The taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. reform debate is heating up in Minnesota. Governor Mark Dayton (DFL) released his proposal several weeks ago, but Republicans have criticized the plan. Criticism picked up particularly after the Department of Revenue released an incidence report that shows the governor’s tax proposal combined with his proposal to extend the MinnesotaCare 2 percent provider tax would raise the tax burden on all Minnesotans.

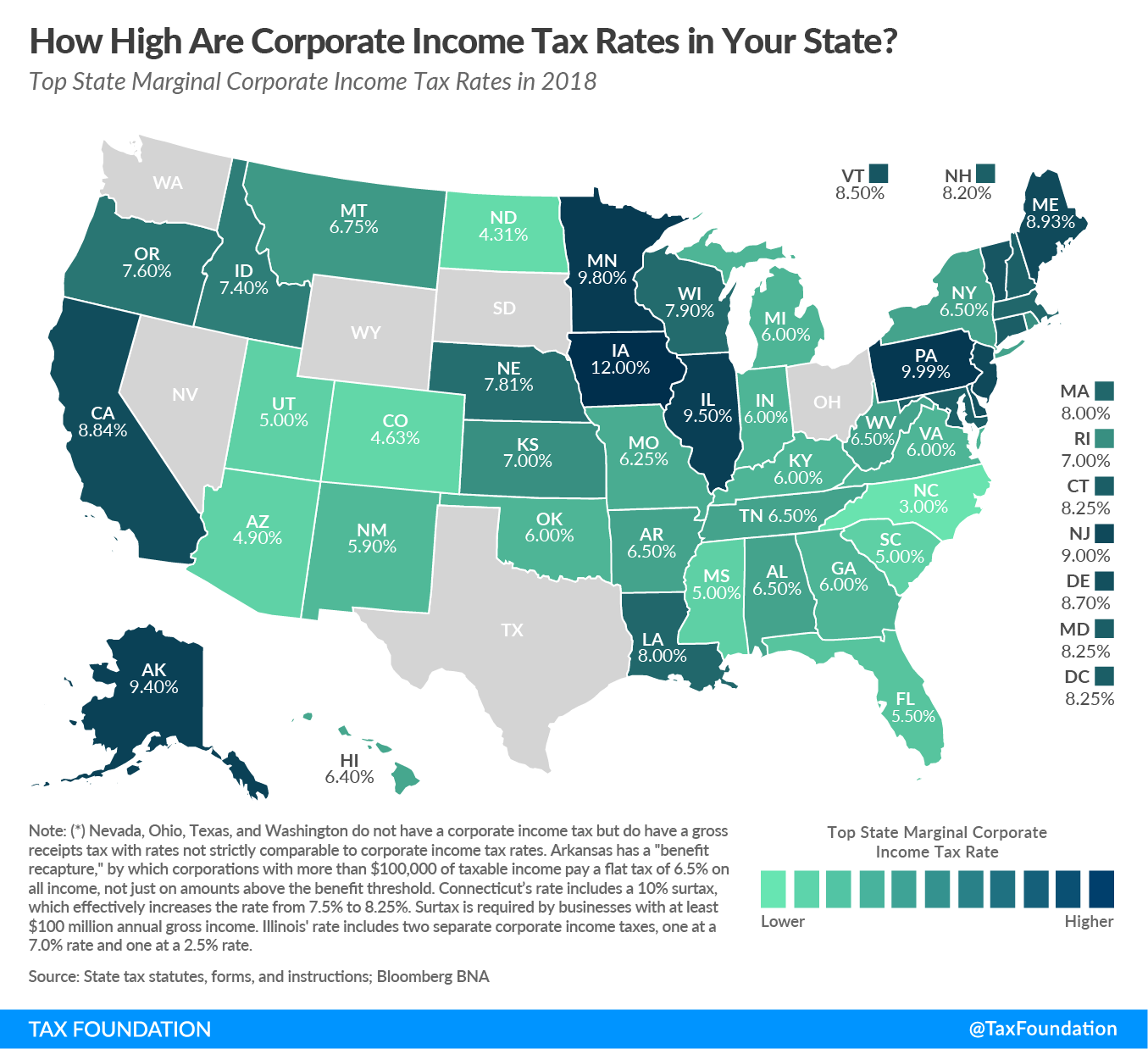

Though Republicans haven’t released comprehensive tax reform legislation this session, Senator Roger Chamberlain (R), chair of the Taxes Committee, has introduced SF 4010, which would eventually reduce the corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. rate and individual income taxAn individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or household earns. The U.S. imposes a progressive income tax where rates increase with income. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment. Though barely 100 years old, individual income taxes are the largest source of tax revenue in the U.S. rates by 1 percent. Minnesota currently levies the fourth highest top individual income tax rate at 9.85 percent, and the third highest corporate income tax rate at 9.8 percent.

Senator Chamberlain’s bill uses tax triggers to gradually reduce the rates. SF 4010 specifies that if revenues exceed expenditures by more than the revenue reduction that would occur from the rate cuts, rates would be reduced by one-tenth of a percentage point.

What’s unique about Minnesota’s individual income tax rates, specifically, is their relatively low bracket threshold for top rates. Minnesota’s top rate kicks in at $160,020 of income for single filers, and the second highest rate of 7.85 percent kicks in at $85,060. For contrast, states that typically come to mind as “high-tax states” like New York and California don’t apply their top rate until above $1 million in income.

Lowering the corporate income tax rate is also a step in the right direction for the state. Minnesota’s 9.8 percent rate is not regionally competitive with states like North Dakota, South Dakota, or Wisconsin. Iowa is the only surrounding state with a higher rate (12 percent), but Iowa offers a deduction for federal taxes paid.

This approach to income tax relief is more comprehensive than Governor Dayton’s proposed income tax creditA tax credit is a provision that reduces a taxpayer’s final tax bill, dollar-for-dollar. A tax credit differs from deductions and exemptions, which reduce taxable income rather than the taxpayer’s tax bill directly. expansion. Using a trigger to gradually lower the rate can also help to limit any volatility associated with rate changes and can ensure revenue predictability for budgeting purposes. Sound tax policy broadens the tax baseThe tax base is the total amount of income, property, assets, consumption, transactions, or other economic activity subject to taxation by a tax authority. A narrow tax base is non-neutral and inefficient. A broad tax base reduces tax administration costs and allows more revenue to be raised at lower rates. and lowers the tax rate. The federal government broadened the tax base under the Tax Cuts and Jobs Act, and this bill begins to reduce rates for Minnesotans.

Share this article