Benefits of Principled Tax Policy: EU VAT Reform Results

The EU’s recent VAT reform is an example of a win for governments, consumers, and companies. Charting a new path toward a more successful tax system.

4 min read

The EU’s recent VAT reform is an example of a win for governments, consumers, and companies. Charting a new path toward a more successful tax system.

4 min read

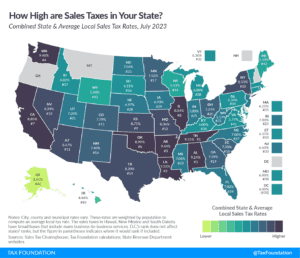

Compare the latest 2023 sales tax rates as of July 1st. Sales tax rate differentials can induce consumers to shop across borders or buy products online.

8 min read

Enhancing the European Union’s competitiveness is necessary, but the European Commission’s latest attempt is the wrong approach.

4 min read

It is hard to imagine the IRS Direct e-File Program operating seamlessly with the complexity of the current U.S. tax system. Instead, lawmakers should first address the more fundamental problem that causes taxpayer frustration: our highly complicated tax code.

4 min read

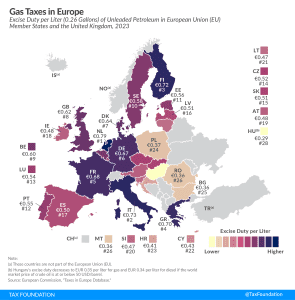

As the EU pursues massive changes in public policy as part of its green transition, expect fuel taxes to be central to any policy discussions.

5 min read

The European Commission proposed a new source of revenue as part of its second basket of own resources: a “temporary statistical own resource based on company profits.” This is an attempt to bolster the EU’s budget as it repays its debt.

5 min read

Given that wealth taxes collect little revenue and have the potential to disincentivize entrepreneurship and investment, perhaps European countries should repeal them rather than implement one across the continent.

4 min read

As fans around the world anticipate the final adventure of Indiana Jones, let’s embark on our own excursion to unravel the mysteries of taxing treasure.

3 min read

This tax reform plan would boost long-run GDP by 2.5%, grow wages by 1.4%, and add 1.3M jobs, all while collecting a similar amount of tax revenue as the current code and reducing the long-run debt burden.

38 min read

Reviewing reported income helps to understand the composition of the federal government’s revenue base and how Americans earn their taxable income. The individual income tax, the federal government’s largest source of revenue, is largely a tax on labor.

10 min read