How Do Taxes Affect Interstate Migration?

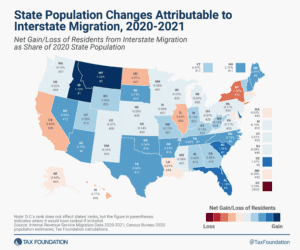

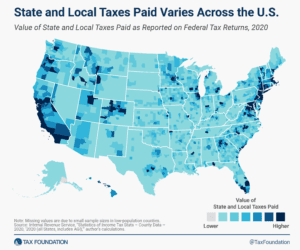

The latest IRS and Census data show that people and businesses favor states with low and structurally sound tax systems, which can impact the state’s economic growth and governmental coffers.

7 min readHow does Georgia’s tax code compare? Georgia has a flat 5.49 percent individual income tax rate. Georgia has a 5.75 percent corporate income tax rate. Georgia also has a 4.00 percent state sales tax rate and an average combined state and local sales tax rate of 7.38 percent. Georgia has a 0.72 percent effective property tax rate on owner-occupied housing value.

Georgia does not have an estate tax or inheritance tax. Georgia also has a 33.05 cents per gallon gas tax rate and a $0.37 cigarette excise tax rate. The State of Georgia collects $4,551 in state and local tax collections per capita. Georgia has $5,730 in state and local debt per capita and has a 76 percent funded ratio of public pension plans. Overall, Georgia’s tax system ranks 32nd on our 2024 State Business Tax Climate Index.

Each state’s tax code is a multifaceted system with many moving parts, and Georgia is no exception. The first step towards understanding Georgia’s tax code is knowing the basics. How does Georgia collect tax revenue? Click the tabs below to learn more! You can also explore our state tax maps, which are compiled from our annual publication, Facts & Figures 2024: How Does Your State Compare?

The latest IRS and Census data show that people and businesses favor states with low and structurally sound tax systems, which can impact the state’s economic growth and governmental coffers.

7 min read

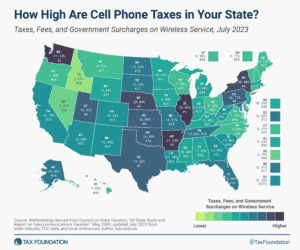

To alleviate the regressive impact on wireless consumers, states should examine their existing communications tax structures and consider policies that transition their tax systems away from narrowly based wireless taxes and toward broad-based tax sources.

18 min read

What do The Rolling Stones, NFL star Tyreek Hill, and Maryland millionaires have in common? They all moved because of taxes.

4 min read

In recognition of the fact that there are better and worse ways to raise revenue, our Index focuses on how state tax revenue is raised, not how much. The rankings, therefore, reflect how well states structure their tax systems.

111 min read

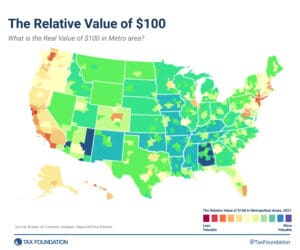

The differences in purchasing power can be large and they have significant implications for the relative impact of economic and tax policies across the United States.

3 min read

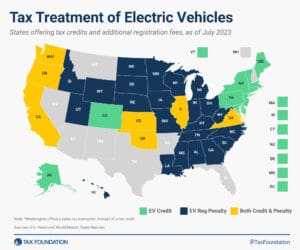

The state EV taxation landscape reflects the evolving transportation sector and the pressing need to address both fiscal gaps in road funding and environmental concerns.

4 min read

Any move to repeal the cap or enhance the deduction would disproportionately benefit higher earners, making the tax code more regressive.

5 min read

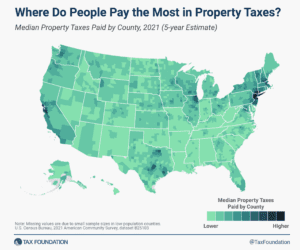

Property taxes are the primary tool for financing local governments and generate a significant share of state and local revenues.

6 min read

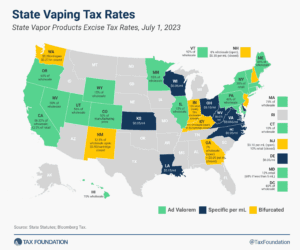

If the policy goal of taxing cigarettes is to encourage cessation, vapor taxation must be considered a part of that policy design.

3 min read