Fiscal Forum: Future of the EU Tax Mix with Dr. Monika Köppl-Turyna

Tax Foundation Europe’s Sean Bray interviews Dr. Monika Köppl-Turyna, director of the EcoAustria Institute for Economic Research, about the future of the EU tax mix.

14 min read

Tax Foundation Europe’s Sean Bray interviews Dr. Monika Köppl-Turyna, director of the EcoAustria Institute for Economic Research, about the future of the EU tax mix.

14 min read

Tax Foundation Europe’s Sean Bray had the opportunity to interview Dr. Stefanie Geringer, a postdoctoral researcher at the Faculty of Law at the University of Vienna and Masaryk University Brno, a certified tax advisor and manager of tax at BDO Austria, about the future of the EU tax mix.

14 min read

Tax Foundation Europe’s Sean Bray had the opportunity to interview Dr. Dominika Langenmayr, Professor of Economics at Catholic University of Eichstätt-Ingolstadt, about the future of the EU tax mix.

15 min read

Tax Foundation Europe’s Sean Bray had the opportunity to interview Professor of International Taxation at the University of Mannheim Business School, Christoph Spengel, about the future of the EU tax mix.

15 min read

An update to the EU’s Excise Tax Directive that embraces harm reduction principles would save lives and provide a steady stream of revenue to support public health expenditures.

22 min read

The agreement represents a major change for tax competition, and many countries will be rethinking their tax policies for multinationals. If there is no agreement on changes to Pillar Two or digital services taxes, retaliatory American tariffs could be on the horizon.

8 min read

The next government needs to prioritize measures to improve Germany’s competitiveness as an investment location.

7 min read

In a recent survey regarding companies’ barriers to conducting business in the EU single market, VAT ranked first. Policymakers should invest in reforming VAT systems to close both compliance and policy gaps in ways that improve the overall efficiency of their tax systems.

7 min read

As the third-largest economy in the world, with an influential voice within EU policymaking, and the United States among its most important trading partners, Germany’s next government will play a particularly important role in deciding the direction of European tax, trade, and transatlantic policy.

6 min read

In a recent speech at the Davos Economic Forum, European Commission President Ursula von der Leyen announced plans to create a single set of rules for corporate law, insolvency, labor law, and taxation, under which companies could seamlessly operate across the European Single Market.

7 min read

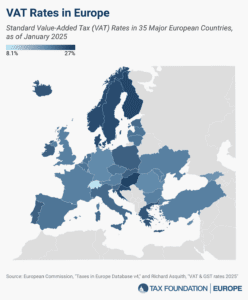

More than 175 countries worldwide—including all major European countries—levy a value-added tax (VAT) on goods and services. EU Member States’ VAT rates vary across countries, though they’re somewhat harmonized by the EU.

5 min read

With war continuing in Ukraine, political instability in France and Germany, and the return of Donald Trump to the White House, this could be a year of major realignment for Europe. The tax policy mindset in Brussels should shift accordingly.

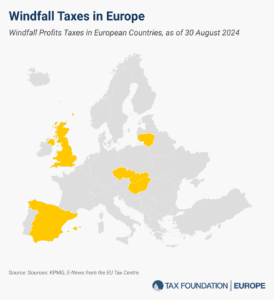

The flawed design of these windfall profits taxes has created problems in countries that implemented them.

4 min read

A few European countries have made changes to their VAT rates, including the Czech Republic, Estonia, Switzerland, and Turkey.

3 min read

A multilateral agreement that eliminates digital services taxes would be valuable, but not if it introduces more complexity and leaves unanswered many questions about the impacts on the U.S. tax base.

The EU Tax Observatory has taken an extreme view in assessing the global minimum tax. The rules were not meant to immediately reduce the stock of shifted profits or align profitability levels more closely with employment costs. The rules do change incentives for multinationals, but profits may continue to remain in low-tax jurisdictions for many years.

6 min read

While existing carbon taxes are a step towards the right direction in addressing climate change and incentivizing reductions in emissions, there is considerable room for improvement to reach the ideal theoretical carbon tax model.

59 min read

The OECD recently released a trove of new documents on a draft multilateral tax treaty. The U.S. Treasury has opened a 60-day consultation period for the proposal and is requesting public review and input.

7 min read

For many Italian banks, there hasn’t been a significant “windfall” to tax. The profit margins of Italian banks have been lower compared to other industries for the past two decades.

5 min read

The EU’s recent VAT reform is an example of a win for governments, consumers, and companies. Charting a new path toward a more successful tax system.

4 min read