The economic harms of the gross receipts tax (GRT) were well understood by the early 20th century. Not only is the taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. inequitable, but it is also inefficient and distortionary. That is why most states abandoned GRTs in the early 1900s, as states developed the capacity to administer less harmful taxes. Unfortunately, some policymakers in Massachusetts want to turn back the clock.

Today, only a handful of states levy any variation of the GRT. Those that still rely on them as a significant source of revenue (like Texas, Nevada, Ohio, and Washington) typically do so in lieu of one or more alternative taxes. None of these states imposes a corporate income tax, and Ohio repealed several other business taxes as well when it adopted its GRT.

Some Massachusetts policymakers, however, want to layer a GRT atop the state’s existing corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. . If H.2855 becomes law, it would reduce the competitiveness of the Bay State and increase prices for consumers on already expensive goods and services. To make matters worse, Bay Staters would be asked to shoulder the added tax burden at a time when inflation is already eroding purchasing power at a rate not seen 1982.

The GRT has persisted into the 21st century thanks, in part, to its claim of a guaranteed revenue stream. But therein lies the inequity. The so-called guaranteed revenue stream occurs because GRTs are assessed regardless of a company’s ability to pay, whether it lost money or earned a profit in any given year. The result is an inequitable tax that forces struggling firms further into the red and disproportionately harms businesses with narrow profit margins.

Unlike other states that have enacted GRTs, Massachusetts’ proposal intends to layer a broad-based tax on services and goods at all stages of production while retaining every component of the present tax regime. When Ohio adopted its GRT, known as the Commercial Activity Tax (CAT), in 2005, policymakers did so while simultaneously repealing the state’s corporate income tax, capital stock tax, and business tangible property tax. H.2855 takes an all-of-the-above approach and applies the GRT to all receipts obtained from sales, services, property deals, interest, rent, royalties, and miscellaneous other fees, without repealing any existing taxes. A 0.25 percent tax rate may seem low, but in the world of GRTs, it is not: it is virtually identical to Ohio’s 0.26 percent rate, which is in lieu of other business taxes.

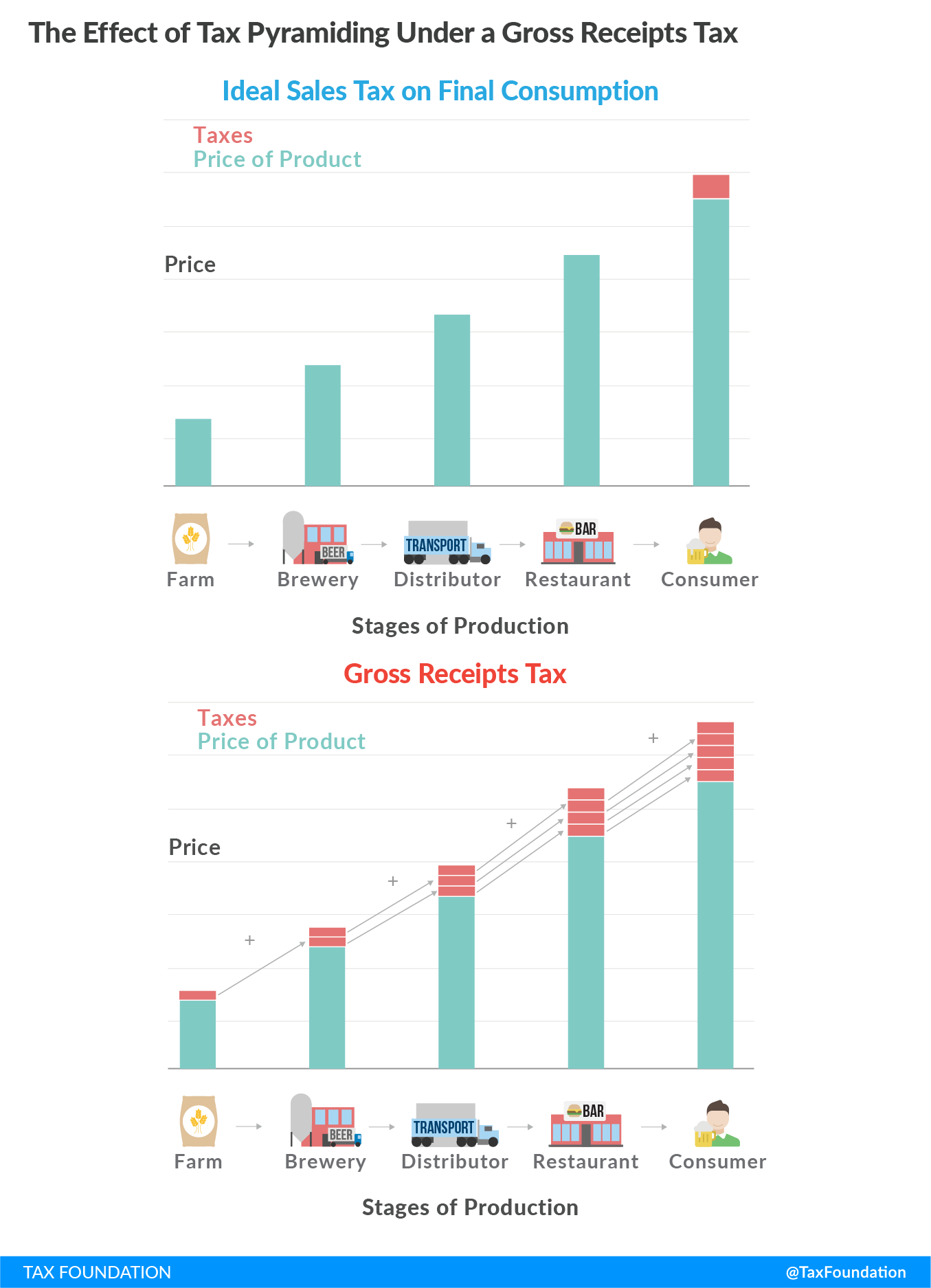

The GRT also lacks transparency, which violates a key tenant of sound tax policy. Although GRTs usually apply to all intermediate transactions during production, consumers are generally unaware that when they purchase a retail product they are paying tax on the price of the good and at least one (perhaps several other) iteration of the GRT. The GRT adds a deadweight cost to production which is compounded as firms build the tax into their sale price at each stage of production. The GRT is compounded a final time when a sales taxA sales tax is levied on retail sales of goods and services and, ideally, should apply to all final consumption with few exemptions. Many governments exempt goods like groceries; base broadening, such as including groceries, could keep rates lower. A sales tax should exempt business-to-business transactions which, when taxed, cause tax pyramiding. is applied at the point of sale. This phenomenon, known as tax pyramiding, harms both producers and consumers as it artificially increases the final price of a good. In cases where there are few substitutes for a good or service, producers will pass the entire cost of the tax on to consumers. And where there are substitutes, Massachusetts businesses are at a disadvantage, because their out-of-state peers won’t have the tax embedded at each layer of their production.

Massachusetts policymakers know the harms of tax pyramidingTax pyramiding occurs when the same final good or service is taxed multiple times along the production process. This yields vastly different effective tax rates depending on the length of the supply chain and disproportionately harms low-margin firms. Gross receipts taxes are a prime example of tax pyramiding in action. , which is why there are exemptions for many business inputs in the Commonwealth’s sales tax. The GRT would effectively override many of those exemptions.

GRTs are infamous for their tax pyramiding effects, but H.2855 is uniquely inefficient. The bill’s exemption threshold creates a disincentive for investment; its broad nexus provision encourages outmigration; and the added cost for the tax base threatens to increase prices for consumers in Massachusetts and elsewhere.

The proposed bill includes a $50 million receipt exemption that is ostensibly designed to target large companies. However, reality may not abide the intention. Unlike the CIT, which accounts for the cost of property, materials, labor, services, interest paid, and other annual losses, GRTs do not deduct the costs of doing business. In high-cost industries or ones with low profit margins, even moderately sized firms by net income metrics could be subject to GRT liability.

Additionally, the exemption threshold creates an impediment for additional investment. Firms in low-margin industries would have little incentive to collect more than $50 million of receipts if additional investment would incur tax liability that negates meaningful return on investment.

Another source of inefficiency is attributable to H.2855’s broad nexus provisions. Under this proposal nexus is triggered, predictably, by a firm that conducts the preponderance of its business operations in the Commonwealth. However, nexus can also be achieved by economic activity as modest as a single employee living in Massachusetts but working remotely for an out-of-state firm. Under this nominal nexus threshold, H.2855 could tax the gross incomeFor individuals, gross income is the total pre-tax earnings from wages, tips, investments, interest, and other forms of income and is also referred to as “gross pay.” For businesses, gross income is total revenue minus cost of goods sold and is also known as “gross profit” or “gross margin.” of, say, a Texas-based firm whose sole activity in the Commonwealth involves a human resources contractor working remotely from her kitchen table in Springfield.

Particularly broad nexus provisions incentivize companies to prohibit employees from working remotely in jurisdictions where new tax liabilities could be incurred. The collective loss of remote workers’ income, sale, and property taxA property tax is primarily levied on immovable property like land and buildings, as well as on tangible personal property that is movable, like vehicles and equipment. Property taxes are the single largest source of state and local revenue in the U.S. and help fund schools, roads, police, and other services. revenues due to outmigration or outright avoidance of the Commonwealth could well offset any new GRT revenue collected from out-of-state firms. In an age when remote work is rapidly becoming the norm, Massachusetts policymakers should set conditions to draw new workers to the state, not risk pushing them away.

Since there are relatively few substitutes for many of products subject to the proposed tax, the GRT on those goods will likely be passed entirely to consumers. But with the 12-month inflationInflation is when the general price of goods and services increases across the economy, reducing the purchasing power of a currency and the value of certain assets. The same paycheck covers less goods, services, and bills. It is sometimes referred to as a “hidden tax,” as it leaves taxpayers less well-off due to higher costs and “bracket creep,” while increasing the government’s spending power. rate at its highest point since 1982 and total spending on health care projected to reach 19 percent of GDP by 2025, Bay Staters do not need additional price increases. Yet the new GRT could provide just that by increasing the cost of everything from automobiles to lab equipment.

The GRT will apply to Massachusetts companies that produce common vehicle inputs such as sunroofs, cupholders, and laser welding machines. It will show up in the price of goods sold by professional sports teams, including tickets and memorabilia. Even as supply chain issues plague the country, the GRT will be added to the cost of shipping companies importing or exporting goods through the Port of Boston.

Other likely candidates for Massachusetts’ GRT include the medical equipment producers, pharmaceutical companies, and technology firms that are so prevalent in the Bay State. These companies produce medical devices like pacemakers, stents, orthopedic shoe insoles, and blood pressure cuffs.

The unique function, high demand, and relatively high barriers to market entry in the aforementioned industries can result in firms accruing high annual receipt totals. Less visible, however, are the similarly high input costs required for production: wages for highly skilled labor, research and development costs, emerging technology costs, etc. With high operating costs, it does not take long before a large amount of gross income is reduced to a small amount of net income. For young businesses dealing with startup debt in these industries, mature businesses recovering from an unprofitable year, or narrow-margin businesses that end up bearing part of the tax, the GRT makes returning to or sustaining profitability even harder.

Still other reasons exist to doubt the promises of the GRT—particularly in Massachusetts. At the top of the list is the availability of substitutes. A producer or consumer can avoid the burden of a tax if he can find a suitable substitute that does not impose the same tax effects, but that is not always possible. In those cases, substituting a state may be just as effective. Massachusetts is a geographically small state. Thus, it may be more cost effective to produce or consume through a neighboring state. Consider Massachusetts’ largely ineffective ban on menthol cigarettes. Instead of quitting the habit, many Bay Staters now simply purchase their tobacco across state lines. If the proposed GRT becomes law, businesses that cannot fully shift the tax to consumers may be convinced to move their operations to one of Massachusetts’ more tax competitive neighbors.

Given Massachusetts’ $5 billion surplus in fiscal year 2021 and its sustained revenue levels in FY 2022, it is hard to justify the economic risk to the Commonwealth from enacting a GRT. Not only is the tax inequitable and inefficient, it also could be what drives businesses and remote workers into another state. Consumers who are unable to move will end up bearing the burden of higher prices. The GRT may be remitted by corporations, but tax pyramiding ensures individuals bear the burden whether they like it or not.

Share this article