Tax Foundation Europe Careers

The mission of Tax Foundation Europe is to improve lives through tax policies that lead to greater economic growth and opportunity.

The mission of Tax Foundation Europe is to improve lives through tax policies that lead to greater economic growth and opportunity.

To encourage greater saving, the US federal income tax provides tax-neutral treatment to some types of saving through a variety of accounts. The type of tax treatment, contribution limits, withdrawal rules, and use cases for contributions all vary by account, leading to a complicated system for households to navigate.

11 min read

With pandemic-era savings now fully depleted and the majority of Americans pointing to their finances as their biggest source of stress, one thing is clear: the US needs policies that help people save more.

4 min read

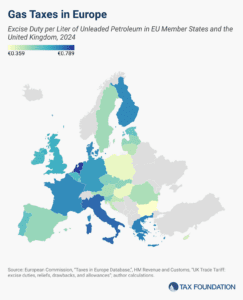

Gas and diesel taxes continue to be prominent policy issues throughout Europe. As the EU undergoes sweeping changes for its green transition, fuel taxes are likely to be a crucial aspect of policy discussions.

3 min read

The government provides various services at the federal, state, and local levels. How are they paid for? Taxes.

Not every change in the Tax Cuts and Jobs Act simplified the tax code. However, the TCJA reduced compliance costs overall for individual filers, and allowing fundamental structural improvements to expire would make the tax code worse.

5 min read

By 2034, the gas tax and other car-related excise taxes are projected to raise less than half of the Highway Trust Fund’s outlays. While broader tax and spending reforms are necessary for overall deficit reduction, improving transportation funding would be a crucial step forward.

34 min read

Gov. Walz’s tax policy record is notable because of how much it contrasts with broader national trends. In recent years, most governors have championed tax cuts. Walz, rare among his peers, chose tax increases.

5 min read

Americans will spend more than 7.9 billion hours complying with IRS tax filing and reporting requirements in 2024. This is equal to 3.8 million full-time workers doing nothing but tax return paperwork—roughly equal to the population of Los Angeles.

7 min read

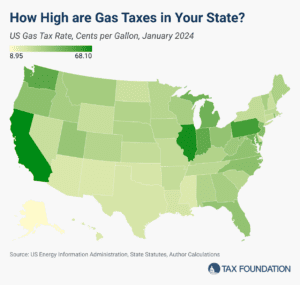

Though gas taxes are intended to serve as user fees and pollution deterrents, they vary widely across states. How does your state’s burden compare?

4 min read