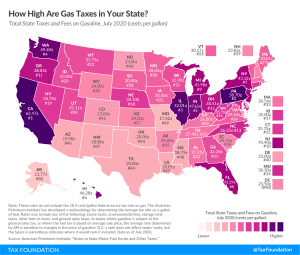

Gas Tax Rates by State, 2020

California pumps out the highest tax rate of 62.47 cents per gallon, followed by Pennsylvania (58.7 cpg), Illinois (52.01 cpg), and Washington (49.4 cpg).

2 min read

California pumps out the highest tax rate of 62.47 cents per gallon, followed by Pennsylvania (58.7 cpg), Illinois (52.01 cpg), and Washington (49.4 cpg).

2 min read

New data sheds light on what share of new business investment was eligible for bonus depreciation as it existed before 2017 tax reform, and what share of new investment was excluded from improved cost recovery. This matters because the income tax is biased against investment in capital assets to the extent that it makes the investor wait years or decades to claim the cost of machines, equipment, or factories on their tax returns.

3 min read

A resurgence in coronavirus cases and receding economic activity in many states threaten the nascent economic recovery. To address the ongoing crisis, the Senate Republican Phase 4 proposal builds on the CARES Act provisions while modifying others, including a scaled down federal UI benefit.

8 min read