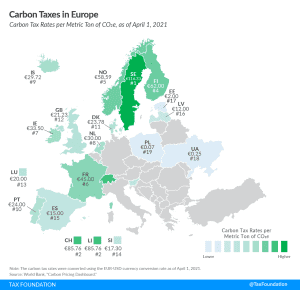

Carbon Taxes in Europe, 2021

In recent years, several countries have taken measures to reduce carbon emissions, including instituting environmental regulations, emissions trading systems (ETS), and carbon taxes.

3 min read

In recent years, several countries have taken measures to reduce carbon emissions, including instituting environmental regulations, emissions trading systems (ETS), and carbon taxes.

3 min read

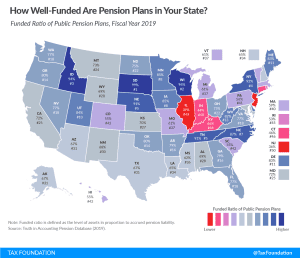

Although most states are on solid financial footing following the coronavirus crisis, pension liabilities are a deep-seated problem that long predates the pandemic.

2 min read

We take a closer look at the most extensive of these proposals: restructuring the Earned Income Tax Credit (EITC) and Child Tax Credit (CTC) based on the Family Security Act proposed by Sen. Mitt Romney (R-UT) in February.

3 min read

Of the many tax policies modeled in our new Options for Reforming America’s Tax Code 2.0, repealing the tariffs imposed under President Trump’s administration would be one of the simplest ways policymakers could boost economic growth.

2 min read

As tempting as inheritance, estate, and gift taxes might look especially when the OECD notes them as a way to reduce wealth inequality, their limited capacity to collect revenue and their negative impact on entrepreneurial activity, savings, and work should make policymakers consider their repeal instead of boosting them.

5 min read

Montana adopted structural reforms to both individual and corporate income taxes during the recently adjourned legislative session, enacting three bills reducing individual tax rates, simplifying the state’s individual tax system, repealing 16 tax credits, and changing the apportionment factor for corporate income tax.

5 min read

Federal lawmakers re-introduced the MORE Act, the most significant federal legislative development on marijuana policy in 50 years. The MORE Act would impose a federal excise tax on marijuana at a rate from 5 to 8 percent.

7 min read

The income tax changes in HB 2900 as introduced would improve Arizona’s individual income tax structure and economic competitiveness, making the state more attractive to individuals and pass-through businesses .

8 min read

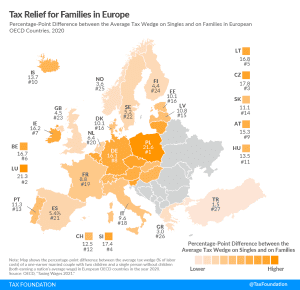

Most countries provide tax relief to families with children—typically through targeted tax breaks that lower income taxes. While all European OECD countries provide tax relief for families, its extent varies substantially across countries.

2 min read

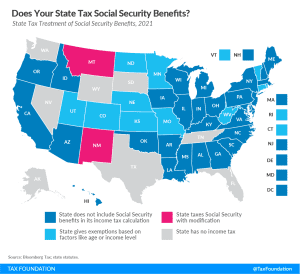

Thirteen states tax Social Security benefits, a matter of significant interest to retirees. Each of these states has its own approach to determining what share of benefits is subject to tax, though these provisions can be grouped together into a few broad categories.

4 min read