Key Findings

-

Removing tax policy barriers can help businesses and individuals invest, work, create jobs, and lift the economy during a post-pandemic recovery without requiring lawmakers to create new spending programs. One of the most cost-efficient options available to lawmakers is to improve the cost recovery treatment of structures.

-

Residential structures must be depreciated over a 27.5-year-period and nonresidential structures over a 39-year period. Because of the time value of money, the delay in taking deductions for taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. purposes means the real value of the deduction to the business is less than the original outlay, which increases the cost of capital and leads to a lower level of investment and economic growth.

-

A neutral tax would allow an immediate deduction for these outlays, the policy of full expensing. Alternatively, a policy that maintains the present value of deductions over time by adjusting the depreciation allowances would also be neutral toward investment; this policy is called neutral cost recoveryCost recovery is the ability of businesses to recover (deduct) the costs of their investments. It plays an important role in defining a business’ tax base and can impact investment decisions. When businesses cannot fully deduct capital expenditures, they spend less on capital, which reduces worker’s productivity and wages. .

-

One challenge of removing the bias against new investment is that it creates a huge disparity between new and existing structures. Rather than retain a bias against new investments by enacting policies short of full expensingFull expensing allows businesses to immediately deduct the full cost of certain investments in new or improved technology, equipment, or buildings. It alleviates a bias in the tax code and incentivizes companies to invest more, which, in the long run, raises worker productivity, boosts wages, and creates more jobs. , lawmakers could extend neutral tax treatment to both new and existing structures.

-

Each of these policies has trade-offs in terms of impact on economic growth, the disparity between new and existing structures, and the cost to the government.

Introduction

Lawmakers are currently putting together a package of policies for Phase 4 economic relief due to the ongoing public health crisis. While policies that address the short-term needs of families and businesses ought to be prioritized, policies that will help set the economy up for a faster recovery are also worth considering. Specifically, removing tax policy barriers can help businesses and individuals invest, work, create jobs, and lift the economy once the public health crisis abates, without requiring lawmakers to create new spending programs.[1] Improving the cost recovery treatment of structures is one policy available to lawmakers:[2]

Improving capital cost recovery will be crucial to the post-pandemic effort to increase investment and economic growth. Under the U.S. tax code, businesses can generally deduct their ordinary business costs when figuring their income for tax purposes. However, this is not always the case for the costs of capital investments, such as when businesses purchase buildings. Typically, when businesses incur these sorts of costs, they must deduct them over several years according to preset depreciationDepreciation is a measurement of the “useful life” of a business asset, such as machinery or a factory, to determine the multiyear period over which the cost of that asset can be deducted from taxable income. Instead of allowing businesses to deduct the cost of investments immediately (i.e., full expensing), depreciation requires deductions to be taken over time, reducing their value and discouraging investment. schedules, instead of deducting them immediately in the year the investment occurs.

Delaying deductions means the present value of the write-offs (adjusted for inflation and the time value of money) is less than the original cost—how much less valuable depends on the rate of inflationInflation is when the general price of goods and services increases across the economy, reducing the purchasing power of a currency and the value of certain assets. The same paycheck covers less goods, services, and bills. It is sometimes referred to as a “hidden tax,” as it leaves taxpayers less well-off due to higher costs and “bracket creep,” while increasing the government’s spending power. and the discount rate. Thus, this system of tax depreciation, rather than full expensing, is highly unfavorable and increases the after-tax cost of making investments, leading to a lower level of investment and economic growth.

Under the current Modified Accelerated Cost Recovery System (MACRS), when businesses incur costs for long-lived capital assets like structures, they must deduct them over several years according to preset depreciation schedules: nonresidential real property must be deducted over a period of 39 years, while residential rental property must be deducted over a period of 27.5 years.[3] This is problematic, because, as explained above, due to inflation and the time value of money, a dollar in the future is worth less than a dollar today. Delaying deductions for the cost of business investments means that the real value of the deductions is less than the original outlay.

While the idea of improving the cost recovery treatment of structures is straightforward, there are a number of ways lawmakers might accomplish this depending on revenue targets and other challenges. This paper walks through five options lawmakers could use and discusses advantages and disadvantages of each approach

Option 1: Full Expensing for Structures

The ideal solution to the problem of the eroding value of depreciation deductions is to offer full and immediate expensing for structures. This would allow companies to immediately deduct the cost of their investments in buildings and would remove the bias against investment in structures from the tax code.

Using the Tax Foundation General Equilibrium Model, we estimate that full expensing for 27.5- and 39-year structures would increase long-run economic output by 2.8 percent, the capital stock by 7.0 percent, wages by 2.4 percent, and full-time equivalent employment by 569,000 jobs. On a conventional basis, we estimate that this policy would reduce federal revenue by $412 billion from 2021 through 2030.

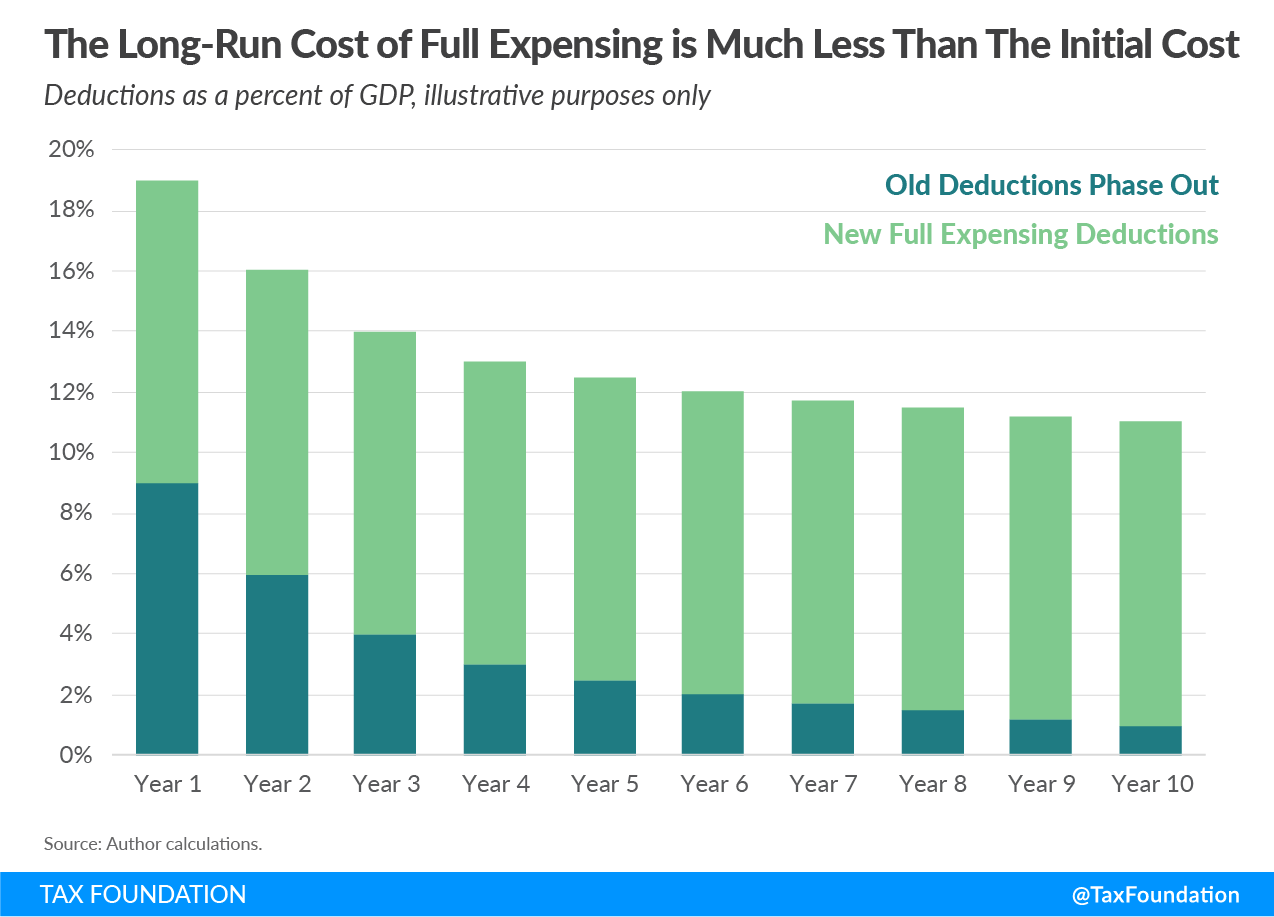

One obstacle to this approach is the large upfront cost. Companies with investments made before the policy change would still be taking depreciation deductions for those existing buildings, while companies with new investments would be taking full deductions. The combination of legacy write-offs from old investments and 100 percent write-offs for new investments makes the upfront cost for switching to full expensing quite large. As legacy write-offs are used up, the cost of the policy will fall, which is illustrated in the figure below.[4]

Another obstacle is that investments in structures are large and lumpy. If a business does not have enough income to absorb the full deduction for the outlay, it would generate a net operating loss that would have to be carried forward to future tax years.[5] This results in the same issue that full expensing aims to fix: the value of the net operating loss (NOL) deduction would fall over time and the business would not recoup the full cost of the investment in real terms. Option 2 addresses this problem.

Option 2: Neutral Cost Recovery System (NCRS) for Structures

A NCRS would address the eroding value of depreciation deductions by indexing the value of deductions to inflation and a real rate of return.[6]

The problem with the current system of depreciation deductions is that they are not as valuable to the company as the original cost of the investment because the deductions lose value over time. Under a NCRS, the current system of depreciation (MACRS) would be retained, but the depreciation deductions would be adjusted to maintain the present value of the write-offs over time.

Using the Tax Foundation General Equilibrium Model, we estimate that a NCRS for new 27.5- and 39-year structures would increase long-run economic output by 2.8 percent, the capital stock by 7.0 percent, wages by 2.4 percent, and full-time equivalent employment by 569,000 jobs. On a conventional basis, we estimate that this policy would reduce federal revenue by almost $11 billion from 2021 through 2030, though the cost would increase beyond the budget window.

Indexing depreciation deductions to inflation and a real rate of return would greatly reduce the penalty imposed on waiting to recognize the cost for tax purposes. In real terms, this indexing provides nearly equal treatment to immediate expensing in most cases while avoiding the large upfront cost of expensing.

The challenges associated with the NCRS approach are twofold: discount rates can vary across firms and investments, which would not be recognized under a NCRS, and firms may experience uncertainty about the long-term stability of the system compared to full expensing, where they would get an immediate deduction.

Both full expensing and neutral cost recovery would represent significant improvements, and thus significant changes, to current policy. In the past, incumbent firms have expressed skepticism over full expensing of structures.[7] Both policy options would provide a huge advantage to new buildings over existing buildings if no mitigating policies were enacted in tandem. For example, a structure put in place the year before the policy change would have to be depreciated over 39 years, while a structure built in the next year under the policy change would have access to full cost recovery. Providing a partial benefit to existing structures or slowly phasing in the benefit to new structures could reduce the disparity between old and new. However, in the past, the proposed solution to this concern has been to abandon full expensing in favor of shortened depreciation schedules for long-lived assets, which is modeled in Option 3.

Option 3: Move to a 20-year Depreciation Schedule for Structures

This option would retain the system of depreciation deductions for structures but would shorten the length of time companies are required to deduct their investment costs in structures to 20 years. Compared to the current schedules of 27.5 and 39 years, companies would get to write off their investments faster and recover a larger share of the original cost in present value terms.

Using the Tax Foundation General Equilibrium Model, we estimate that moving to a 20-year depreciation schedule for structures that would fall into the 27.5 and 39 years categories under current law would increase long-run economic output by 1 percent, the capital stock by 2.4 percent, wages by 0.8 percent, and full-time equivalent employment by 199,000 jobs. On a conventional basis, we estimate that this policy would reduce federal revenue by $72 billion from 2021 through 2030.

A shorter depreciation schedule would increase the present value of deductions compared to current law and decrease the after-tax cost of making investments, but ultimately retain a bias against investment in structures in the tax code. Rather than reducing the disparity between new and existing structures by maintaining a bias against new structures, lawmakers could extend neutral tax treatment to existing structures too.

Option 4: 20 Percent Bonus Depreciation for Structures

This option would allow businesses to write off 20 percent of the initial cost of investments in structures in the first year and depreciate the remaining 80 percent of the cost over the depreciation schedule as they would under current law. By increasing the amount of the deduction businesses can take immediately, this option increases the total present value of the write-offs that would occur under regular depreciation schedules but would still fall short of full expensing or neutral cost recovery.

Using the Tax Foundation General Equilibrium Model, we estimate that 20 percent bonus depreciationBonus depreciation allows firms to deduct a larger portion of certain “short-lived” investments in new or improved technology, equipment, or buildings in the first year. Allowing businesses to write off more investments partially alleviates a bias in the tax code and incentivizes companies to invest more, which, in the long run, raises worker productivity, boosts wages, and creates more jobs. for 27.5- and 39-year structures would increase long-run economic output by 0.5 percent, the capital stock by 1.3 percent, wages by 0.5 percent, and full-time equivalent employment by 111,000 jobs. On a conventional basis, we estimate that this policy would reduce federal revenue by $83 billion from 2021 through 2030.

Both Option 3 and Option 4 would improve the tax treatment of new structures, but to a lesser extent than Option 1 and Option 2. Shortening asset lives or providing a larger upfront deduction—instead of moving to a policy that would maintain the present value of deductions to equal the size of the outlay—would result in a smaller positive economic effect.

Option 5: Neutral Cost Recovery for Existing and New 27.5- and 39-year Structures

This option would apply the NCRS adjustments to new investments in structures and to the remaining basis of the existing stock of structures. For example, in the year of enactment of a NCRS, businesses that already have deductions on the books for investments made in the past would receive the same adjustment to their deductions that new investments would receive moving forward. This would increase the value of deductions to companies that made investments in the past, reducing the advantage new investments would have relative to old investments.

It is important to emphasize that improving the tax treatment of investments made in the past will not boost economic output. Companies cannot go back in time and choose a different investment pattern based on improved tax treatment today. Instead, this option of a NCRS for existing investment can be viewed as lessening the disparity between new and existing structures, which may help prevent wasteful churning that would otherwise occur.

Using the Tax Foundation General Equilibrium Model, we estimate that a NCRS for both new and existing 27.5- and 39-year structures would increase long-run economic output by 2.8 percent, the capital stock by 7.0 percent, wages by 2.4 percent, and full-time equivalent employment by 569,000 jobs. Note that this is the same long-run effect as a NCRS for new structures; extending the benefit to existing structures does not affect long-run growth. On a conventional basis, we estimate that this policy would reduce federal revenue by $84 billion from 2021 through 2030.

If lawmakers want to provide more of a benefit to existing structures, they could offer adjustments dating to the time the investment was placed in service. Note that this would significantly increase the short-term cost of the policy without providing additional long-run growth, but would be a way to improve the liquidity of firms by providing an infusion of cash and further reduce the disparity between existing investments that would otherwise continue to receive poor tax treatment and new investments that would receive neutral tax treatment.

| Full Expensing for 27.5- and 39-year Structures | Neutral Cost Recovery for New 27.5- and 39-year Structures | 20-Year Depreciation for 27.5- and 39-year Structures | 20 Percent Bonus Depreciation for 27.5- and 39-year Structures | Neutral Cost Recovery for New and Existing 27.5- and 39-year Structures | |

|---|---|---|---|---|---|

| Long-run Gross Domestic Product | 2.8% | 2.8% | 1% | 0.5% | 2.8% |

| Capital Stock | 7.0% | 7.0% | 2.4% | 1.3% | 7.0% |

| Wages | 2.4% | 2.4% | 0.8% | 0.5% | 2.4% |

| Full-Time Equivalent Employment | 569,000 | 569,000 | 199,000 | 111,000 | 569,000 |

| 10-year Conventional Revenue (2021-2030) | -$412.9 billion | -$10.6 billion | -$71.9 billion | -$82.7 billion | -$84.1 billion |

|

Note: We did not allow 20-year asset lives for structures to qualify for the 100 percent bonus depreciation provision in effect under current law. Source: Tax Foundation General Equilibrium Model, November 2019. |

|||||

Full expensing and neutral cost recovery provide the largest increase in economic output of the options discussed in this paper. The trade-off between these two policies is the timing of the cost; full expensing has a large upfront cost that falls over time, while a NCRS has a small upfront cost that rises over time. Another consideration is that implementing either full expensing or neutral cost recovery would create a huge disparity between new and existing structures. Options that slightly improve the tax treatment of investments in new structures—a shorter depreciation schedule or a bonus depreciation deduction in the first year—would lessen the disparity between new and existing structures and the cost to the government, but would also have a smaller effect on economic output. Rather than retain the bias against new investment, one option would be to extend neutral cost recovery to existing structures. Providing neutral cost recovery to new and existing investment would increase the short-term cost of a NCRS but would reduce the disparity between new and existing structures while eliminating the bias against long-lived investments.

Other Concerns

In past policy discussions of extending full expensing to long-lived structures, the issue of how to treat land under a full expensing policy has been raised. Under current law, land does not have a limited life and thus is not given a cost recovery allowance. When land is sold, the purchase price is subtracted from the sale price, and any capital gain or loss is included in taxable income.

In an ideal cash-flow tax, all outlays, including for land, would be deductible in the year the outlay occurs, just as for any other production input.[8] Similarly, there are other classes of assets, such as Section 197 intangible assets (e.g., acquired intangibles like goodwill, purchased copyrights, or licenses such as for spectrum), that would also be expensed under a cash-flow tax. These concerns are less immediate in the current context of removing barriers to investment for the post-pandemic economic recovery. Extending expensing to many of these outlays, such as land, would not increase long-run economic growth because they would not affect the cost of corporate capital. However, providing an immediate deduction for all outlays would improve the neutrality and simplicity of the tax code.

Conclusion

There are many ways that lawmakers could improve the cost recovery treatment of long-lived investments in structures. These range from the ideal policy of full expensing to smaller improvements like shorter asset lives or providing bonus depreciation. Policymakers must weigh the trade-offs among long-run economic output goals, revenue constraints, and the existing stock of structures. Nevertheless, improving the tax treatment of structures is one of the most cost-effective tax policy changes available to lawmakers as they consider how to remove investment barriers in the tax code to hasten the economic recovery.

[1] Scott A. Hodge, Jared Walczak, Karl Smith, and Daniel Bunn, “Tax Policy After Coronavirus: Clearing a Path to Economic Recovery,” Tax Foundation, Apr. 22, 2020, https://taxfoundation.org/coronavirus-economic-recovery/.

[2] Erica York and Huaqun Li, “Reviewing the Economic and Revenue Implications of Cost Recovery Options,” Tax Foundation, Apr. 28, 2020, https://taxfoundation.org/full-immediate-expensing/.

[3] Internal Revenue Service, Publication 946 (2019), How To Depreciate Property, https://www.irs.gov/publications/p946#en_US_2017_publink1000107538.

[4] Kyle Pomerleau and Scott Greenberg, “Full Expensing Costs Less Than You’d Think,” Tax Foundation, June 13, 2017, https://taxfoundation.org/full-expensing-costs-less-than-youd-think/.

[5] Stephen J. Entin, “Tax Treatment of Structures Under Expensing,” Tax Foundation, May 24, 2017, https://taxfoundation.org/tax-treatment-structures-expensing/.

[6] Stephen J. Entin, “The Neutral Cost Recovery System: A Pro-Growth Solution for Capital Cost Recovery,” Tax Foundation, Oct. 29, 2013, https://taxfoundation.org/neutral-cost-recovery-system-pro-growth-solution-capital-cost-recovery.

[7] Jeffrey D. DeBoer, “Statement for the Record: Hearing on Business Tax Reform,” The Real Estate Roundtable, Sept. 19, 2017, https://www.finance.senate.gov/imo/media/doc/19SEP2017DeBoerSTMNT.pdf.

[8] Dr. Norman B. Ture and Stephen J. Entin, The Inflow Outflow Tax – A Saving-Deferred Neutral Tax System, Institute for Research on the Economics of Taxation, 1997, http://iret.org/pub/inflow_outflow.pdf.

Share this article