In today’s Wall Street Journal, Nobel laureate Peter Diamond and Emmanuel Saez write “High Tax Rates Won’t Slow Growth“. This is certainly out of the box thinking – the box that defines the foundation of economics. The First Law of Demand states that as prices go up demand goes down. This is apparent to all of us who do our own shopping. Taxes are part of the price of that which is taxed, so higher taxes will necessarily reduce that activity. For example, taxes on cigarettes reduce smoking.

But Diamond and Saez tell us the Law doesn’t apply to income taxes on high-income earners; that raising taxes on them will not reduce their propensity to work or invest for the long-term:

“But will taxable incomes of the top 1% respond to a taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. increase by declining so much that revenue rises very little or even drops? In other words, are we already near or beyond the peak of the famous Laffer Curve, the revenue-maximizing tax rate?

The Laffer Curve is used to illustrate the concept of taxable incomeTaxable income is the amount of income subject to tax, after deductions and exemptions. Taxable income differs from—and is less than—gross income. “elasticity,”-i.e., that taxable income will change in response to a change in the rate of taxation. Top earners can, of course, move taxable income between years to subject them to lower tax rates, for example, by changing the timing of charitable donations and realized capital gains. And some can convert earned income into capital gains, and avoid higher taxes in other ways. But existing studies do not show much change in actual work being done.”

Existing studies can be rigged in a lot of ways, for instance by ignoring the long-term effects of lower after-tax wage rates. Do these studies somehow measure the propensity of school children to work towards a medical degree under conditions of high versus low doctor salaries? And what are the effects on would-be entrepreneurs?

Taxes matter, though it is certainly true that the degree to which they matter depends on a number of factors, including the type of tax, the culture, the relative income of those being taxed, etc. However, Diamond and Saez tell us that cross-country and historical evidence provides no support for the idea that income taxes affect growth:

“There is no clear correlation between economic growth since the 1970s and top tax-rate cuts across Organization for Economic Cooperation and Development countries.

For example, from 1970 to 2010, real GDP annual growth per capita averaged 1.8% and 2.03% in the U.S. and the U.K., both of which dramatically lowered their top tax rates during that period, while it averaged 1.72% and 1.89% in France and Germany, which kept high top tax rates during the period. While in no way does this prove that higher top tax rates actually encourage growth, there is not good evidence from the aggregate data supporting the view that higher rates slow growth.”

My recent study comes to just the opposite conclusion, showing a strong correlation between top marginal rates and growth in the OECD over the last 11 years. The chart below shows total real GDP growth over this period. All seven of the fastest growing economies have below average tax rates on high-incomes. Within my report are links to other studies showing similar results.

Lastly, Diamond and Saez point to the Reagan era as an illustration of how high taxes can go without reducing revenue:

“According to our analysis of current tax rates and their elasticity, the revenue-maximizing top federal marginal income tax rate would be in or near the range of 50%-70% (taking into account that individuals face additional taxes from Medicare and state and local taxes). Thus we conclude that raising the top tax rate is very likely to result in revenue increases at least until we reach the 50% rate that held during the first Reagan administration, and possibly until the 70% rate of the 1970s. To reduce tax avoidance opportunities, tax rates on capital gains and dividends should increase along with the basic rate. Closing loopholes and stepping up enforcement would further limit tax avoidance and evasion.”

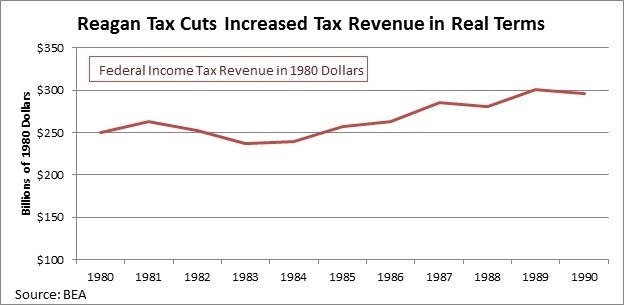

The Reagan era is actually a great illustration of the Laffer Curve. Reagan dropped the top marginal tax rateThe marginal tax rate is the amount of additional tax paid for every additional dollar earned as income. The average tax rate is the total tax paid divided by total income earned. A 10 percent marginal tax rate means that 10 cents of every next dollar earned would be taken as tax. from 70 percent in 1980 to 28 percent in 1988, which created such an economic boom that tax revenues actually increased in real terms, as shown in the chart below. That is strong evidence that even the government loses when the top marginal rate goes higher than 28 percent. It is currently 35 percent, and if the Bush tax cuts expire at the end of the year the top rate will go to 39.6 percent.

One might argue that even though tax revenues increased under Reagan, the population increased as well and along with it the work load of the federal government. But the next chart shows that even as a share of income, federal income tax revenue remained roughly the same. In that limited sense, Diamond and Saez are correct that we could return to marginal rates of 70 percent and perhaps see no reduction in government’s share of income. The problem is that it would drastically reduce incomes.

Follow William McBride on Twitter @EconoWill

Share this article