All Related Articles

State Corporate Income Tax Rates and Brackets, 2020

Forty-four states currently levy a corporate income tax. Rates range from 2.5 percent in North Carolina to 12 percent in Iowa. Over the past year, several states, including Florida, Georgia, Indiana, Mississippi, Missouri, and New Jersey, implemented notable corporate income tax changes.

7 min read

Analysis of Sen. Warren and Sen. Sanders’ Wealth Tax Plans

New modeling finds that the wealth taxes proposed by Sen. Warren and Sen. Sanders would raise significantly less revenue than promised, face serious administrative and compliance challenges, and would increase foreign ownership of U.S. capital.

38 min read

The Davos Digital (Tax) Détente?

The past week has been nearly nonstop with news on various fronts of a dispute over taxation of digital businesses. The main characters have been the U.S., France, and the UK, although the EU and the OECD have also played roles. Though the dust is still settling, it is worth trying to tie the various events and arguments together.

7 min read

The Impact of a Financial Transaction Tax

Policymakers should exercise caution in deciding whether to enact an FTT given the uncertainty regarding the FTT’s ability to raise revenue and the significant damage it could cause to the U.S. financial system

39 min read

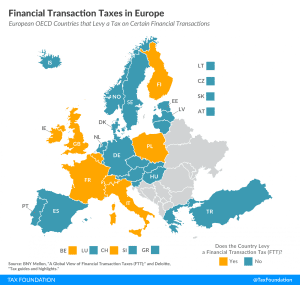

Financial Transaction Taxes in Europe

2 min read

Looking Back on Taxation of Capital Gains

When considering options to eliminate the deferral advantage of capital gains taxation, a lookback charge provides a reasonable solution for taxing hard-to-value assets. However, policymakers need to understand the limitations of a lookback charge compared to both mark-to-market taxation and the current system.

16 min read

Taxing Nicotine Products: A Primer

New nicotine products, along with a greater consciousness about the dangers of smoking, have prompted millions to give up smoking. This has contributed to federal and state excise tax collections on tobacco products declining since 2010. Our new report outlines the best way to tax nicotine products based on health outcomes and revenue stability.

49 min read