All Related Articles

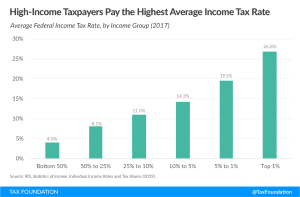

Income Taxes on the Top 0.1 Percent Weren’t Much Higher in the 1950s

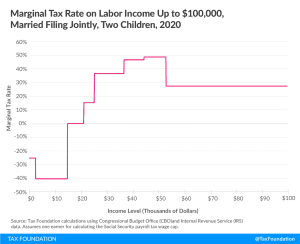

Recent plans to increase the tax burden on wealthy Americans, such as higher marginal income tax rates and wealth taxes, are flawed in several ways, including in their lack of understanding of tax history.

4 min read