrow tax breaks to the code, adding complexity and raising revenue costs.

7 min read

Congress is racing to pass the One Big Beautiful Tax Bill before the July 4 deadline. In this episode, Kyle Hulehan and Erica York break down what just happened over the weekend, what’s actually in the bill, and what comes next as the House and Senate try to reconcile their differences.

Our preliminary analysis finds the tax provisions increase long-run GDP by 0.8 percent and reduce federal tax revenue by $4.0 trillion from 2025 through 2034 on a conventional basis before added interest costs.

9 min read

As the current tax package stands, the House’s use of temporary policy is leaving most of the economic growth opportunities on the table.

2 min read

Letting the SALT cap slip further upwards would undercut the TCJA’s long-term legacy, worsening the fiscal outlook of the tax package and providing an unneeded benefit to higher earners.

4 min read

Tax simplification has two aspects. The first is a code without a mess of targeted provisions for various social policy goals. The second is a code with provisions that are simple and easy to comply with. The bill succeeds at the first, but fails at the second.

7 min read

The US Ways and Means Committee’s “Big Beautiful Bill” includes a retaliatory provision called Section 899, along with an expansion of the base erosion and anti-abuse tax (BEAT).

7 min read

We break down the House GOP’s One, Big, Beautiful Bill—a sweeping tax package designed to extend key parts of the 2017 Tax Cuts and Jobs Act before they expire in 2026.

As lawmakers continue to debate the “One Big Beautiful Bill,” they should abandon temporary and complex policy in favor of simplicity and stability.

4 min read

The One Big Beautiful Bill is now law—but what does it actually do? In this episode, we break down the new tax law’s key provisions, including who benefits, who doesn’t, and what it means for the economy, tax certainty, and the federal deficit.

The One Big Beautiful Bill Act makes many of the individual tax cuts and reforms of the TCJA permanent. It improves upon the TCJA by making expensing for R&D and equipment permanent. However, for the most part, it does not include further structural reforms, and instead introduces many new, narrow tax breaks to the code, adding complexity and raising revenue costs.

7 min read

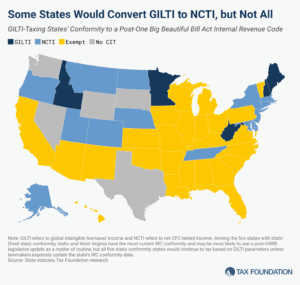

The One Big Beautiful Bill’s changes to the taxation of international income have surprising implications for state codes, yielding tax increases and a revised tax base that, through quirks of state incorporation, bears very little resemblance to the federal base and almost nothing of its purpose.

10 min read

Policymakers continue to debate international tax rules after the US gained agreement on a new approach at the G7 that could result in US anti-avoidance policies existing side-by-side with the global minimum tax.

4 min read

We estimate the One Big Beautiful Bill Act would increase long-run GDP by 1.2 percent and reduce federal tax revenue by $5 trillion over the next decade on a conventional basis.

11 min read

President Trump signed the One Big Beautiful Bill Act into law on July 4, 2025.

16 min read

The increased senior deduction with the phaseout would deliver a larger tax cut to lower-middle- and middle-income taxpayers compared to exempting all Social Security benefits from income taxation and would not weaken the trust funds as much. But given the temporary nature of the policy, it would increase the deficit-impact of the reconciliation bills without boosting long-run economic growth.

3 min read

We are living in an age of hyperbole, or as writer Matthew Hennessey calls it, the “Age of Excusability,” in which our politicians succeed by making outlandish claims. So it goes with the One Big Beautiful Bill, which will usher in a new golden age or send us down the tubes for good, depending on your sources.

Lawmakers should consider maintaining QBAI and applying the several billion dollars from the Senate’s change toward other pro-growth international tax reforms instead.

6 min read

Congress is racing to pass the One Big Beautiful Tax Bill before the July 4 deadline. In this episode, Kyle Hulehan and Erica York break down what just happened over the weekend, what’s actually in the bill, and what comes next as the House and Senate try to reconcile their differences.

Lawmakers are right to be concerned about deficits and economic growth. The best path to address those concerns is to ensure OBBB provides permanent full expensing of capital investment, avoids inefficient tax cuts, and offsets remaining revenue losses by closing tax loopholes and reducing spending.

8 min read

The Senate draft overall makes more changes to international tax policy than the House draft. On net the changes are positive.

8 min read

The Senate’s version of the OBBB restores the benefit of avoiding the SALT deduction cap with PTETs for all pass-through businesses, while placing new limits on the extent of the workarounds.

6 min read

The House-passed reconciliation bill leaves out Trump’s promise to eliminate taxes on Social Security benefits, opting instead to expand the standard deduction for seniors.

Senator Ted Cruz’s (R-TX) CREATE JOBS Act prioritizes permanence for the most cost-effective tax reforms—expensing and Neutral Cost Recovery (NCRS)—to boost growth in a relatively fiscally responsible way.

4 min read

If the federal government really wanted to make saving more accessible for taxpayers, it would swap the proposal for Trump Accounts to replace the complicated mess of savings accounts currently available with universal savings accounts.

4 min read

The final House bill makes impressive cuts to the IRA green energy tax credits, but it does so in part by introducing more complexity.

5 min read

President’s Trump’s policies would throw high-tax states a life raft as they swim against the tide—before potentially hitting all states with a tariff-induced economic tsunami that could force lawmakers’ hands and reverse recent tax relief.

Rather than permanently expanding a complicated, nonneutral tax break, Congress should prioritize permanence for the most neutral and pro-growth policies like bonus depreciation and R&D expensing.

6 min read

Our preliminary analysis finds the tax provisions increase long-run GDP by 0.8 percent and reduce federal tax revenue by $4.0 trillion from 2025 through 2034 on a conventional basis before added interest costs.

9 min read