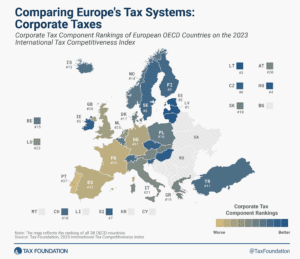

Comparing Europe’s Tax Systems: Corporate Taxes

According to the corporate tax component of the 2023 International Tax Competitiveness Index, Latvia and Estonia have the best corporate tax systems in the OECD.

3 min readCosta Rica ranks 21st overall on the 2024 International Tax Competitiveness Index, one place better than in 2023.

How does Costa Rica raise tax revenue? Explore the latest data regarding corporate taxes, individual taxes, consumption taxes, property taxes, and international taxes in Costa Rica below.

The Tax Foundation' s International Tax Competitiveness Index (ITCI) measures the degree to which the 38 OECD countries' tax systems promote competitiveness through low tax burdens on business investment and neutrality through a well-structured tax code. The ITCI considers more than 40 variables across five categories: Corporate Taxes, Individual Taxes, Consumption Taxes, Property Taxes, and International Tax Rules.

The ITCI attempts to display not only which countries provide the best tax environment for investment but also the best tax environment for workers and businesses.

According to the corporate tax component of the 2023 International Tax Competitiveness Index, Latvia and Estonia have the best corporate tax systems in the OECD.

3 min read

The variety of approaches to taxation among European countries creates a need to evaluate these systems relative to each other. For that purpose, we have developed the European Tax Policy Scorecard—a relative comparison of European countries’ tax systems.

52 min read

While there are many factors that affect a country’s economic performance, taxes play an important role. A well-structured tax code is easy for taxpayers to comply with and can promote economic development while raising sufficient revenue for a government’s priorities.

88 min read

The global minimum tax agreement known as Pillar Two is intended to curb profit shifting. However, OECD countries already have a variety of mechanisms in place that seek to prevent base erosion and profit shifting by multinational corporations.

40 min read

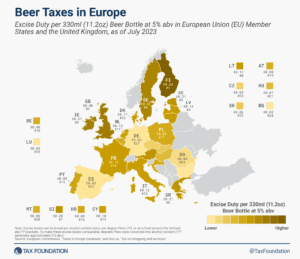

As Oktoberfest celebrations kick off around the world, let’s look at how much tax European Union (EU) countries add to the world’s favorite alcoholic beverage.

2 min read

Enhancing the European Union’s competitiveness is necessary, but the European Commission’s latest attempt is the wrong approach.

4 min read

When designed well, excise taxes discourage the consumption of products that create external harm and generate revenue for funding services that ameliorate social costs. The effectiveness of excise tax policy depends on the appropriate selection of the tax base and tax rate, as well as the efficient use of revenues.

83 min read

To recover from the pandemic and put the global economy on a trajectory for growth, policymakers need to aim for more generous and permanent capital allowances. This will spur real investment and can also contribute to more environmentally friendly production across the globe.

33 min read

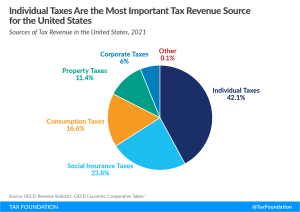

Designing tax policy in a way that sustainably finances government activities while minimizing distortions is important for supporting a productive economy.

5 min read

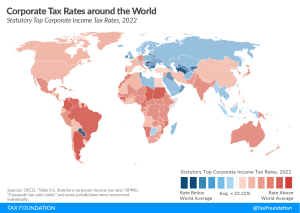

A new report shows that corporate tax rates around the world continue to level off. “We aren’t seeing a race to the bottom, we’re seeing a race toward the middle,” said Sean Bray, EU policy analyst at the Tax Foundation.

25 min read