All Related Articles

9225 Results

A Path Forward for Greece

4 min read

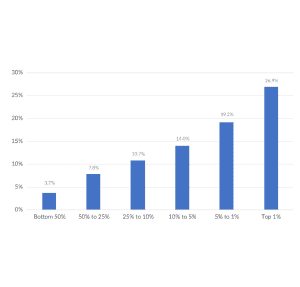

Summary of the Latest Federal Income Tax Data, 2018 Update

The top 50 percent of all taxpayers pay 97 percent of all individual income taxes, while the bottom 50 percent paid the remaining 3 percent.

21 min read