Taxes and Interstate Migration: 2024 Update

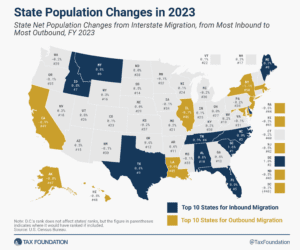

The latest IRS and Census data show that people and businesses favor states with low and structurally sound tax systems, which can impact the state’s economic growth and governmental coffers.

8 min read

The latest IRS and Census data show that people and businesses favor states with low and structurally sound tax systems, which can impact the state’s economic growth and governmental coffers.

8 min read

Do taxes affect individuals’ decisions regarding where to live and work? Can high taxes cause the outmigration of wealthy individuals?

5 min read

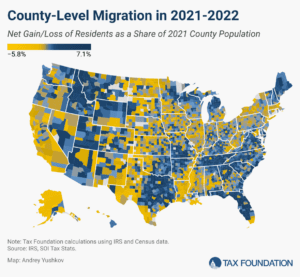

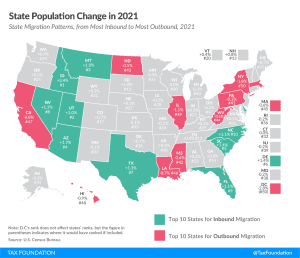

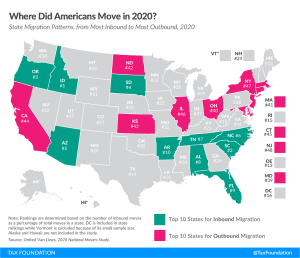

The pandemic has accelerated changes to the way we live and work, making it far easier for people to move—and they have. As states work to maintain their competitive advantage, they should pay attention to where people are moving, and try to understand why.

5 min read

Massachusetts’ competitive tax advantage in New England is driven primarily by its competitive individual income tax rate and its sales and use tax structure. If the Commonwealth changes its tax code in ways that narrow the base or increase the rate, it cedes greater tax competitiveness to other states, regionally and nationally.

34 min read

Every change to a state’s tax system makes its business tax climate more or less competitive compared to other states and makes the state more or less attractive to business.

7 min read

Research almost invariably shows a negative relationship between income tax rates and gross domestic product (GDP). Cuts to marginal tax rates are highly correlated with decreases in the unemployment rate.

26 min read

Before competing in the UEFA Champions League, football clubs in Europe also compete to lure the best players.

5 min read

The pandemic has accelerated changes in the way we live and work, making it far easier for people to move—and they have. As states work to maintain their competitive advantage, they should pay attention to where people are moving, and try to understand why.

6 min read

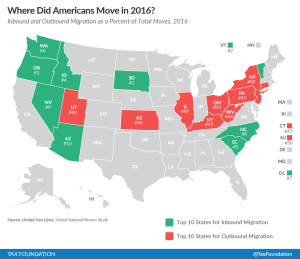

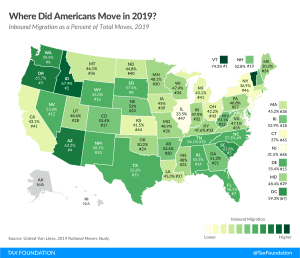

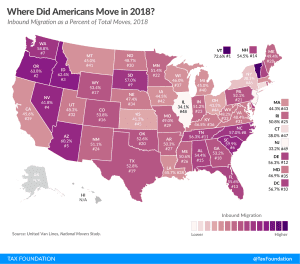

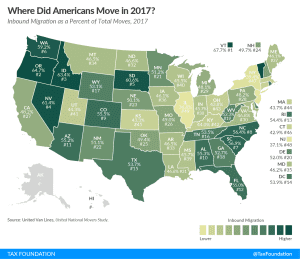

States compete with each other in a variety of ways, including in attracting (and retaining) residents. Sustained periods of inbound migration lead to (and reflect) greater economic output and growth. Prolonged periods of net outbound migration, however, can strain state coffers, contributing to revenue declines as economic activity and tax revenue follow individuals out of state.

4 min read

Individuals respond to taxes by changing their behavior. Hence, when there are tax differences between countries, some might respond by moving to a lower-tax area. For higher-income individuals, the benefits of moving as a result of higher taxes are greater because they have more income or wealth at stake.

4 min read

There are many ways that states can compete with one another for residents, and tax rates and structures should certainly be part of the conversation for states looking to attract new residents.

2 min read