Inflation Reduction Act One Year After Enactment

Congress should reconsider key elements of the IRA, including the book minimum tax and the green energy credits, with an eye towards simplification and fiscal responsibility.

46 min read

Congress should reconsider key elements of the IRA, including the book minimum tax and the green energy credits, with an eye towards simplification and fiscal responsibility.

46 min read

Now is the time for lawmakers to focus on long-term fiscal sustainability, as further delay will only make an eventual fiscal reckoning that much harder and more painful. Congressional leaders should follow through on convening a fiscal commission to deal with the long-term budgetary challenges facing the country.

35 min read

One year after its enactment, there are concerns about the Inflation Reduction Acts overall fiscal impact, the additional complexity it introduces to the tax system, and the sustainability of its initiatives.

Fiscal pressures are likely to weigh heavily on lawmakers as they craft a tax reform package. That increased pressure could result in well-designed tax reform that prioritizes economic growth, simplicity, and stability, or it could encourage budget gimmicks and economically harmful offsets. Lawmakers should avoid the latter.

8 min read

Investment matters across the economy, and policymaking should reflect that.

4 min read

Broad, pro-investment tax policy matters for growth, and the US has plenty of opportunities to make improvements, particularly given the advantages our cross-Pacific rival confers on its firms.

5 min read

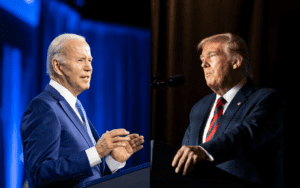

Trump’s tariff hikes would rank as the the largest tax increase outside of wartime since 1940. Meanwhile, Harris’s tax plan would rank as the 6th largest tax increase outside of wartime since 1940.

5 min read

How does tax policy shape a nation’s competitiveness? Today, we’re diving into the showdown between the US and China, exploring how China’s enticing tax incentives pose a formidable challenge to America’s economic supremacy.

On tax policy, Harris carries forward much of President Biden’s FY 2025 budget, including higher taxes aimed at businesses and high earners. She would also further expand the child tax credit (CTC) and various other tax credits and incentives while exempting tips from income tax.

17 min read

We estimate Trump’s proposed tariffs and partial retaliation from all trading partners would together offset more than two-thirds of the long-run economic benefit of his proposed tax cuts.

12 min read

While federal tax collections—especially corporate taxes—have reached historically high levels, these gains have not kept pace with escalating spending, particularly on debt interest, leading to a substantial and concerning budget deficit in FY24.

6 min read

Restoring expensing for R&D, machinery, and equipment; extending better cost recovery to structures investment; and avoiding raising the corporate tax rate would create a stronger, pro-investment policy environment for the US economy.

44 min read

The stakes for next year’s expiring tax provisions are quite high. If Congress does nothing, then 62 percent of households will see their taxes go up in January of 2026.

Lawmakers should consider compliance costs—not just tax liabilities—when evaluating reforms to business income taxation.

22 min read

While both President Biden and Vice President Harris aim their proposed tax hikes on businesses and high earners, key differences between their tax ideas in the past reveal where Harris may take her tax policy platform in the 2024 campaign.

6 min read

Project Apollo achieved its clear objective to put a man on the moon. But not all government spending projects are so simple (that is, if you consider flying a spaceship to the moon simple).

3 min read

From President Biden calling the Tax Cuts and Jobs Act the “largest tax cut in American history,” to former President Trump claiming that Biden “wants to raise your taxes by four times,” the campaign rhetoric on taxes may be sparking some confusion.

5 min read

A higher tax burden for private infrastructure investments like wireless spectrum, 5G technology, and machinery and equipment makes an existing problem worse—especially against the backdrop of outright state subsidies in countries like China.

6 min read

The Treasury Department recently touted strong business investment in the years following the pandemic-driven recession and pointed to the Biden administration’s industrial policies in the Inflation Reduction Act and CHIPS Act as key drivers.

7 min read

As members of Congress prepare to address the expiration of the TCJA, they should appreciate how revenues have evolved since 2017.

4 min read

President Biden is proposing extraordinarily large tax hikes on businesses and the top 1 percent of earners that would put the US in a distinctly uncompetitive international position and threaten the health of the US economy.

19 min read

Over the next 10 years, the IRA’s energy tax credits are projected to cost north of $1 trillion, adding to the federal government’s budgetary challenges and burgeoning debt.

6 min read

Lawmakers should aim for policies that support investment and hiring in the United States and refining anti-avoidance measures to improve administrability and lower compliance costs.