All Related Articles

Iowa Decouples from 163(j) and GILTI, Clarifies Non-Taxation of PPP Loans

Iowa’s HF 2614, which passed both chambers of the legislature and now waits for the governor’s signature, makes several changes to the state’s tax code, which, although they will affect revenue, will encourage economic growth and make the state’s tax code more competitive.

4 min read

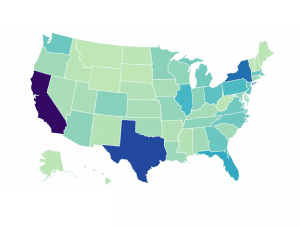

Estimated Impact of Improved Cost Recovery Treatment by State

We estimate that moving to permanent full expensing and neutral cost recovery for structures would add more than 1 million full-time equivalent jobs to the long-run economy and boost the long-run capital stock by $4.8 trillion.

4 min read

Montana Voters Will Decide on Recreational Marijuana

Montana could vote to legalize and tax recreational marijuana in November, bringing in an estimated $39 million by 2025, but would the move help with short-term budget issues?

4 min read

GAO Report Reveals Need to Simplify Next Round of Rebates

A new Government Accountability Office (GAO) report revealed that almost a half-million taxpayers missed their total rebate payment due to complications over disbursing funds to non-filers with eligible dependents. Administrability is just as important as rebate design and simplicity is just as important as speed.

3 min read

Improving the Tax Treatment of Residential Buildings Will Stretch Affordable Housing Assistance Dollars Further

By updating the tax code to allow developers to more fully cover their investments, construction costs will fall, which, in turn, means that federal affordable housing assistance dollars will go that much further in helping low-income tenants.

3 min read

European Countries Might Consider Scrapping the Bank Tax for Greater Financial Support

In the wake of the coronavirus crisis, some governments are seeking to cut bank taxes to enhance financial support to businesses and public investment projects.

2 min read

Three Reasons Expanding Credits Aren’t the Best Pandemic Response for the Vulnerable

While reforming certain tax credits may make sense, there are far better ways to provide individuals and families with more liquidity during this crisis.

6 min read