All Related Articles

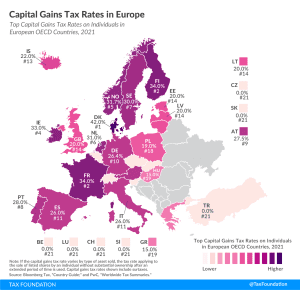

Road Taxes and Funding by State, 2021

Traditionally, revenue dedicated to infrastructure spending has been raised through taxes on motor fuel, license fees, and tolls, but revenue from motor fuel has proven less effective over the last few decades.

6 min read

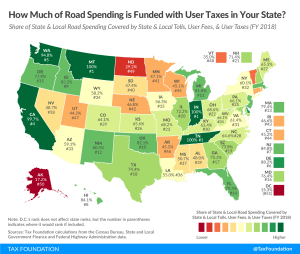

Inventory Valuation in Europe

The method by which a country allows businesses to account for inventories can significantly impact a business’s taxable income. When prices are rising, as is usually the case due to factors like inflation, LIFO is the preferred method because it allows inventory costs to be closer to true costs at the time of sale.

2 min read

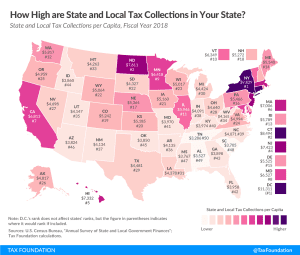

State and Local Tax Collections by State, 2021

Although Tax Day has been pushed back this year, mid-April is still a good occasion to take a look at tax collections in the United States. Because differing state populations can make overall comparisons difficult, today’s state tax map shows state and local tax collections per capita in each of the 50 states and the District of Columbia.

3 min read

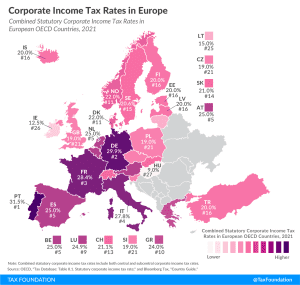

Corporate Income Tax Rates in Europe, 2021

On average, European OECD countries currently levy a corporate income tax rate of 21.7 percent. This is below the worldwide average which, measured across 177 jurisdictions, was 23.9 percent in 2020.

2 min read

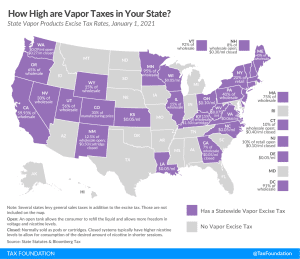

Vaping Taxes by State, 2021

Several states are considering introducing or increasing taxes on vapor products to make up declining tax revenue from traditional tobacco products or to fill budget holes in the wake of the coronavirus pandemic. However, lawmakers should approach the issue carefully because flawed excise tax design on vapor products could drive consumers back to more harmful combustible products like cigarettes.

3 min read

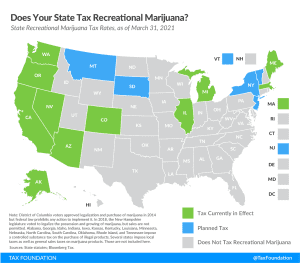

Recreational Marijuana Taxes by State, 2021

The legalization and taxation of recreational marijuana remains one of the hottest trends in state taxation.

6 min read

Capital Cost Recovery across the OECD, 2021

The ongoing pandemic has once again highlighted the importance of investment. To address the economic fallout of the pandemic, several OECD countries have temporarily accelerated depreciation schedules for various assets.

31 min read

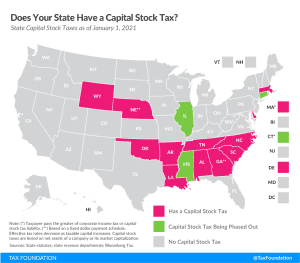

Does Your State Levy a Capital Stock Tax?

Capital stock taxes are imposed on a business’s net worth (or accumulated wealth). As such, the tax tends to penalize investment and requires businesses to pay regardless of whether they make a profit in a given year, or ever.

4 min read

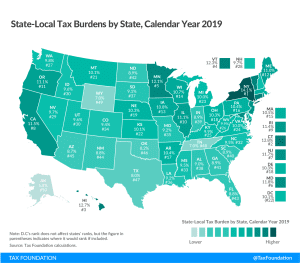

State and Local Tax Burdens, Calendar Year 2019

New Yorkers faced the highest burden, with 14.1 percent of income in the state going to state and local taxes. Connecticut (12.8 percent) and Hawaii (12.7 percent) followed.

19 min read