Pro-Growth Tax Reform for Oklahoma

Our new study identifies a number of deficiencies in Oklahoma’s tax code and outlines possible solutions for reform that would create a more neutral tax code and encourage long-term growth in the state.

6 min read

Our new study identifies a number of deficiencies in Oklahoma’s tax code and outlines possible solutions for reform that would create a more neutral tax code and encourage long-term growth in the state.

6 min read

The nicotine tax proposal in the Build Back Better Act neglects sound excise tax policy design and by doing so risks harming public health. Lawmakers should reconsider this approach to nicotine taxation.

8 min read

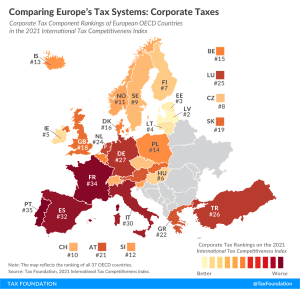

According to the corporate tax component of the 2021 International Tax Competitiveness Index, Latvia and Estonia have the best corporate tax systems in the OECD.

3 min read

Through 10 ballot measures across four states—Colorado, Louisiana, Texas, and Washington—voters will decide significant questions of state tax policy.

7 min read

Austria should not shy from lowering the corporate income tax rate sooner or even implementing a more ambitious tax reform to improve its tax competitiveness and contribute to greater economic growth.

3 min read

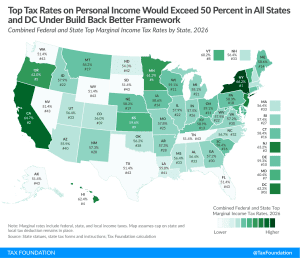

Under the latest iteration of the House Build Back Better Act (BBBA), the average top tax rate on personal income would reach 57.4 percent, giving the U.S. the highest rate in the Organisation for Economic Co-operation and Development (OECD).

2 min read

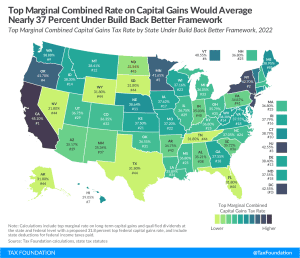

Under the Build Back Better framework, six states and D.C. would face combined top marginal capital gains tax rates of more than 40 percent, nearing the top rate among OECD countries.

3 min read

The intentions behind federal deductibility are undoubtedly pro-taxpayer. Unfortunately, that is not what happens in practice. Tax liability is not reduced. It is distorted.

7 min read

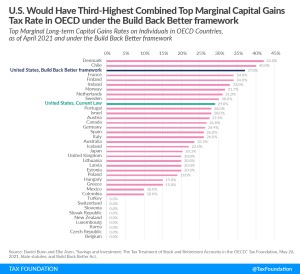

Under the new Build Back Better framework, the United States would tax capital gains at the third-highest top marginal rate among rich nations, averaging nearly 37 percent.

1 min read