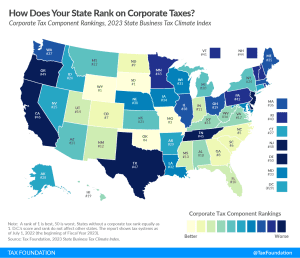

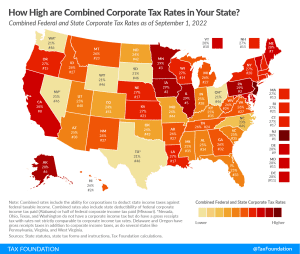

Ranking State Tax Systems: Corporate Taxes

All corporate income taxes fall on capital investment, but the structure should not make matters worse, and policymakers should take care not to distort investment decisions through the use of targeted incentives for select firms or activities instead of a lower rate for all businesses.

2 min read