All Related Articles

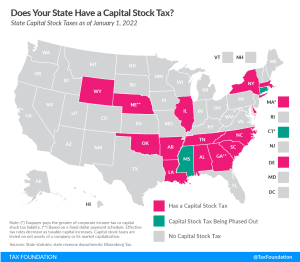

Does Your State Levy a Capital Stock Tax?

States can better position themselves for success by moving away from economically-damaging taxes like the capital stock tax.

3 min read

Four Issues with Proposal to Increase Tobacco and Vapor Taxes in Maine

Maine’s proposal to increase tobacco and vapor taxes has at least four major issues: flawed revenue allocation, risk of increased smuggling, regressivity, and violation of the harm reduction principle.

4 min read

U.S. Tax Incentives Could be Caught in the Global Minimum Tax Crossfire

The current prospect for the global minimum tax requires the attention of U.S. lawmakers. Otherwise, a tax benefit at home will just mean a tax increase abroad.

6 min read

States Should Act Fast on UC Trust Fund Deposits, and Other Takeaways from the New Treasury Guidance on ARPA Funding

States will continue to cut taxes because revenues are skyrocketing. But some will also be keeping a close eye on litigation targeting this dubious restriction on states’ fiscal autonomy.

8 min read

Tennessee Should Build on Success and Improve Corporate Taxes

While Tennessee now boasts no individual income tax, there is still more work to be done for businesses—Tennessee is in a good position to get the job done.

7 min read

Testimony: Kansas Should Keep Groceries in the Sales Tax Base

Tax relief can take many different forms, but not all tax cuts have the same effects. Ultimately, maintaining broad tax bases while reducing tax rates is a more neutral and less complex approach than further narrowing an already-narrow sales tax base.

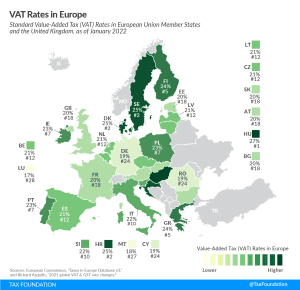

VAT Rates in Europe, 2022

The VAT is a consumption tax assessed on the value added in each production stage of a good or service. Every business along the value chain receives a tax credit for the VAT already paid. The end consumer does not, making it a tax on final consumption.

4 min read