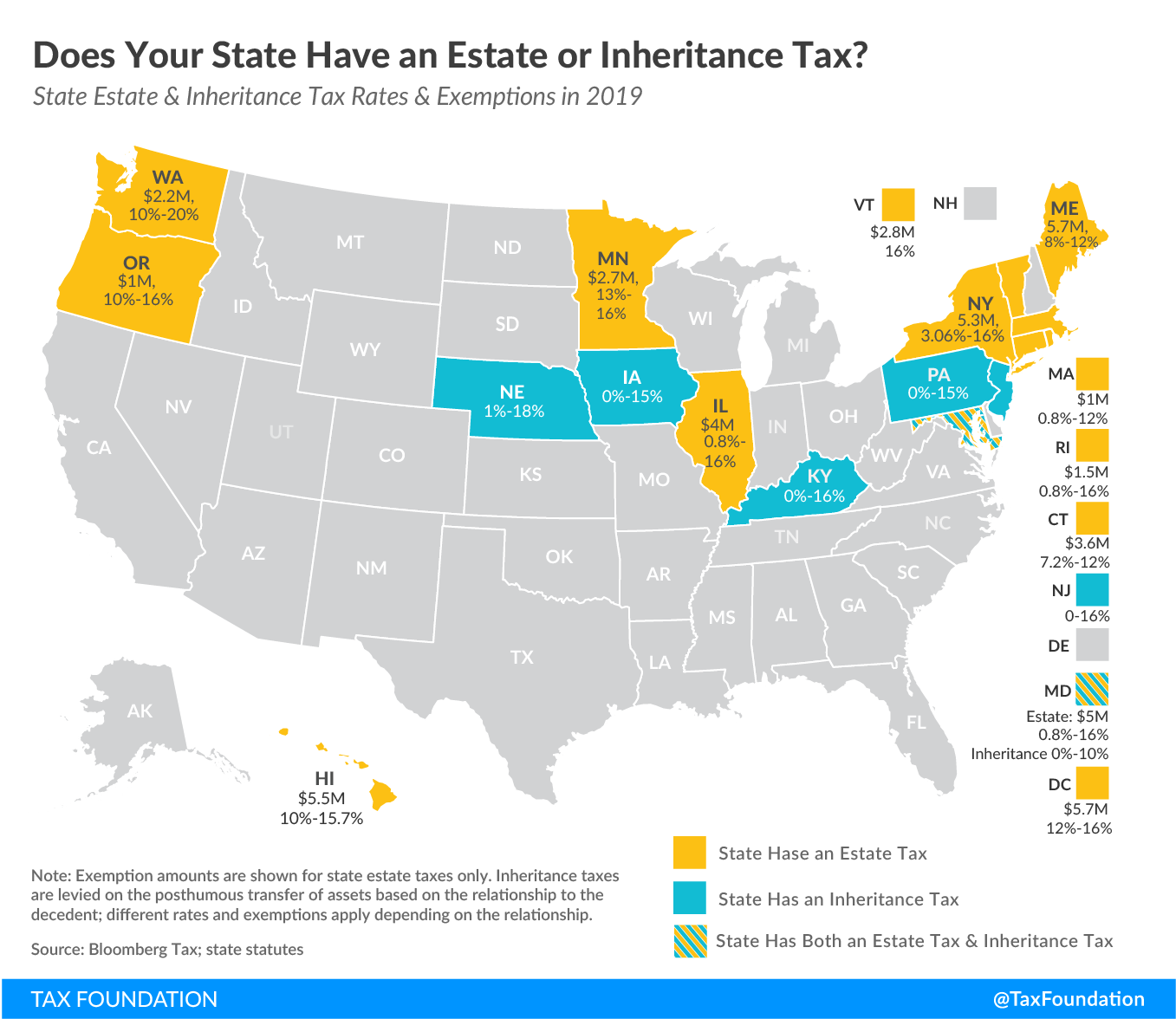

In addition to the federal estate taxAn estate tax is imposed on the net value of an individual’s taxable estate, after any exclusions or credits, at the time of death. The tax is paid by the estate itself before assets are distributed to heirs. of 40 percent, some states levy an additional estate or inheritance taxAn inheritance tax is levied upon an individual’s estate at death or upon the assets transferred from the decedent’s estate to their heirs. Unlike estate taxes, inheritance tax exemptions apply to the size of the gift rather than the size of the estate. . Twelve states and the District of Columbia impose estate taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. es and six impose inheritance taxes. Maryland is the only state to impose both.

Washington State’s 20 percent rate is the highest estate tax rate in the nation, although Hawaii is set to increase its top rate to 20 percent effective January 1, 2020. Eight states and the District of Columbia are next with a top rate of 16 percent. Massachusetts has the lowest exemption level at $1 million, and D.C. has the highest exemption level at $5.68 million.

Of the six states with inheritance taxes, Nebraska has the highest top rate at 18 percent. Maryland imposes the lowest top rate at 10 percent. All six states exempt spouses, and some fully or partially exempt immediate relatives.

In 1926, the federal government began offering a generous federal credit for state estate taxes, meaning taxpayers were paying the same amount in estate taxes whether or not their state levied the tax. This made estate and inheritance taxes an attractive option for states. After the federal government fully phased out the state estate tax creditA tax credit is a provision that reduces a taxpayer’s final tax bill, dollar-for-dollar. A tax credit differs from deductions and exemptions, which reduce taxable income, rather than the taxpayer’s tax bill directly. , some states stopped collecting estate taxes by default, as their provisions were directly linked with the federal credit, while others responded by repealing their tax legislatively.

Most states have been moving away from estate or inheritance taxes or have raised their exemption levels, as estate taxes without the federal exemption hurt a state’s competitiveness. New Jersey finished phasing out its estate tax last year, and now only imposes an inheritance tax. Delaware repealed its estate tax in 2018.

In the Tax Cuts and Jobs Act, the federal government raised the estate tax exclusion from $5.49 million to $11.2 million per person, though this provision expires December 31, 2025.

Estate and inheritance taxes are burdensome. They disincentivize business investment and can drive high-net-worth individuals out-of-state. They also yield estate planning and tax avoidance strategies that are inefficient, not only for affected taxpayers, but for the economy at large. The handful of states that still impose them should consider eliminating them or at least conforming to federal exemption levels.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe