All Related Articles

9228 Results

Testimony: The Positive Economic Growth Effects of the Tax Cuts and Jobs Act

Tax Foundation President, Scott Hodge, provides written testimony before the United States Joint Economic Committee on the economic growth effects of TCJA.

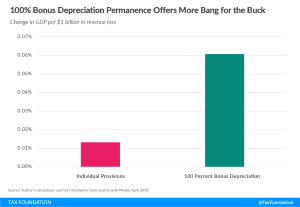

Permanence for 100 Percent Bonus Depreciation Provides More Cost-Effective Growth than Permanence for Individual Provisions

In the long run, permanent full expensing produces about 4.5 times more GDP growth per dollar of revenue than making individual TCJA provisions permanent.

2 min read

The TCJA’s Expensing Provision Alleviates the Tax Code’s Bias Against Certain Investments

The Tax Cuts and Jobs Act made significant progress in improving businesses’ ability to recover the cost of making investments in the United States by enacting 100 percent bonus depreciation.

11 min read

Pennsylvania: A 21st Century Tax Code for the Commonwealth

Policymakers from across the spectrum recognize that Pennsylvania’s tax code has not kept up with a 21st century economy. Here are comprehensive solutions for how Pennsylvania can achieve a more competitive tax code.

13 min read