Related Research

A new study provides modern-day evidence for what economists have long said: tariffs are bad, and international trade should be free. The International Monetary Fund (IMF) paper finds that tariff increases have negative effects on output and productivity that are magnified “when tariffs rise during expansions, for advanced economies, and when tariffs go up.” This evidence does not bode well for the protectionist measures the United States is currently pursuing.

The research looks at tariffTariffs are taxes imposed by one country on goods imported from another country. Tariffs are trade barriers that raise prices, reduce available quantities of goods and services for US businesses and consumers, and create an economic burden on foreign exporters. changes across 151 countries from 1963 to 2014 and the effects on output, productivity, employment, inequality, exchange rates, and trade balances. Here are some of the key takeaways and charts I pulled from the paper:

Output and Productivity

- Tariff increases lead to declines of output and productivity in the medium term

- Why does output fall after a tariff increase? The wasteful effects of protectionism eventually lead to a meaningful reduction in the efficiency with which labor is used, and thus output

- Tariffs encourage the deflection of trade to inefficient producers in order to avoid tariffs, along with encouraging smuggling to evade tariffs; such distortions reduce welfare [by reducing economic output, efficiency, etc.]

- Consumers lose more from a tariff than producers gain, so there is “deadweight loss”

- The longer‐term consequences of tariffs are likely higher than the medium‐term effects

taxfoundation.org/wp-content/uploads/2018/10/1.png” alt=”New Research Bolsters the Case Against Tariffs 1″ />

Note: The solid line indicates the response of output to a one standard deviation increase in tariff; the dotted lines correspond to 90% confidence bands. The x‐axis denotes time. t=0 is the year of the change.

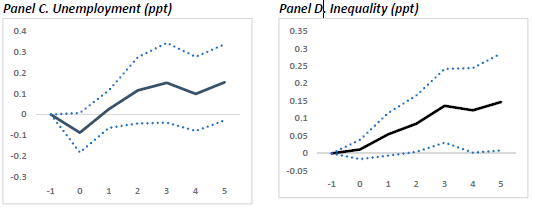

Unemployment and Inequality

- Tariff increases lead to more unemployment

- Tariff increases lead to more inequality, as measured by the Gini index [a summary measure of income inequality]; the effect becomes statistically significant two years after the tariff change

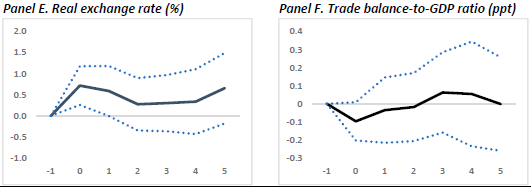

Exchange Rates and Trade Balances

- Higher tariffs lead to an appreciation of the real exchange rate, though the effect is only statistically significantly different from zero in the short term

- The net effects of higher tariffs on the trade balance are small and insignificant; absent shifts in saving or investment, commercial policy has little effect on the trade balance

The authors note:

We emphasize that our results bolster the case for free trade and seem wholly consistent with conventional wisdom in the discipline….Overall, we find that tariff changes have more negative consequences for output and productivity when tariffs a) increase (rather than decrease), for b) advanced economies (not emerging markets and developing economies), during c) good economic conditions.

This research serves as a further warning that increasing tariffs are not good policy.

Launch Tracker: The Economic Impact of U.S. Tariffs and Retaliatory Actions

Share this article