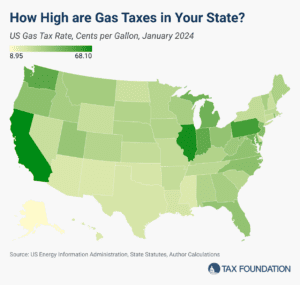

Gas Tax Rates by State, 2024

Though gas taxes are intended to serve as user fees and pollution deterrents, they vary widely across states. How does your state’s burden compare?

4 min read

Though gas taxes are intended to serve as user fees and pollution deterrents, they vary widely across states. How does your state’s burden compare?

4 min read

According to recent reports, 72 percent of the current marijuana market in the US is illicit. Evidently, the federal criminalization of marijuana has failed to prevent its sale or consumption.

6 min read

If Vice President Kamala Harris is elected the 47th U.S. president, she would inherit a trade war started by former President Donald Trump and continued by President Joe Biden. But she’d also have the chance to end it.

Exempting Social Security benefits from income tax would increase the budget deficit by about $1.6 trillion over 10 years, accelerate the insolvency of the Social Security and Medicare trust funds, and create a new hole in the income tax without a sound policy rationale.

6 min read