Among the many achievements in the illustrious career of former Sen. Orrin Hatch (R-UT), who passed away Saturday at 88, was his commitment to tax reform. The longest-serving Republican senator in history helped shepherd passage of the TaxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. Cuts and Jobs Act of 2017, when he was chairman of the Senate Finance Committee.

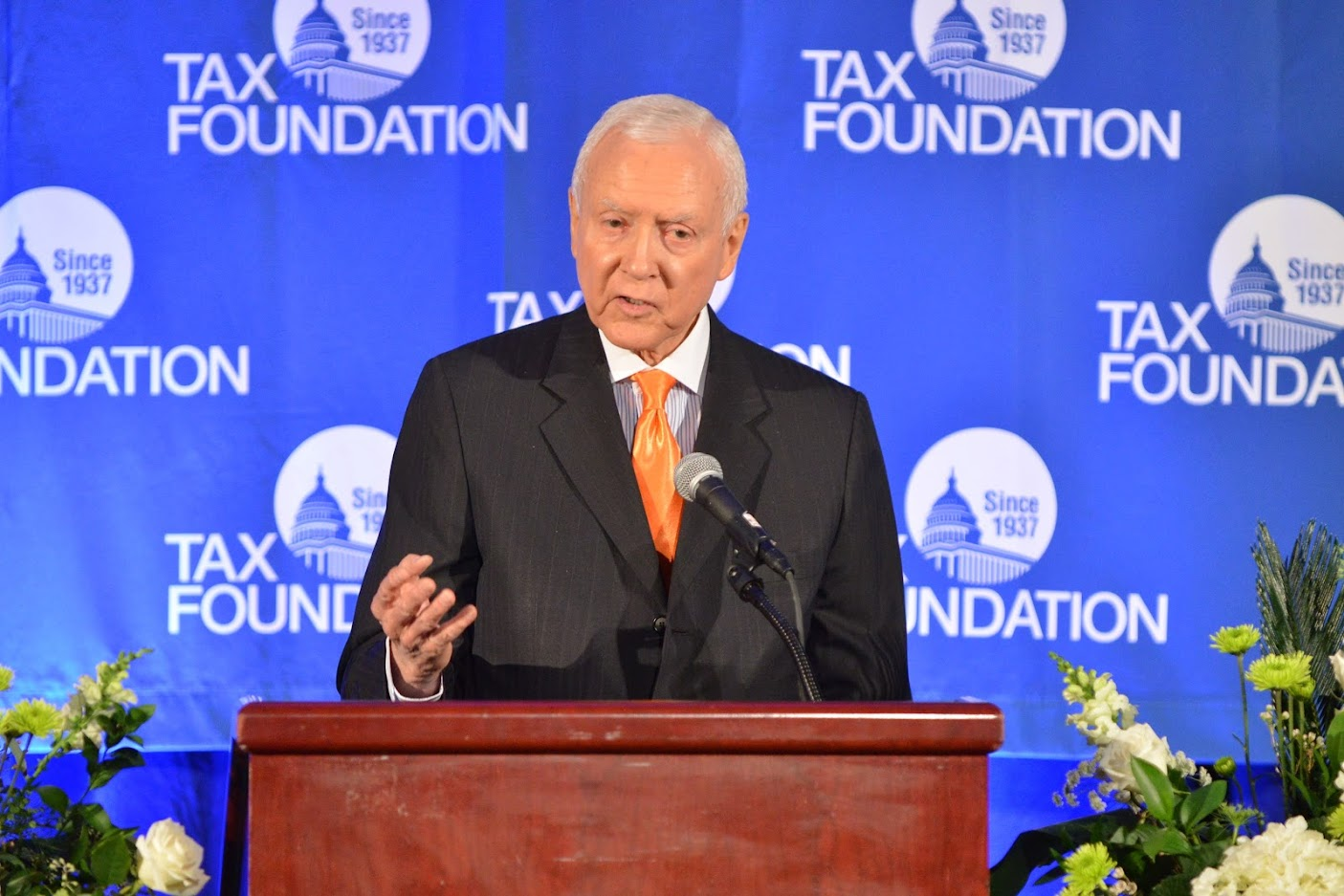

The Tax Foundation honored Sen. Hatch in 2013 with its Distinguished Service Award for his legacy of working for bipartisan tax reform. In inviting him to accept the award, Tax Foundation President Scott Hodge highlighted that the Senator would be joining a prestigious fraternity of past recipients, including Presidents Dwight Eisenhower and George W. Bush, economists like Paul Volcker, Senators John Breaux (D-LA), Connie Mack (R-FL), and Ron Wyden (D-OR), and Rep. Kevin Brady (R-TX).

In his letter, Mr. Hodge stressed a value that countless others have fondly recalled since Sen. Hatch’s death: an unwavering commitment to bipartisanship.

“Our Board specifically noted the importance of highlighting your bipartisan leadership in promoting fundamental tax reform and a more competitive U.S. tax system,” Hodge wrote in 2013. “We appreciate the courage it takes to look at the tax system as a blank slate and challenge the established interests. Like you, we believe that reforming the tax system is key to a more prosperous America.”

During his four-decade tenure in the U.S. Senate, Sen. Hatch was a stalwart for free trade and sound tax policy while boasting a notable legacy on health care. Working with colleagues on both sides of the aisle, he is credited with helping create the Children’s Health Insurance Program (CHIP), spurring legislation that has made generic drugs more readily available, and extending programs that help free trade deals become law more quickly.

Sen. Hatch helmed the Senate Finance Committee in 2017, helping shape and shepherd through the final version of the most substantial rewrite of the U.S. tax code in over 30 years, the Tax Cuts and Jobs Act (TCJA). The TCJA cut the corporate tax rate from 35 percent to a more globally competitive 21 percent, lowered individual income taxAn individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or household earns. The U.S. imposes a progressive income tax where rates increase with income. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment. Though barely 100 years old, individual income taxes are the largest source of tax revenue in the U.S. rates for all taxpayers, doubled the standard deductionThe standard deduction reduces a taxpayer’s taxable income by a set amount determined by the government. Taxpayers who take the standard deduction cannot also itemize their deductions; it serves as an alternative. , and put limitations on the state and local tax deduction. The law also increased the Child Tax Credit, repealed the Affordable Care Act’s individual mandate, and repealed the corporate alternative minimum tax.

President Joe Biden, upon learning of Sen. Hatch’s death, spoke fondly of his late colleague. “[The] greatest perk one has as a Senator was access to people with serious minds, a serious sense of purpose, and who cared about something. That was Orrin,” President Biden said. “He was, quite simply, an American original.”

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe