All Related Articles

Louisiana Voters Have Chance to Simplify Taxes and Lower Burdens

Passage of Louisiana Amendments 1 and 2, which are aimed at the sales tax and individual and corporate income taxes, respectively, would substantially simplify the Pelican State’s tax code and provide tax relief in both the short and long term.

8 min read

New Jersey May Be the First State Without an Excise Tax Levy on Recreational Marijuana

New Jersey’s tax design adds another element to the ongoing experiment with legal recreational marijuana in the states.

3 min read

Election Analysis: California and Colorado Voters Resist Temptation to Shift More of Property Tax Burden to Businesses

In Tuesday’s election, voters in two states—California and Colorado—were tasked with deciding whether to amend their states’ constitution to change how the property tax burden is distributed. In many ways, the ballot measures were mirror images of each other, but the outcomes were similar.

3 min read

Election Analysis: Why Voters Split the Difference on Income Tax Measures

Illinois voters rejected a high graduated rate income tax (“Fair Tax”) while Arizonans embraced a large income tax rate increase for high earners, among the many attention-grabbing results from Tuesday’s elections.

7 min read

Election Analysis: Recreational Marijuana Now Legal in Four More States

Voters in four states, Arizona, Montana, New Jersey, and South Dakota, approved ballot measures legalizing recreational marijuana.

7 min read

2020 State Tax Ballot Initiatives and the Future of State Tax Policy

They may not draw as much attention as elections for office, but Election Day 2020 will also feature a number of important votes on tax-related ballot initiatives in states around the country. What are the ballot measures taxpayers should be paying attention to this year and what could they mean for the future of state tax policy? Tax Foundation Vice President of State Projects Jared Walczak and Senior Policy Analyst Katherine Loughead break down measures ranging from recreational marijuana legalization in New Jersey and Montana to income tax increases in Illinois and Arizona.

Arizona Proposition 208 Threatens Arizona’s Status as a Destination for Interstate Migration

Significantly raising the income tax through Proposition 208 will only serve to make Arizona less competitive, especially at a time when individuals and small businesses are already struggling. If Arizona is looking for a long-term way to increase education funding, it would do well to avoid overburdening struggling taxpayers and look toward more broad-based, stable sources of revenue.

5 min read

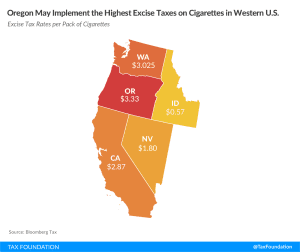

Taxation of Tobacco and Vapor Products on the Ballot in Oregon

Oregon’s Measure 108 introduces a risk of increased tax avoidance and evasion activity as consumers of the products often procure cigarettes from lower tax jurisdictions. At $3.33 per pack, Oregon would have the highest excise tax on cigarettes in the region.

5 min read

State and Local Tax Ballot Measures to Watch on Election Day 2020

Here are the state tax ballot measures to watch on Election Day 2020. Explore the most notable 2020 state tax ballot measures in 15 states.

4 min read

Colorado Proposition 116: Will Voters Reduce the State Income Tax Rate?

This Election Day, Colorado voters will weigh in on Proposition 116, which would permanently reduce the state’s flat income tax rate from 4.63 to 4.55 percent.

2 min read

Colorado Voters to Decide Fate of Longstanding Property Tax Limit

One of the many policy questions Colorado voters will be tasked with deciding this November is whether to amend the state constitution to repeal the Gallagher Amendment, a provision within the Colorado constitution that, since 1982, has limited residential property to 45 percent of the statewide property tax base. Repealing the Gallagher Amendment would cause residential property taxes to rise over time but would also enhance the neutrality and overall competitiveness of the tax code.

4 min read

Voters in Four States to Vote on Recreational Marijuana

Legalizing recreational marijuana is a hot topic in many states where the state budgets are in disarray because of the coronavirus pandemic and new revenue sources are being sought.

7 min read

Split Roll Initiative in California Threatens Property Tax Limitations on Commercial Real Estate

On Election Day this year, California voters will vote on Proposition 15, a ballot measure that would create a “split roll” property tax system in the Golden State, increasing taxes on just commercial property by $8 billion to $12.5 billion.

15 min read