Fiscal Fact No. 76

This week, the House Ways and Means Committee will hold a hearing on the economic challenges facing the “middle class.” The purpose of the hearing is to investigate the notion that today’s families are experiencing economic pressures greater than those faced by their parents’ or grandparents’ generations.

To understand this issue, however, Members first need to understand how different today’s families are from those of 40 or 50 years ago and how demographic changes have affected the notions of who is “middle-class” and who is upper-income in America.

If by “middle class” we mean intact families with children (the stereotypical family of four), then these families no longer comprise the majority of the statistical middle 20 percent of taxpayers. The majority of families with children now populate the wealthiest 40 percent of Americans, in part because of the growth in dual-earner households. So if Ways and Means members focus too much on the “median family” or “median taxpayers” they will not be accurately portraying the economic status of today’s working families.

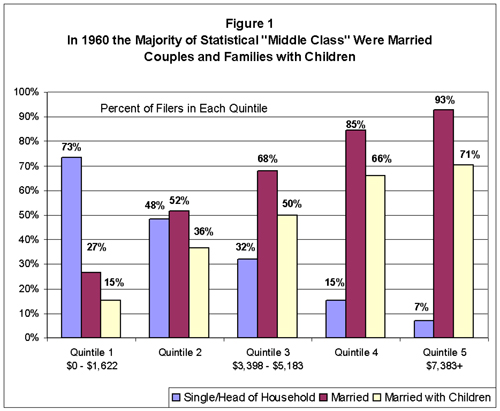

Figure 1 below looks at the composition of taxpayers in 1960, back in Leave it to Beaver days. The population of taxpayers is divided evenly into five equal parts, or quintiles, each with 20 percent of taxpayers. Focusing specifically on the middle quintile, we can see that the stereotype was true: nearly 70 percent were married couples and most were raising children. Indeed, in 1960, married couples comprised the majority of every group of taxpayers except for the lowest 20 percent. Of that low-income group, 73 percent were single filers.

Source: 1960 IRS Public Use File

Over the past four decades, demographic changes have dramatically altered the picture of the statistical middle and contributed to the perception of widening income disparity in America. As Figure 2 shows, three things are immediately clear about today’s society:

(1) There are vastly more single taxpayers than ever before and they comprise the majority of the populations of the first three quintiles.

(2) Because of the rise in dual-earner families, married couples are mostly found in the two highest quintiles.

(3) A greater percentage of taxpayers in the top two quintiles are married couples without dependents; no doubt many are “empty-nest” Baby Boomers nearing their peak earning years.

Source: 2002 IRS Public Use File

Today, the composition of taxpayers in the statistical “middle class” is completely reversed from what it was in 1960. More than two-thirds of modern middle-income taxpayers are single, or single-headed households, while just 36 percent are married. More dramatically, while half of the middle-income taxpayers in 1960 were couples with children, today only 18 percent of these taxpayers are couples with children. The majority of couples with children are now clustered in the top two quintiles.

These demographic shifts have no doubt contributed to the perception of rising income inequality. When the so-called rich are increasingly couples with two incomes, they will naturally look wealthier than the vast number of single taxpayers who now populate the statistical middle.

As has been outlined in previous Tax Foundation studies, taxes are stressing these dual-earner families from all sides. Many of these families live in high-cost urban and suburban areas and have incomes commensurate with the cost of living. Because of the progressivity of the federal taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. code, these couples end up facing the highest federal income tax rates even though they live distinctly “middle-class” lifestyles.

These couples also tend to live in communities with high state and local taxes–especially property taxes. As a result, they are increasingly subjected to the Alternative Minimum Tax, which increases their federal tax bills.

As lawmakers look for solutions to the economic challenges facing today’s “middle-class” but upper-income families, they would do well to consider the way in which taxes–federal and local–are contributing to the problem.

Share this article