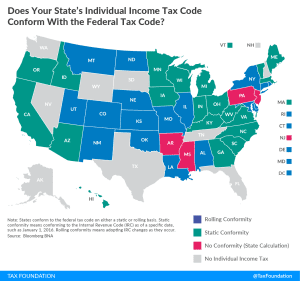

Does Your State’s Individual Income Tax Code Conform with the Federal Tax Code?

As the federal government continues to debate tax reform, states, and many taxpayers, are asking an important question: How is my state’s tax code impacted? The exact impacts won’t be known until the federal bill is finalized, but a good place to start is understanding the issue of conformity.

2 min read