The Impact of BEPS 1.0

The global landscape of international corporate taxation is undergoing significant transformations as jurisdictions grapple with the difficulty of defining and apportioning corporate income for the purposes of tax.

22 min read

The global landscape of international corporate taxation is undergoing significant transformations as jurisdictions grapple with the difficulty of defining and apportioning corporate income for the purposes of tax.

22 min read

Limiting interest deductibility continues to be a worthwhile policy goal, but given the current climate, policymakers should opt to pair any further limitations with other pro-growth policies such as full expensing to ensure firms’ incentives to invest are preserved.

3 min read

The House Ways and Means Committee has advanced a tax deal to the House floor that would temporarily—and retroactively—restore two major business deductions for cost recovery and expand the child tax credit through 2025.

10 min read

In Congress, both parties have expressed widespread support for improving the treatment of R&D and potentially extending some or all of the major business provisions, while the White House and congressional Democrats have indicated interest in an expanded child tax credit, suggesting potential for a deal.

6 min read

Lawmakers will have to weigh the economic, revenue, and distributional trade-offs of extending or making permanent the various provisions of the TCJA as they decide how to approach the upcoming expirations. A commitment to growth, opportunity, and fiscal responsibility should guide the approach.

18 min read

The global minimum tax agreement known as Pillar Two is intended to curb profit shifting. However, OECD countries already have a variety of mechanisms in place that seek to prevent base erosion and profit shifting by multinational corporations.

40 min read

As Congress continues its work on the fiscal year 2024 appropriations process and associated tax provisions, it should consider an often-overlooked tax provision: the limitation on deductions companies take for interest payments.

7 min read

While there is disagreement about the amount of interest that should be deductible, it’s clear that the limit based on EBIT makes the U.S. an outlier compared to other countries across the OECD while raising the cost of new investment.

7 min read

As Congress contemplates adding a new worldwide interest limitation rule as part of the House Build Back Better Act, it is useful to consider the potential effects of this proposal as well as whether it is necessary to add this on top of the U.S.’s existing restrictions on the value of interest deductions.

9 min read

The Build Back Better Act would raise taxes to pay for social spending programs. But the design of some of the tax increases may end up hurting private pensions, among other problems.

6 min read

As the House Ways and Means Committee continues working on the latest round of fiscal relief amid the pandemic, one curious provision in the legislation is a tax hike on multinational companies. One section of the legislation would repeal a provision in current law that allows U.S. multinationals to choose to allocate their interest costs on a worldwide basis (more on that in a moment).

4 min read

There is no good reason to eliminate interest deductions to permit expensing. Expensing is a key element of any tax system which seeks to put all economic activity on a level playing field.

9 min read

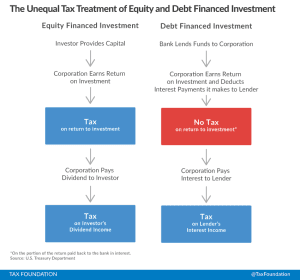

Interest deductibility creates holes in the tax base, distorts corporate investment strategies, and contributes to a potentially dangerous macroeconomic environment of overleveraging.

17 min read