Testimony: Lessons for the 2025 Tax Policy Debate

The stakes for next year’s expiring tax provisions are quite high. If Congress does nothing, then 62 percent of households will see their taxes go up in January of 2026.

The stakes for next year’s expiring tax provisions are quite high. If Congress does nothing, then 62 percent of households will see their taxes go up in January of 2026.

Taxes are on the ballot this November—not just in the sense that candidates at all levels are offering their visions for tax policy, but also in the literal sense that voters in some states will get to decide important questions about how their states raise revenue.

9 min read

While tax policy was almost nonexistent in the first debate between Vice President Kamala Harris and former President Donald Trump, this episode will explore each candidate’s latest proposals in greater depth.

Supernormal profits are an important concept, but we should be wary of analysis that both defines supernormal profits very broadly and equates all supernormal profits with monopoly profits that can be easily taxed without negative economic effects.

23 min read

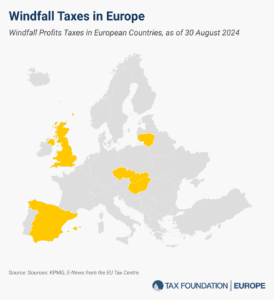

The flawed design of these windfall profits taxes has created problems in countries that implemented them.

4 min read

Rather than pursuing temporary policies, policymakers should implement long-term, pro-growth tax reforms that stimulate economic activity and incentivize energy diversification by supporting private investment through full expensing.

19 min read

Allowing full deductibility of residential structures would mean more housing construction, particularly multifamily housing—a practical solution to address housing affordability challenges.

6 min read

Utah is the only state to earmark the entirety of one of its major taxes, but a measure on the ballot this November might change that.

4 min read

The sales tax is the second-largest source of state tax revenue and an important source of local tax revenue, but decades of base erosion threaten the tax’s share of overall revenue and have prompted years of countervailing rate increases.

72 min read

In her campaign for president, VP Kamala Harris has embraced all the tax increases President Biden proposed in the White House FY 2025 budget—including a new idea that would require taxpayers with net wealth above $100 million to pay a minimum tax on their unrealized capital gains from assets such as stocks, bonds, or privately held companies.

5 min read