All Related Articles

Trade and Capital Flow Consequences of Tax Reform: A Means to a Faster Expansion of U.S. Capital Formation and Employment

The tax bill will boost investment and incomes in the United States, and make the country a better place to locate production and hiring. There will be a transitory rise in the trade deficit, but in the context of a stronger, faster-growing economy.

5 min read

Statement on Final Passage of the Tax Cuts and Jobs Act

With the Tax Cuts and Jobs Act, Congress took a historic step toward rewriting the U.S. tax code for the first time since 1986.

1 min read

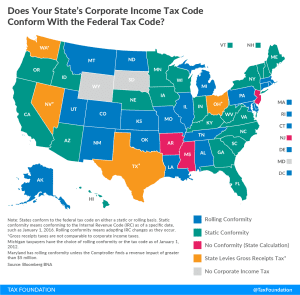

Does Your State’s Corporate Income Tax Code Conform with the Federal Tax Code?

Whether your state’s corporate income tax code conforms to the federal corporate income tax code matters a great deal for how the Tax Cuts and Jobs Act will impact revenue in your state.

2 min read

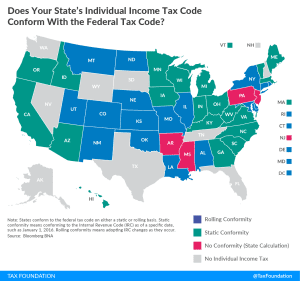

Pass-Through Deduction Won’t Flow Through to Most States

For policymakers in most states, the fact that the pass-through deduction doesn’t affect AGI should come as a relief. For those in the six states which use federal taxable income as their starting point for conformity, decoupling from the provision is an entirely viable option.

2 min read

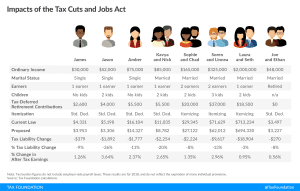

Who Gets a Tax Cut Under the Tax Cuts and Jobs Act?

How would the Tax Cuts and Jobs Act impact different households? Check out our sample taxpayers to see what would change if the bill is enacted.

5 min read

The Tax Cuts and Jobs Act: The Impacts of Jobs and Incomes by State

Overall, the Tax Cuts and Jobs Act is projected to add 339,000 new jobs to the U.S. economy and boost average after-tax incomes for middle-income families by $649.43. Here’s how jobs and after-tax wages will be impacted in your state.

2 min read

Preliminary Details and Analysis of the Tax Cuts and Jobs Act

According to the Tax Foundation’s Taxes and Growth Model, the Tax Cuts and Jobs Act would lead to a 1.7 percent increase in GDP over the long term, 1.5 percent higher wages, an additional 339,000 full-time equivalent jobs, and cost $1.47 trillion on a static basis and by $448 billion on a dynamic basis.

22 min read