Taxes, Fiscal Policy, and Inflation

Consumer prices rose by 7 percent in 2021, the highest annual rate of inflation since 1982. Where did this inflation come from and what might its impacts be? Tax and fiscal policy offer important clues.

5 min read

Consumer prices rose by 7 percent in 2021, the highest annual rate of inflation since 1982. Where did this inflation come from and what might its impacts be? Tax and fiscal policy offer important clues.

5 min read

While hoping for inflation’s continued decline, policymakers should finish the job and index the tax code to prepare for future bouts of high inflation and as a contingency in case it takes longer to defeat elevated inflation than expected.

4 min read

Inflation is often called a hidden tax, but in many states it yields a far more literal tax increase as tax brackets fail to adjust for changes in consumer purchasing power.

5 min read

While the U.S. tariffs were intended to protect American industries, they have largely hurt the U.S. economy. Rather than pass on the tariffs to Chinese consumers, analysis shows that most U.S. firms simply bore the costs.

5 min read

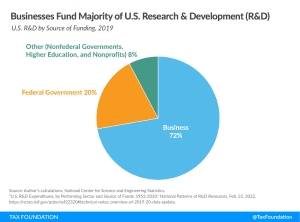

The ongoing economic uncertainty from the COVID-19 pandemic, supply chain disruptions, and current inflationary pressures have highlighted the importance of investment.

33 min read

Government-set pricing of prescription drugs is not a fix for today’s rampant inflation and further, it would give rise to new problems of its own.

6 min read

Tax reform has become a major focus for state legislatures this session, and Missouri lawmakers are tuned in to the action: after adjusting individual income tax triggers in 2021, the legislature is exploring further tax reform options.

6 min read

Total tax collections are currently running 25 percent higher than last year, and if that pattern holds, total federal tax collections will reach over $5 trillion in FY 2022—a new all-time high.

3 min read

In times of inflation, a review of the tax code shows that some provisions are automatically indexed, or adjusted, to match inflation, while others are not. And that creates unfair burdens for taxpayers. But it’s not always as simple as just “adjusting for inflation.”

4 min read

Lawmakers can be proud of the steps that they have taken toward a better tax code but should consider revisiting the design of the bill’s tax triggers in order to better accomplish their goal of responsible improvement.

6 min read

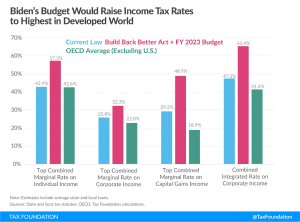

The FY 2023 budget proposes several new tax increases, which in combination with the Build Back Better Act, would give the U.S. the highest top tax rates on individual and corporate income in the developed world.

4 min read

In a letter to lawmakers, the 46th President said that his $5.8 trillion budget package would “[grow] our economy, while ensuring that the wealthiest Americans and the biggest corporations begin to pay their fair share.” We break down what the President is proposing for this upcoming fiscal year and what its impact would be on the U.S. economy in the face of record-high inflation.

The Biden administration should lift the Trump administration’s tariffs, as they have failed in their objective to bring better trading practices and instead brought about significant damage to U.S. businesses and workers.

6 min read

After a whirlwind of cuts and reforms in 2021, it looks like 2022 might be an even bigger year for state tax codes. Republican and Democratic governors alike used their annual State of the State addresses to call for tax reform, and there is already serious momentum from state lawmakers nationwide to get the job done.

3 min read

States are flush with cash, but taxpayers’ purchasing power is being eroded by high inflation. Tax rebates, gas tax holidays, and other temporary tax expedients have the potential to add to existing inflation—but good intentions do not always make for good policy.

5 min read

Households across the country are struggling with the effects of high inflation. Lawmakers in New Jersey are looking to combat an unlegislated tax increase by indexing the state’s individual income tax code for inflation, something all states should consider.

3 min read

Policymakers actively marginalized the manufacturing sector by saddling them with cost recovery rules that prevent them from deducting the full cost of investment in physical plant and equipment. Going forward, policymakers should avoid haphazard fixes, targeted measures, and protectionism.

50 min read

In a time of increased mobility and tax competition, a lower rate and simpler tax structure would help Georgia stand out among states. Lawmakers would be wise to consider reforming the state’s income tax to improve the state’s competitiveness.

3 min read

If policymakers are looking to change the tax code to help fight inflation, they should pump the brakes on the federal gas tax holiday and instead consider structural reforms to raise the economy’s productive capacity in the long term.

4 min read

By reducing the tax code’s current barriers to investment and saving and simplifying its complex rules, lawmakers would greatly enhance the ability of Americans to pursue new ideas, create more opportunities, and build financial security for themselves and their families.

40 min read