Arkansas’s Rate Reduction Acceleration

Arkansas recently became the 13th state to authorize an individual income tax rate reduction this year. This round of tax cuts accelerated reforms enacted eight months ago.

7 min read

Arkansas recently became the 13th state to authorize an individual income tax rate reduction this year. This round of tax cuts accelerated reforms enacted eight months ago.

7 min read

Pillar One Amount A is meant to reallocate taxable profits of large multinationals, mitigate double taxation of profits, and avoid a harmful tax and trade war.

The Internal Revenue Service (IRS) finds itself under fire often. Outdated technology, millions of unanswered calls, and cafeterias full of paper returns—it’s clear that America’s tax collector needs improvement. Jesse is joined by Courtney Kay-Decker and Jared Ballew, chair and vice chair (respectively) of the Electronic Tax Administration Advisory Committee (ETAAC). They discuss ETAAC’s annual report that lays out what the IRS is doing right, and what it’s doing wrong, as the agency continues to see its duties grow.

The Inflation Reduction Act increases the IRS’s budget by roughly $80 billion over 10 years. The money is broken into four main categories—enforcement, operations support, business system modernization, and taxpayer services—as well as a few other small items such as an exploratory study on the potential of a free-file system.

6 min read

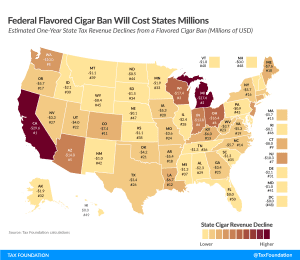

The FDA’s proposal to ban flavored cigars would carry significant revenue implications for many state governments.

7 min read

The Japanese tax and benefit system comes with trade-offs that policymakers must keep in mind when planning to reform the tax policy.

7 min read

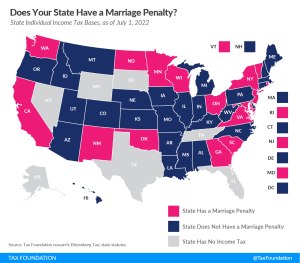

A marriage penalty exists when a state’s income brackets for married taxpayers filing jointly are less than double the bracket widths that apply to single filers. In other words, married couples who file jointly under this scenario have a higher effective tax rate than they would if they filed as two single individuals with the same amount of combined income.

3 min read

The Inflation Reduction Act calls for a new 1 percent excise tax on stock buybacks, the argument being it would be better for the economy if firms invested their surplus cash in the business, rather than returning this value to shareholders.

3 min read

The House of Representatives is set to pass the Inflation Reduction Act, the latest iteration of President Biden’s tax and climate agenda. Garrett Watson joins Jesse to discuss what sacrifices were made by key lawmakers to bring this bill to the finish line. They also look at what the economic impact of this proposal would be as the country continues to face historic rates of inflation.

In dollar terms, the industries that would account for the largest book minimum tax liabilities are manufacturing, at $73.2 billion, followed by finance, insurance, and management at $46.9 billion.

6 min read