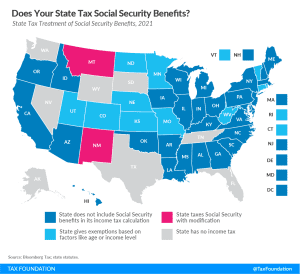

How Does Your State Treat Social Security Income?

Thirteen states tax Social Security benefits, a matter of significant interest to retirees. Each of these states has its own approach to determining what share of benefits is subject to tax, though these provisions can be grouped together into a few broad categories.

4 min read