Last week, Maryland House Majority Leader Eric G. Luedtke (D) introduced HB1628 which, if enacted, would expand the state sales tax base to include services and raise an estimated $2.6 billion annually by 2025. The concept of broadening the sales tax base to include retail service consumption is one that taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. economists across the spectrum have long supported as a way to improve the neutrality of state sales taxA sales tax is levied on retail sales of goods and services and, ideally, should apply to all final consumption with few exemptions. Many governments exempt goods like groceries; base broadening, such as including groceries, could keep rates lower. A sales tax should exempt business-to-business transactions which, when taxed, cause tax pyramiding. codes. However, economists who look at the issue also agree that business purchases should be exempt from sales taxation. HB1628 defines services in a way that would not only tax consumer services but also business inputs, which actually constitute the vast majority of the proposed expansion. This would cause tax pyramiding that would hurt Maryland’s competitiveness and increase costs for all Marylanders.

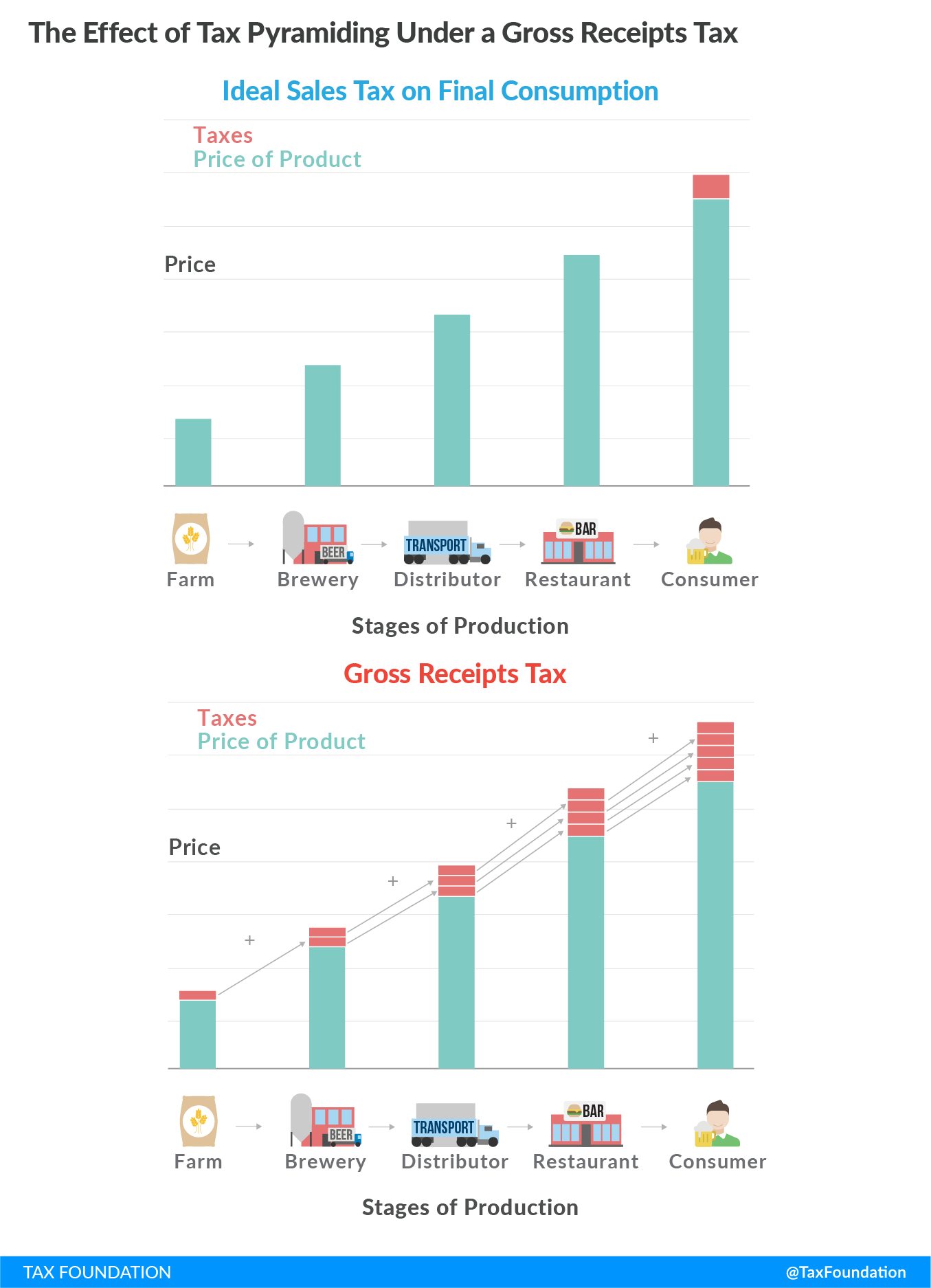

A well-designed sales tax is levied on all final consumer goods and services while exempting all purchases made by businesses that will be used as inputs in the production process. Exemption of business-to-business purchases can be done by exempting from taxation services exclusively purchased by businesses and with tax exemptionA tax exemption excludes certain income, revenue, or even taxpayers from tax altogether. For example, nonprofits that fulfill certain requirements are granted tax-exempt status by the Internal Revenue Service (IRS), preventing them from having to pay income tax. certificates for businesses to use when they make purchases. Unfortunately, business-to-business transactions are taxed to some degree in every state that levies a sales tax. Businesses do not deserve special treatment under the tax code, but applying the sales tax to business inputs results in multiple layers of taxation embedded in the price of goods once they reach final consumers, a process known as “tax pyramidingTax pyramiding occurs when the same final good or service is taxed multiple times along the production process. This yields vastly different effective tax rates depending on the length of the supply chain and disproportionately harms low-margin firms. Gross receipts taxes are a prime example of tax pyramiding in action. .” The result is higher and inequitable effective tax rates for different industries and products, which is both nonneutral and nontransparent because it hides actual tax costs from consumers. Furthermore, this tax pyramiding makes local businesses uncompetitive with businesses in states with less tax pyramiding, and can distort company structures.

The Maryland sales tax expansion proposal is motivated by plans to expand public spending on education. Majority Leader Luedtke suggests that the state should raise the funding through sales tax base broadening as the current tax code is outdated.

HB1628 taxes economic activity far too broadly, but there are legitimate reasons to modernize Maryland’s sales tax—not necessarily to collect more revenue, but rather, to achieve greater balance. Like most states, Maryland imposes it sales tax on a base consisting mostly of goods. While there are exemptions, the sales tax by and large applies to tangible property. There is historical background for this. When the sales tax was introduced in Maryland in 1947, the economy looked very different from today. In 1947, services comprised 38.5 percent of personal consumption nationwide. In the fourth quarter of 2019, services comprised 69 percent of personal consumption expenditures.

Today, many consumers never actually purchase music, movies, or shows. Instead, they subscribe to online services such as Hulu, Netflix, Spotify, and Apple Music. Increasingly, younger generations purchase “experiences” more than tangible goods—and most of those experiences involve services, whether it’s yoga classes or cooking lessons.

These developments influence the neutrality and effectiveness of the sales tax, which can be expressed by the breadth. One way to estimate the breadth is as a percentage of personal income. In fiscal year 2017, Maryland’s sales tax breadth, as a percentage of state income, was 24 percent. As not all income is consumed within the year it is made (and not all final consumption is practical to tax), a sales tax breadth should not reach 100 percent. However, a wider sales tax breadth would allow Maryland to collect the same revenue at much lower rates.

Another way of looking at whether the sales tax in Maryland reflects modern consumption patterns is to multiply all personal consumption in the state ($283 billion in 2018) and the sales tax rate (6 percent in 2018), which yields a theoretical $16.9 billion in collections—a figure three times higher than what the state actually collects in sales tax. On the flip side, the state’s actual collections include significant revenue from business-to-business transactions, which do not form a part of personal consumption. Majority Leader Luedtke is correct when he says that Maryland’s sales tax does not reflect modern consumption.

Below are some of the principles of a well-designed sales tax:

- An ideal sales tax is imposed on all final consumption, both goods and services;

- An ideal sales tax exempts all intermediate transactions (business inputs) to avoid tax pyramiding;

- Sales taxes should be destination-based, meaning that tax is owed in the state and jurisdiction where the good or service is consumed;

- The sales tax is more economically efficient than many competing forms of taxation, including the income tax, because it only falls on present consumption, not saving or investment;

- Because lower-income individuals have lower savings rates and consume a greater share of their income, the sales tax can be regressive, though broadening the base to include additional consumer services (much more heavily consumed by higher-income individuals) represents a progressive change;

- The sales tax scales well with ability to pay, because it grows with consumption and is therefore more discretionary than many other forms of taxation; and

- Consumption is a more stable tax baseThe tax base is the total amount of income, property, assets, consumption, transactions, or other economic activity subject to taxation by a tax authority. A narrow tax base is non-neutral and inefficient. A broad tax base reduces tax administration costs and allows more revenue to be raised at lower rates. than income, though the failure to tax most consumer services is leading to a gradual erosion of sales tax revenues as services become an ever-larger share of consumption.

A common concern heard about the sales tax is that it is regressive. However, broadening the sales tax base to collect the same revenue is a progressive change. Maryland’s current sales tax has two potential sources of regressivity: one, the tendency of lower-income individuals to consume a greater share of their income, and two, a scope of taxable consumption that is more likely to fall on the sorts of transactions (goods) which dominate the consumption of lower- and middle-income individuals.

To limit the regressive effects of sales taxation, policymakers often exempt certain purchases from taxation or lower rates on certain consumption categories. Maryland’s exemption of groceries is one such example, although there is reason to believe it may not be terribly effective. Prepared foods are taxed at the standard rate and much of the regressivity of taxing unprepared foods is addressed by the exemption for SNAP (food stamps) and WIC purchases.

In fact, while not enough work has been undertaken to establish a consensus, there is research finding that lower-income taxpayers would actually be better off if groceries were fully included in sales tax bases (while retaining the federally-indicated exemption of SNAP and WIC purchases) and revenue neutral adjustments were made to the tax rate. The lower grocery rate is designed to create progressivity but largely fails to do so. Broadening the base to include services, which tend to be more discretionary, would have a progressive effect on the sales tax.

While Maryland lawmakers would do well to expand the sales tax base to include consumer services, an expansion of the sales tax is best paired with a reduction of either the sales tax rate or the rate of other levies—especially given that Maryland already is a high-tax state. For instance, increased revenues from an updated sales tax would allow Maryland to exempt business inputs currently taxed under the sales tax, reduce the sales tax rate, or rely less on the more economically harmful income tax.

Share this article