All Related Articles

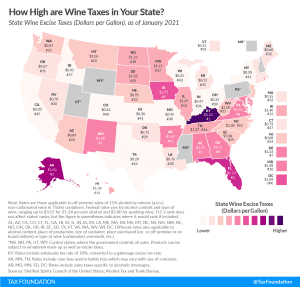

How High Are Wine Taxes in Your State?

States tend to tax wine at a higher rate than beer but at a lower rate than distilled spirits due to wine’s mid-range alcohol content. You’ll find the highest wine excise taxes in Kentucky at $3.23 per gallon, far above Alaska’s second-place $2.50 per gallon. Those states are followed by Florida ($2.25), Iowa ($1.75), and Alabama and New Mexico (tied at $1.70).

2 min read

Net Operating Loss Policies in the OECD

During the COVID-19 pandemic, several OECD countries temporarily expanded their NOL carrybacks and carryforwards to provide relief to illiquid but otherwise solvent businesses. These policies should be made permanent and, where necessary, expanded.

21 min read

New Hampshire Closes in on Tax Cuts to Enhance State’s Competitive Advantage

New Hampshire lawmakers are scheduled to take up a budget conference report which contains several tax reforms negotiated by both chambers that would ultimately make New Hampshire the ninth state to impose no tax on individual income. These reforms floated at the beginning of the 2021 session found their way into HB 2, including rate reductions in the Business Profits Tax (BPT) and Business Enterprise Tax (BET) and a phaseout of the interest and dividends tax.

4 min read

Boost Semiconductor Manufacturing by Removing Tax Barriers—Not Creating Tax Subsidies

A bipartisan group of Senators introduced a bill to create a permanent 25 percent tax credit for investments in semiconductor manufacturing equipment and construction of related facilities—but their proposal would not address underlying bias against investment that exists in the tax code today.

3 min read

Spain Determined to Cash in on Digital Services Tax

Spain’s digital services tax levies a 3 percent tax on revenues from online ads, deals brokered on digital platforms, and sales of user data by tech companies with at least €750 million (US $893 million) in total annual worldwide revenues and Spanish revenues of €3 million ($3.57 million).

4 min read

States Continue to Bet on Sports

With many state legislative sessions wrapping up for this year, and a new fiscal year about to begin, it’s a good time to examine some of the 2021 legislative trends—and sports betting taxes are among the more prominent.

5 min read

Tax Foundation Comment on Treasury’s State Tax Cuts Limitation Rule

The Tax Foundation recently submitted regulatory comment on the U.S. Treasury’s state tax cuts limitation rule, highlighting three areas of concern and suggesting revisions to the rule.

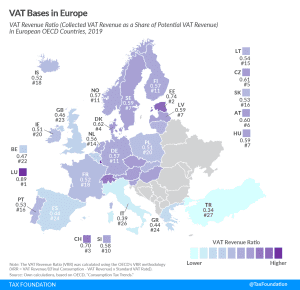

VAT Bases in Europe

As economic activity resumes and the task of accounting for the deficits incurred in navigating the crisis of the past year becomes the focus of fiscal policy deliberations, a greater reliance on VAT could be an important tool in ensuring fiscal stability going forward. Countries should use this as an opportunity to improve VAT systems by re-examining carveouts in the form of exemptions and reduced rates.

2 min read