Last week, an analysis by Reuters suggested that U.S. firms pay less income taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. than foreign competitors, in part because “the U.S. tax code is unusually generous with tax breaks and deductions,” also known as corporate tax expenditures. However, the Reuters analysis is at odds with other data and studies indicating that U.S. corporate tax expenditures and effective tax rates are about on par with those in peer countries in the Organisation for Economic Co-operation and Development (OECD).

Various tax deductions, exemptions, and credits within the U.S. tax code and the tax laws of other countries reduce revenue collected by the corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. . Some of these tax expenditures—like tax credits for research & development—are used to encourage specific types of economic activity. Others that are categorized as tax expenditures, like accelerated depreciation, are important for taxing the proper amount of income earned by corporations.

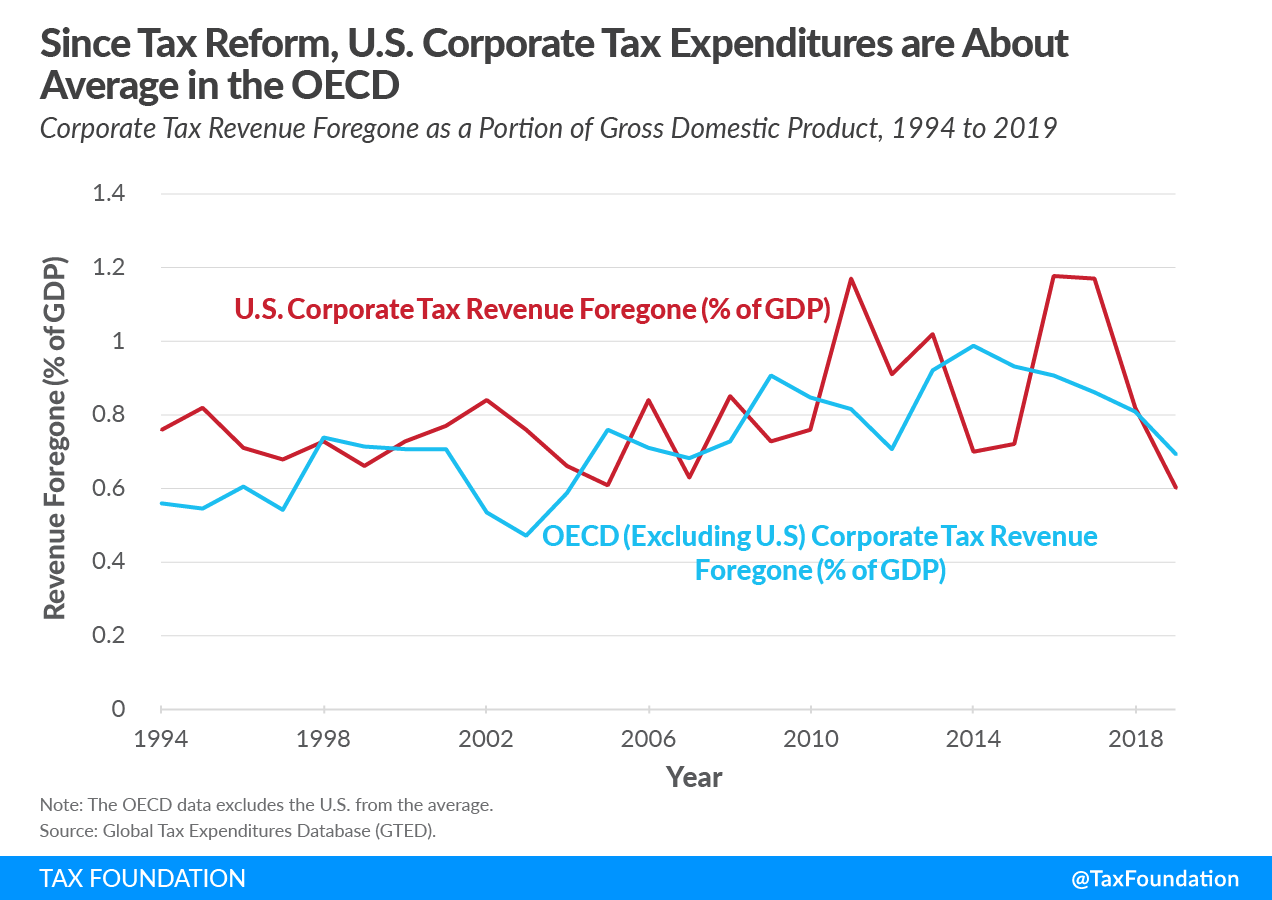

One way to compare tax expenditures across countries is by examining the revenue lost by the tax expenditures as a portion of economic output. According to the Global Tax Expenditure Database (GTED), the U.S. was near or slightly above the OECD average from 1994 to 2017, and fell along with the OECD average after the 2017 U.S. tax law’s corporate tax changes were enacted.

In fact, the U.S. corporate tax performs better than the OECD average on several types of tax expenditures: the U.S. since 2008 has forgone about 0.10 percent of GDP in revenue from exemptions from taxable incomeTaxable income is the amount of income subject to tax, after deductions and exemptions. For both individuals and corporations, taxable income differs from—and is less than—gross income. , while the OECD average hovered between 0.20 percent and 0.30 percent. The U.S. is not an especially generous provider of corporate tax credits and rebates, either: the U.S. gave up about 0.16 percent of GDP on corporate credits and rebates in 2019, while the OECD averaged about 0.11 percent.

Data from the OECD also suggests that the U.S. corporate income tax is not an outlier when providing tax incentives to encourage economic activity such as research & development (R&D). For example, the U.S. provided about 0.08 percent of GDP worth of R&D tax expenditures in 2018, compared to the OECD average of 0.09 percent. While the U.S. tends to rely more on R&D credits to encourage that activity in the tax code, other OECD countries provide incentives like super deductions for R&D or reduced tax rates on income from intellectual property (known as patent boxes).

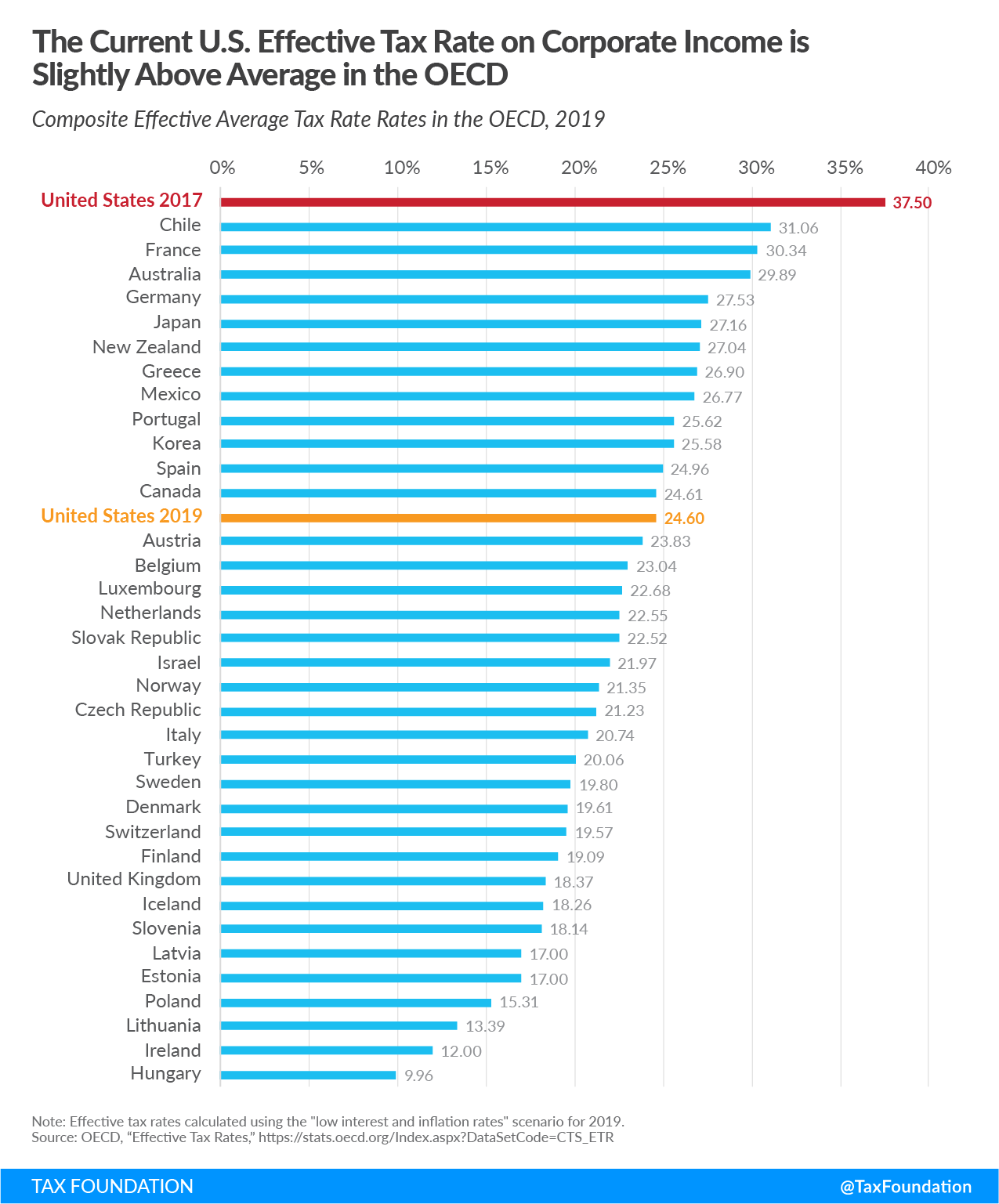

For another way to look at how corporate tax expenditures impact firms across countries, we can compare the effective average tax rate (EATR), which is a forward-looking indicator of the tax burden on a prospective investment made by a corporation, accounting for tax rates, depreciation, and other tax provisions. The EATR faced by U.S. corporations in 2019 was 24.6 percent, higher than the non-U.S. average of 21.9 percent and 13th highest out of 37 countries in the OECD.

This and other data suggest that U.S. corporate tax expenditures and effective tax rates are not substantially out of line with peer countries, and at least by some measures the U.S. effective tax rate exceeds the OECD average.

There are opportunities to reduce or eliminate tax expenditures that could create complexity or distortions in the U.S. corporate tax code. However, U.S. corporate tax expenditures are well within the average when compared to other OECD countries. U.S. tax expenditures will not blunt the economic damage of higher corporate income taxes.

Share this article