Prohibition by Price

Step into the shadows of illicit trade where taxation, incentives, and criminal networks intersect to fuel the lucrative cigarette smuggling market.

Step into the shadows of illicit trade where taxation, incentives, and criminal networks intersect to fuel the lucrative cigarette smuggling market.

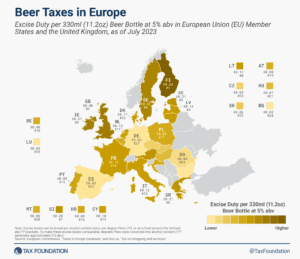

As Oktoberfest celebrations kick off around the world, let’s look at how much tax European Union (EU) countries add to the world’s favorite alcoholic beverage.

2 min read

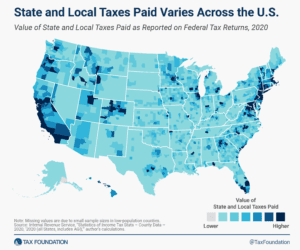

Any move to repeal the cap or enhance the deduction would disproportionately benefit higher earners, making the tax code more regressive.

5 min read

As Congress continues its work on the fiscal year 2024 appropriations process and associated tax provisions, it should consider an often-overlooked tax provision: the limitation on deductions companies take for interest payments.

7 min read

Now is the time for lawmakers to focus on long-term fiscal sustainability, as further delay will only make an eventual fiscal reckoning that much harder and more painful. Congressional leaders should follow through on convening a fiscal commission to deal with the long-term budgetary challenges facing the country.

35 min read

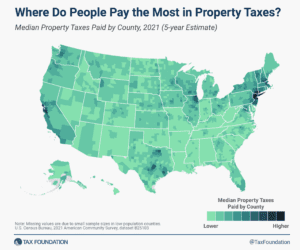

Property taxes are the primary tool for financing local governments and generate a significant share of state and local revenues.

6 min read

The Spanish election results are moving the country away from pro-growth tax reforms while launching the government’s tax agenda, and the agenda of the Spanish presidency of the Council of the European Union, into uncertainty.

7 min read

Policymakers at all levels of government should avoid the pitfalls of incentives. Instead, they should focus on creating a more efficient, neutral, and structurally sound tax code to the benefit of all types of business investment.

6 min read

Congress should recognize that Pillar Two has significant U.S.-specific downsides, but also that it cannot unilaterally stop Pillar Two from taking effect. Instead, it should carefully consider a policy response for the next Congress, when a variety of forces are likely to compel it to act.

7 min read

Politicians often bemoan the trade deficit, but their disdain for this economic statistic is largely misplaced. The trade deficit reflects deeper choices about how we use our money, and reducing it may require lowering our standard of living.

4 min read