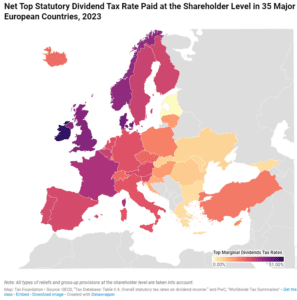

Portugal’s Personal Income Tax System: High Top Rate, Threshold, and Tax Credits

Portugal’s personal income tax system levies high tax rates on an unusually narrow set of high earners, striking a poor balance between earnings incentives and revenue contributions.

4 min read