Europe Opened the Pandora Box of Reduced VAT Rates

With this new VAT directive, the EU has invited member states to adopt policies that create new complexities, are poorly targeted, and undermine an Own Resource.

5 min read

With this new VAT directive, the EU has invited member states to adopt policies that create new complexities, are poorly targeted, and undermine an Own Resource.

5 min read

While the U.S. tariffs were intended to protect American industries, they have largely hurt the U.S. economy. Rather than pass on the tariffs to Chinese consumers, analysis shows that most U.S. firms simply bore the costs.

5 min read

Amidst bipartisan climate negotiations on Capitol Hill, there have been renewed calls for a carbon tax. Carbon taxes have long been magnets for political controversy. But from an economic standpoint, they deserve to be taken seriously. Here’s why.

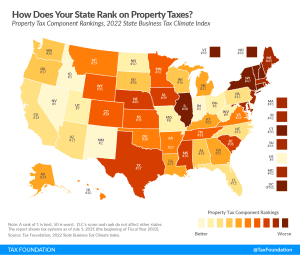

Which states have the highest property taxes in 2022? See how your state compares in property taxes across the United States

5 min read

Wyoming’s low taxes are highly attractive, but policymakers are still hard at work helping the state achieve broader economic development goals.

13 min read

The sales tax is too important a part of states’ revenue toolkits to be permitted further erosion, making sales tax modernization a vital project of the 2020s.

17 min read

Federal policymakers are debating a legislative package focused on boosting U.S. competitiveness vis-a-vis China; however, it currently contains little to no improvements to the U.S. tax code.

34 min read

Arizona now joins a growing cohort of states that are moving toward a flat income tax. Pending revenue triggers, the income tax rate will be reduced to 2.5 percent giving Arizona one of the lowest individual income tax rates in the country.

7 min read

Learn more about the FDA’s proposal to ban the sale of menthol cigarettes and flavored cigars. Including its effect on revenue & public health measures.

4 min read