All Related Articles

Georgia Income Tax Reform Would Improve Standing Among Neighbors, Country

In a time of increased mobility and tax competition, a lower rate and simpler tax structure would help Georgia stand out among states. Lawmakers would be wise to consider reforming the state’s income tax to improve the state’s competitiveness.

3 min read

Federal Gas Tax Holiday? Suspending the Gas Tax Is a Mistake

If policymakers are looking to change the tax code to help fight inflation, they should pump the brakes on the federal gas tax holiday and instead consider structural reforms to raise the economy’s productive capacity in the long term.

4 min read

10 Tax Reforms for Growth and Opportunity

By reducing the tax code’s current barriers to investment and saving and simplifying its complex rules, lawmakers would greatly enhance the ability of Americans to pursue new ideas, create more opportunities, and build financial security for themselves and their families.

40 min read

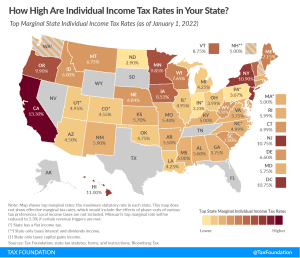

State Individual Income Tax Rates and Brackets, 2022

Individual income taxes are a major source of state government revenue, accounting for more than a third of state tax collections:

28 min read

Mississippi Nears Income Tax Repeal but Additional Work Is Necessary

Before declaring victory, it is imperative to get the details right. The latest proposal is a drastic improvement over the last one, but there is still more work to be done if the Magnolia State is to sustain the intended transformation.

7 min read

Taxes, Fiscal Policy, and Inflation

Consumer prices rose by 7 percent in 2021, the highest annual rate of inflation since 1982. Where did this inflation come from and what might its impacts be? Tax and fiscal policy offer important clues.

5 min read

2022 Tax Brackets

The IRS recently released the new inflation adjusted 2022 tax brackets and rates. Explore updated credits, deductions, and exemptions, including the standard deduction & personal exemption, Alternative Minimum Tax (AMT), Earned Income Tax Credit (EITC), Child Tax Credit (CTC), capital gains brackets, qualified business income deduction (199A), and the annual exclusion for gifts.

5 min read

As Inflation Rises, So Will Tax Bills in Many States

Inflation is often called a hidden tax, but in many states it yields a far more literal tax increase as tax brackets fail to adjust for changes in consumer purchasing power.

5 min read

Should Tax Policy Play a Role in Tobacco Harm Reduction?

In an effort to raise roughly $100 billion, the House proposal would double cigarette taxes and increase all other tobacco and nicotine taxes to comparable rates—a strategy with severe unintended consequences.

5 min read

How the Tax Code Handles Inflation (and How It Doesn’t)

While parts of the U.S. tax code can handle inflation, full expensing of capital investment would be a major improvement along these lines.

5 min read

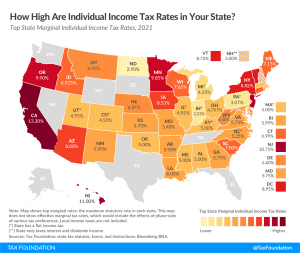

State Individual Income Tax Rates and Brackets, 2021

Individual income taxes are a major source of state government revenue, accounting for 37 percent of state tax collections in fiscal year (FY) 2017. Several states had notable individual income tax changes in 2020: Arizona, Arkansas, Massachusetts, Michigan, Minnesota, North Carolina, Ohio, Tennessee, Virginia, and Wisconsin.

22 min read

Answering Four Questions About How Neutral Cost Recovery Works in Practice

A neutral cost recovery system lowers the short-term cost of the policy to the federal government while providing nearly equivalent economic benefits. While neutral cost recovery is not a new idea, there are several policy questions lawmakers will want to consider when designing this system.

6 min read

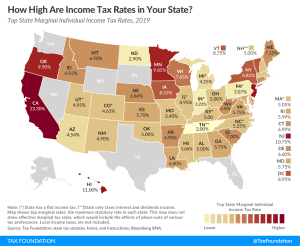

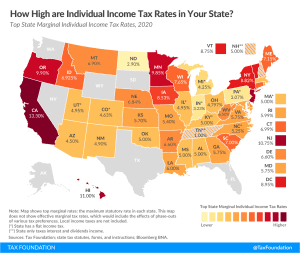

State Individual Income Tax Rates and Brackets, 2020

Individual income taxes are a major source of state government revenue, accounting for 37 percent of state tax collections in fiscal year (FY) 2017. Several states had notable individual income tax changes in 2020: Arizona, Arkansas, Massachusetts, Michigan, Minnesota, North Carolina, Ohio, Tennessee, Virginia, and Wisconsin.

9 min read