Key Findings

- Saving and investment are necessary for a society to adequately provide for its future.

- Saving and investment have declined substantially as a percentage of GDP over the last 40 years, and have collapsed almost entirely since the financial crisis.

- American private saving barely keeps pace with total government deficits. On the whole, the country saves very little.

- American investment barely keeps pace with depreciationDepreciation is a measurement of the “useful life” of a business asset, such as machinery or a factory, to determine the multiyear period over which the cost of that asset can be deducted from taxable income. Instead of allowing businesses to deduct the cost of investments immediately (i.e., full expensing), depreciation requires deductions to be taken over time, reducing their value and discouraging investment. ; U.S. private and public capital stock and infrastructure deteriorates almost as quickly as it can be repaired or replaced with new investment.

- The U.S., overall, does not save enough money to fund all of the worthwhile domestic investments and relies substantially on foreign investors to make up the difference.

- TaxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. reform could help the U.S. become a forward-looking economy that invests and saves at more prudent rates.

Introduction

A society provides for its future by accumulating both physical and financial assets with lasting value. The United States, one of the wealthiest countries in the world, has long been a forward-thinking country that builds for tomorrow through saving and investment.

However, over the last fifty years, U.S. saving and investment have eroded substantially, and during the most recent financial crisis, they collapsed almost completely. At the national level, the U.S. is essentially treading water. Citizens are barely running enough household surplus to make up for government deficits, and businesses are barely investing enough new capital to make up for the depreciation of old capital.

Saving gives us security, while investment gives us rising incomes through enhanced productivity. America could do well with a great deal more of both.

Currently, the U.S. tax code places substantial burdens on saving and investment. As the world has globalized, other nations have made themselves more attractive destinations for investment by changing their tax codes. The United States would be wise to follow suit.

National Saving Is American Ownership of Assets and Freedom from Liabilities

One way for a society to provide for its future is by saving—diverting some of its income into assets with lasting value rather than using it all for immediate consumption. This process can start, for example, when a family puts aside some of its earnings into a saving account at a bank. The bank can then lends the money out to a business, which purchases new equipment.

This is a creation of assets and liabilities. The family owns a bank deposit, an asset. The bank owes the family money—a liability—but the bank owns the corporate bond, which counts as an asset. Finally, the business owes the bank—a liability—but it also owns new equipment, which counts as an asset.

Frequently, as with the bank’s loan to the business, one American’s asset is another American’s liability, and they cancel out. But on net, real wealth was saved in this example. The family ultimately enabled the purchase of the business equipment, a tangible representation of real wealth. The family has an asset—the saving account—and no liabilities. The way America saves, then, is if the whole country—individuals, organizations, and governments—acquires more assets than liabilities.

Assets are things like homes, shares of corporations, physical capital (such as machinery and factory buildings), and foreign bonds. Liabilities are things like debts, both private (mortgages) and public (treasury bills). Assets and liabilities are not just important as a measure of static wealth. They are important because of the capital income that flows from them. People who lend collect interest. People who borrow pay interest. Landlords receive the rent that tenants pay. Ownership is both a barometer of current financial success and a tool to enable future financial success.

When America as a whole accumulates more assets than liabilities, it becomes richer. Furthermore, it can expect returns on those assets, providing it with sources of income in the future. If America wants to become wealthier, saving helps. Unfortunately, the United States has done a poor job with this, both in the lead up to the financial crisis and in the years since.

The Last Decade in Saving

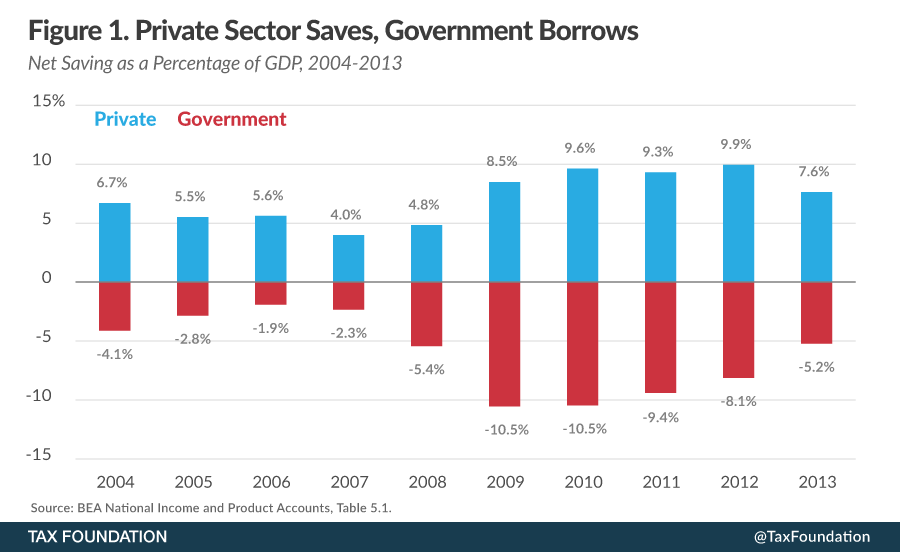

Over the last ten years—both before and after the Great Recession—the private sector has accumulated more assets than liabilities. It has saved. Meanwhile, the government has accumulated more liabilities than assets—the opposite of saving, or “dissaving.” This is primarily represented by government deficits.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

SubscribeNote in Figure 1 that government dissaving is frequently about as large as—or, in the case of the years 2008 to 2011, larger than—private sector saving. National savings is the sum of both public and private saving. On net, America is saving only a small percentage of its income; less than 4 percent for every year between 2004 and 2013, and less than 0 percent for several of them.

This is not to contrast a virtuous public with a spendthrift government. Rather, it is to show that, on the whole, large changes in government deficits were matched by an equal and opposite reaction in the private sector.

Incidentally, this reveals some of the limits of fiscal stimulus. Some government spending—particularly “automatic stabilizers” like means-tested benefits—can stabilize the consumption of people hit hardest by recessions. However, much of that stimulus ends up in banks, which may invest in the very same treasury bonds issued to create the fiscal stimulus in the first place. In the end, the banks owe the depositors, the government owes the banks, and the citizens are taxed by the government, resulting in no change in American wealth of any kind.

Low Personal Saving Contributed to the Great RecessionA recession is a significant and sustained decline in the economy. Typically, a recession lasts longer than six months, but recovery from a recession can take a few years.

Consider the finances of buying a home. A home is an asset, but a mortgage is a liability. One critical characteristic of the subprime loans issued in the last decade were low (or no) down payments. In fact, the National Association of Realtors reported in 2006 that the median first-time homebuyer financed 98 percent of the purchase price of the home.[1]

The accounting for this kind of transaction is fairly straightforward. The house and the mortgage virtually cancel each other out as an asset and a liability. The net saving is only the amount of the down payment. With only 2 percent down, even a minimal fall in price creates an underwater mortgage situation.

Borrowing in order to buy something is called “leveraging.” Leveraging can help finance useful activity, like home ownership, but it also comes with risks. Life becomes very difficult if the value of the asset you bought declines; if that happens, your asset is worth less but the value of your debt remains the same, and you might not be able to repay it.

Dangerously high leverage is the only way for people to finance high levels of consumption without saving first. In 2008, that high leverage proved itself disastrous when house prices fell. While this simple feature of subprime mortgages is only part of the story of the financial crisis, it is an important part. People with savings can insulate themselves from hard times in a way that people without savings cannot.

Saving Contributes to Investment

While the primary benefit of saving comes to the saver, national saving also allows us to invest in physical assets that help everyone. In the example of saving described above—where a family saves money and deposits it into the bank, and the bank lends that money to a business for the purchase of a new machine—the machine is what economists call investment.

Investment is the process by which financial savings are turned into real assets.[2] Investment is important because it allows the benefits of individual saving to be shared more broadly. The purchase of equipment makes the workers at the business more productive, raising their wages, and helps the economy produce more goods overall for consumers to use.

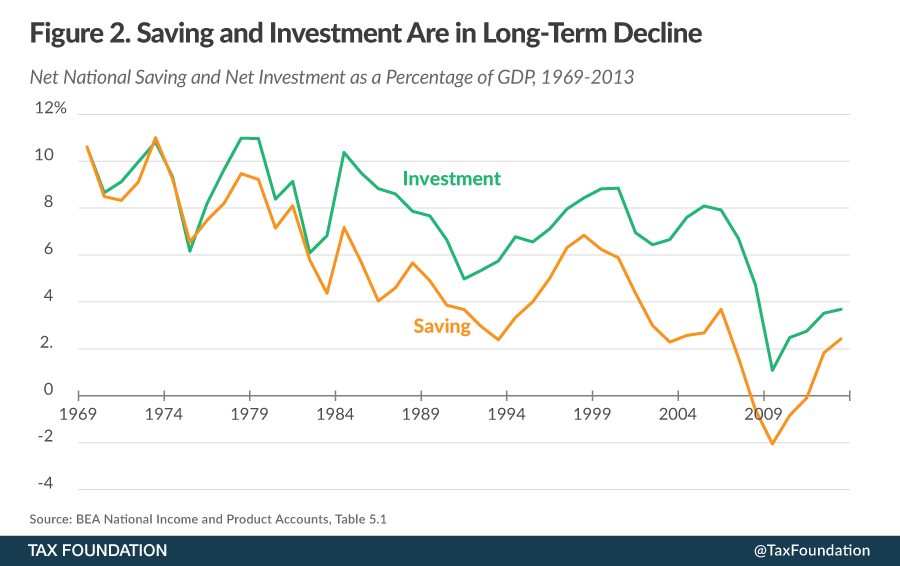

As saving has declined in the U.S., though, so has investment.

Figure 2 (above) includes all saving and investment in the U.S. as a percentage of GDP, including both the private and public sectors. Over the last four decades, saving and investment have continued on a downward trend, falling from over 10 percent of GDP to less than 4 percent today.

Saving and investment move in similar patterns overall. In general, saving is necessary to enable investment. But saving and investment are not exactly the same thing; in the U.S., investment outpaces saving. This discrepancy exists because the United States has an open economy. Foreign savers can purchase investments in our nation, and vice versa.[3] Much of the investment in America is financed from abroad. Foreign savers, in other words, are stepping in with their savings to fund the investments that American savers cannot afford.

There are limits to how much foreign savers can step in, though. Small businesses, like sole proprietorships, almost certainly must be owned domestically. Public investments, like highways, are owned by the government. And owner-occupied housing, by definition, must be owned by someone who lives here. For many of our investments, the financing must come from within.

America Does Not Save Enough to Cover its Domestic Investments

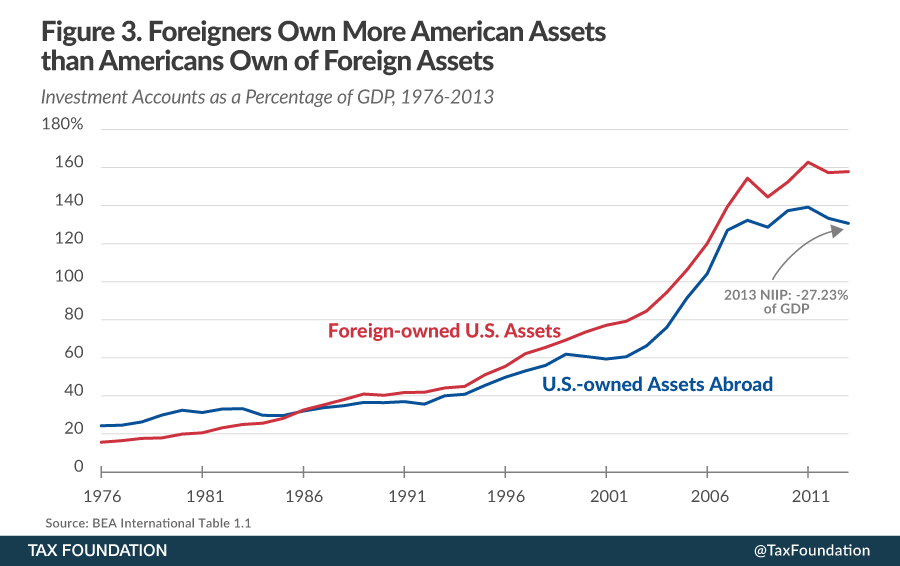

American investment has remained persistently higher than American saving. This is because, despite its lack of saving, America is a fairly good place to own investments, and foreign savers recognize this. The physical manifestation of this economic trend is that foreign investors own more property in America than Americans own abroad.

A particularly visible example is on the New York skyline. The Chrysler Building, the iconic 77-story tower on Lexington Avenue, is 90 percent owned by the Abu Dhabi Investment Council.[4] There is nothing particularly special about this transaction; it is one of many. But it is representative of the trend that Americans do not save enough to own the capital contained within America.

Openness to foreign investment is a good thing, a hallmark of a free and open society. The flow of rent—from American tenants in New York to landlords in Abu Dhabi—is perhaps no big deal in the grand scheme of things. But it is a missed opportunity.

America would be strictly better off, of course, if it had saved enough money to continue owning the building itself. Collectively, transactions like this one create a bigger picture where America owns less of the outside world than the outside world owns of America. There is a measure of this phenomenon called net international investment position (NIIP.) The U.S. NIIP is about negative $4.6 trillion, meaning that foreigners own about $4.6 trillion more of American assets than Americans own of foreign assets.[5]

Foreign investors own about $26.5 trillion of the stock of investments in the United States. Economists call this the capital stock. But not all of the capital stock can be financed from abroad, and in any case, there are cross-border transaction costs. The U.S. may be a bit over-reliant on foreign saving to supply it with the investments it needs to be productive.

Investment Increases Wages

The benefits of a high capital stock are shared broadly. As a country attracts high amounts of capital, workers become more productive. Additionally, local workers gain more bargaining power as more high-value employers enter the area. When a billion-dollar automobile assembly plant is built in a city, the corporation that owns the plant has a strong, permanent stake in competing for local workers, even if it requires substantially higher wages. The upward pressure on wages becomes even stronger with more investment.

This is a principle that applies to all kinds of capital-rich areas, and most workers understand it intuitively. There is a reason why skilled pile driver operators are paid well; if a company is willing to pay $700,000 for a pile driving rig, it will pay a premium to make sure the equipment is operated properly. This principle is, in fact, one of the primary reasons that American workers are paid so well by worldwide standards.

Investment Collapsed During the Recession

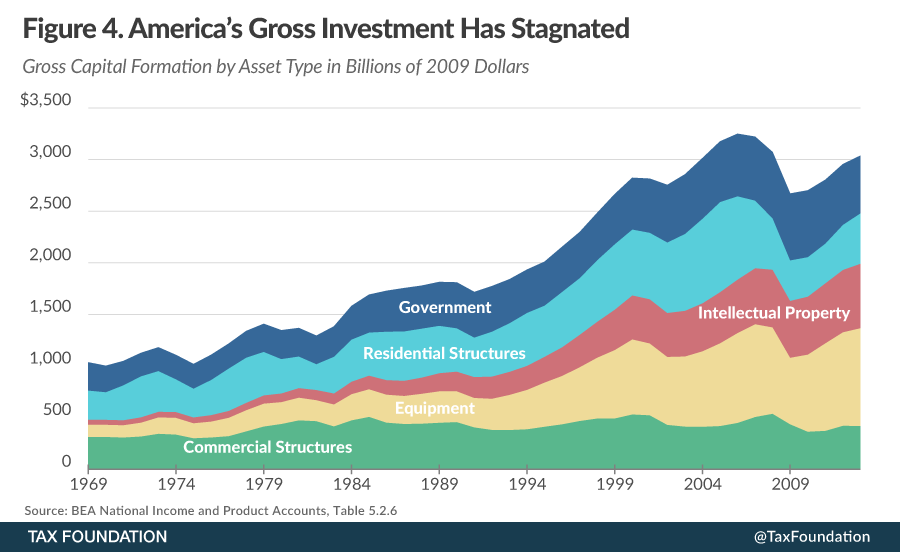

Since the Great Recession, American investment has come to a standstill, slowing wage growth. Even well into the recovery, America’s gross investment is still not much different than it was a decade ago.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

SubscribeReal American investment, prior to the recession, tended to increase with time. However, the last ten years have been a sort of lost decade for America; gross investment was $3.03 trillion in 2004, and it was $3.03 trillion in 2013. The last peak in investment came in the period of 2005 to 2006 just after the 2003 tax cuts reduced the cost of capital but before the housing bubble burst.

Unfortunately, this picture looks far worse when we remember the depreciation, or wearing down, of former capital investments. Bridges develop structural faults and need to be shored up. Buildings need repair. Industrial equipment reaches the end of its usable life and requires replacement.

When we subtract depreciation from gross investment to look at net investment, we see a bleak picture of what the 2008 recession did to investment in the United States. Much of that gross investment (or, in some sectors, all of that gross investment) is offset by depreciation, resulting in no net increase in wealth.

The most obvious trend is the housing bubble; net investment in housing was strong, but then it took a dramatic turn toward zero as the crisis developed. But the construction of plants and equipment—the stuff of industry—faltered as well, with greater levels of depreciation than investment. Even government—though it might be a small portion of national investment—invested less.

There is a place in this country for debate over what investments should be private and what investments should be public. It’s quite another thing to make barely any new net investments at all. A common perception of our economic malaise is that even if things aren’t getting worse anymore, they aren’t getting better, either. A great deal of this has to do with the fact that our capital stock is barely holding steady. Our possessions are falling into disrepair almost as fast as we build new ones.

It is also no wonder that talk about business in America is about “disruption” and innovative ideas; we aren’t getting rich the old-fashioned way anymore by building better physical infrastructure. The only sort of “capital” that has gained substantially over the last few years is intellectual property, which is great for the innovators in Silicon Valley and consumers all over the country, but hardly beneficial for the vast majority of workers employed outside of high-tech industries.

A One-Marshmallow Nation

In thinking about America’s slow economic growth, the Stanford marshmallow experiment comes to mind. In Walter Mischel’s famous series of studies on delayed gratification, participants were offered the choice between one marshmallow immediately or two marshmallows in the future. In other words, it was a very literal tradeoff between current and future consumption. In follow-up studies, researchers found that the patience to wait for the larger reward was correlated with all kinds of superior outcomes later in life, like higher educational attainment or SAT score. In light of this framework, the United States should perhaps consider more ways to become a two-marshmallow nation—one that defers immediate rewards for greater gains in the future.

Unfortunately, the incentives offered by the tax code have the opposite effect. Capital gains taxes are high—well above the OECD average—which creates a bias against saving.[6] Corporate taxes provide small, short-term revenue gains, but make the U.S. unattractive for investment. In a sample of 163 countries or tax jurisdictions, the U.S. top corporate rate was third highest in the world, behind only the United Arab Emirates and Chad.[7]

These taxes on capital income lower the after-tax return on capital; in effect, they change the tradeoff between tomorrow and today, making it less beneficial to wait for tomorrow. A fair way to tax capital income that does not change the tradeoff between tomorrow and today would be something more similar to the treatment of Traditional IRA contributions. The money in the IRA is taxed once, at ordinary rates, when it is withdrawn.

The non-neutrality of the tax code is a strong contributing factor in the decline of U.S. saving and investment. The U.S. could improve its saving and investment by reducing these taxes, moving to a territorial corporate tax system like those used in the rest of the world, or improving capital allowances in the corporate code.[8]

Conclusion

Declining saving and investment are a long-term trend in the United States. No individual policy, presidential administration, or event bears sole responsibility for the problem. Tax reform, however, is part of the solution.

The current tax code is a one-marshmallow tax code. It encourages Americans to consume their income immediately by artificially lowering the rates of return on saving. It is non-neutral between present consumption and saving for future consumption. That non-neutral treatment is a violation of a principle of good tax policy; good tax policy treats all economic activity equally. Yet it is also a violation of a greater principle: the principle that we ought to leave a better world for our children than the one given to us. We are a wiser people than what these trends represent.

American workers are highly productive. They are industrious, entrepreneurial, and innovative, and they will continue to earn high wages, even under a poor tax regime. But the country would have greater prosperity in its future if it saved and invested more judiciously today. A better tax regime would contribute substantially to that better future.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe[1] National Association of Realtors, 2006 National Association of Realtors Profile of Home Buyers and Sellers (Nov. 2006).

[2] This is a separate idea from the vernacular idea of “investment,” in which, for example, an individual purchases shares of stock or real estate. National accounts call only the construction of the asset “investment,” such that the asset doesn’t get double-counted as it changes hands.

[3] In an entirely closed economy, such as the planet Earth, saving and investment would be entirely equal as a matter of accounting identity.

[4] Charles V. Bagli, Abu Dhabi Buys 90% Stake in Chrysler Building, New York Times, July 10, 2008, http://www.nytimes.com/2008/07/10/nyregion/10chrysler.html.

[5] Bureau of Economic Analysis, International Data, International Transactions and International Investment Position Tables, Table 1.1. U.S. International Transactions, http://www.bea.gov/iTable/iTableHtml.cfm?reqid=62&step=6&isuri=1&6210=1&6200=1.

[6] Kyle Pomerleau, The High Burden of State and Federal Capital Gains TaxA capital gains tax is levied on the profit made from selling an asset and is often in addition to corporate income taxes, frequently resulting in double taxation. These taxes create a bias against saving, leading to a lower level of national income by encouraging present consumption over investment. Rates, Tax Foundation Fiscal Fact No. 414 (Feb. 11, 2014), https://taxfoundation.org/article/high-burden-state-and-federal-capital-gains-tax-rates.

[7] Kyle Pomerleau, Corporate Income TaxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. Rates around the World, 2014, Tax Foundation Fiscal Fact No. 436 (Aug. 20, 2014), https://taxfoundation.org/article/corporate-income-tax-rates-around-world-2014.

[8] Will McBride, How Tax Reform Can Address America’s Diminishing Investment and Economic Growth, Tax Foundation Fiscal Fact No. 395 (Sept. 23, 2013), https://taxfoundation.org/article/how-tax-reform-can-address-america-s-diminishing-investment-and-economic-growth.