Facts & Figures 2022: How Does Your State Compare?

Facts & Figures serves as a one-stop state tax data resource that compares all 50 states on over 40 measures of tax rates, collections, burdens, and more.

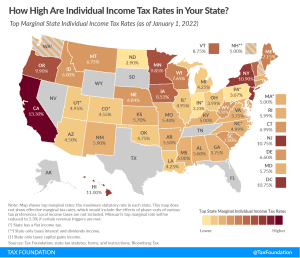

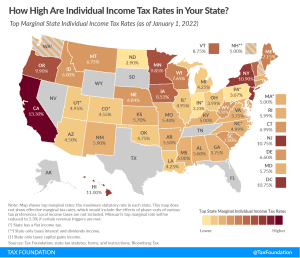

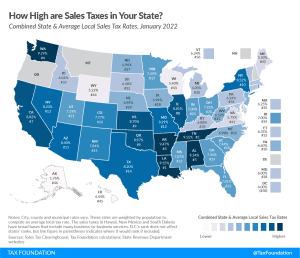

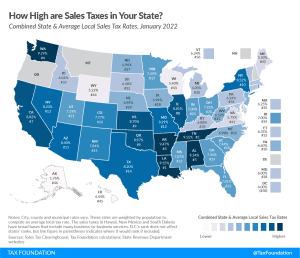

2 min readHow does Iowa’s tax code compare? Iowa has a graduated individual income tax, with rates ranging from 4.40 percent to 6.00 percent. There are also jurisdictions that collect local income taxes. Iowa has a 5.50 percent to 8.40 percent corporate income tax rate. Iowa has a 6.00 percent state sales tax rate, a max local sales tax rate of 1.00 percent, and an average combined state and local sales tax rate of 6.94 percent. Iowa’s tax system ranks 38th overall on our 2023 State Business Tax Climate Index.

Each state’s tax code is a multifaceted system with many moving parts, and Iowa is no exception. The first step towards understanding Iowa’s tax code is knowing the basics. How does Iowa collect tax revenue? Click the tabs below to learn more! You can also explore our state tax maps, which are compiled from our annual publication, Facts & Figures: How Does Your State Compare?

Facts & Figures serves as a one-stop state tax data resource that compares all 50 states on over 40 measures of tax rates, collections, burdens, and more.

2 min read

Even if 2022 sees many tax reforms, the scope of Iowa’s tax relief measures is likely to stand out. With the most recent reform package, Iowa lawmakers have made a significant investment in a more competitive tax climate for an increasingly competitive era.

6 min read

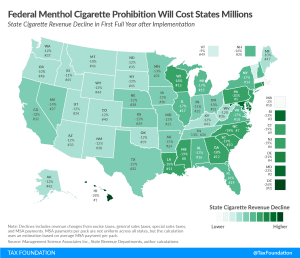

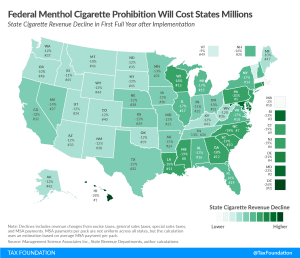

The FDA’s expected announcement of a national ban on menthol-flavored cigarettes and cigars with a characterizing flavor would carry significant revenue implications for both the federal government and state governments, with likely limited benefits in smoking cessation.

6 min read

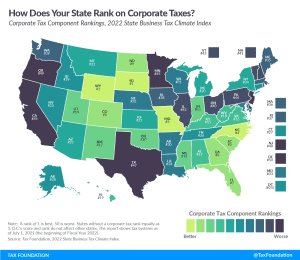

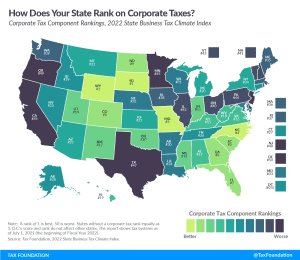

Unlike other studies that look solely at tax burdens, the State Business Tax Climate Index measures how well or poorly each state structures its tax system. It is concerned with the how, not the how much, of state revenue, because there are better and worse ways to levy taxes.

4 min read

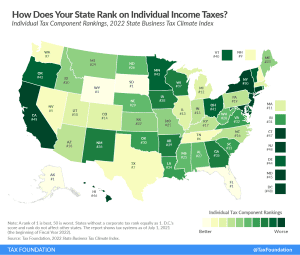

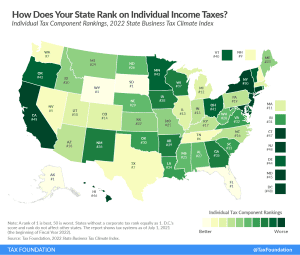

Individual income taxes are a major source of state government revenue, accounting for more than a third of state tax collections:

28 min read

While many factors influence business location and investment decisions, sales taxes are something within policymakers’ control that can have immediate impacts.

12 min read

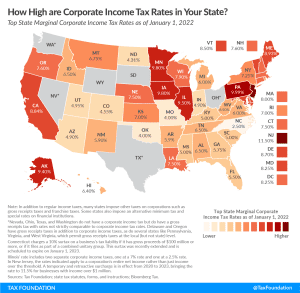

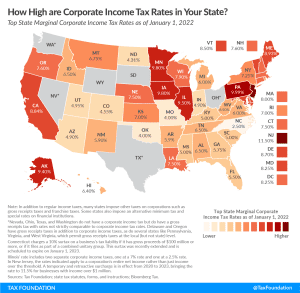

Forty-four states levy a corporate income tax. Rates range from 2.5 percent in North Carolina to 11.5 percent in New Jersey.

8 min read

Well-designed Net Operating Loss (NOL) provisions benefit the economy by smoothing business income, which mitigates entrepreneurial risk and helps firms survive economic downturns.

24 min read

Twenty-one states and D.C. had significant tax changes take effect on January 1, including five states that cut individual income taxes and four states that saw corporate income tax rates decrease.

17 min read