As Inflation Rises, So Will Tax Bills in Many States

Inflation is often called a hidden tax, but in many states it yields a far more literal tax increase as tax brackets fail to adjust for changes in consumer purchasing power.

5 min read

Inflation is often called a hidden tax, but in many states it yields a far more literal tax increase as tax brackets fail to adjust for changes in consumer purchasing power.

5 min read

In an effort to raise roughly $100 billion, the House proposal would double cigarette taxes and increase all other tobacco and nicotine taxes to comparable rates—a strategy with severe unintended consequences.

5 min read

While parts of the U.S. tax code can handle inflation, full expensing of capital investment would be a major improvement along these lines.

5 min read

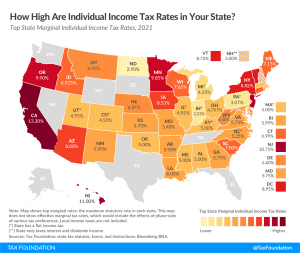

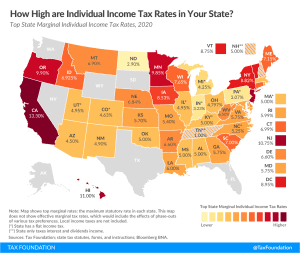

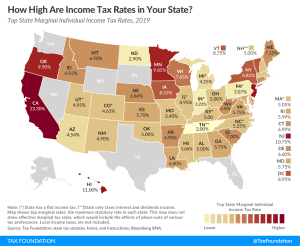

Individual income taxes are a major source of state government revenue, accounting for 37 percent of state tax collections in fiscal year (FY) 2017. Several states had notable individual income tax changes in 2020: Arizona, Arkansas, Massachusetts, Michigan, Minnesota, North Carolina, Ohio, Tennessee, Virginia, and Wisconsin.

22 min read

A neutral cost recovery system lowers the short-term cost of the policy to the federal government while providing nearly equivalent economic benefits. While neutral cost recovery is not a new idea, there are several policy questions lawmakers will want to consider when designing this system.

6 min read

Individual income taxes are a major source of state government revenue, accounting for 37 percent of state tax collections in fiscal year (FY) 2017. Several states had notable individual income tax changes in 2020: Arizona, Arkansas, Massachusetts, Michigan, Minnesota, North Carolina, Ohio, Tennessee, Virginia, and Wisconsin.

9 min read

Many elements of the income tax are adjusted for inflation, such as tax brackets, but the purchase price of assets that are later sold for capital gains or losses is not. Here’s the case for changing that.

17 min read