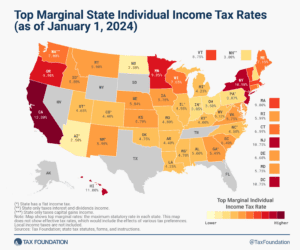

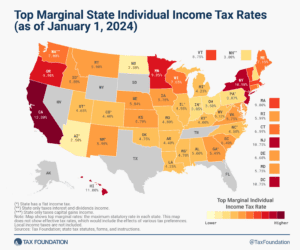

State Individual Income Tax Rates and Brackets, 2024

Individual income taxes are a major source of state government revenue, accounting for more than a third of state tax collections. How do income taxes compare in your state?

8 min readHow does California’s tax code compare? California has a graduated state individual income tax, with rates ranging from 1.00 percent to 13.30 percent. California has a 8.84 percent corporate income tax rate. California has a 7.25 percent state sales tax rate, a max local sales tax rate of 4.75 percent, and an average combined state and local sales tax rate of 8.85 percent. California has the highest gas tax rate in the nation at 77.90 cents per gallon. California’s tax system ranks 48th overall on our 2024 State Business Tax Climate Index.

Each state’s tax code is a multifaceted system with many moving parts, and California is no exception. The first step towards understanding California’s tax code is knowing the basics. How does California collect tax revenue? Click the tabs below to learn more! You can also explore our state tax maps, which are compiled from our annual publication, Facts & Figures: How Does Your State Compare?

Individual income taxes are a major source of state government revenue, accounting for more than a third of state tax collections. How do income taxes compare in your state?

8 min read

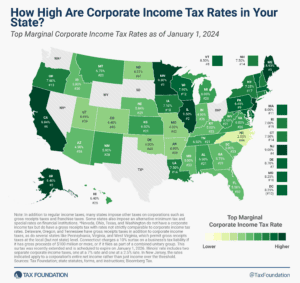

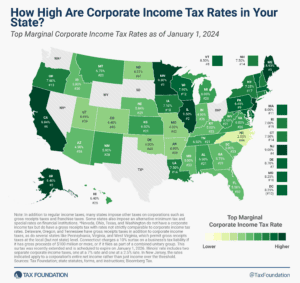

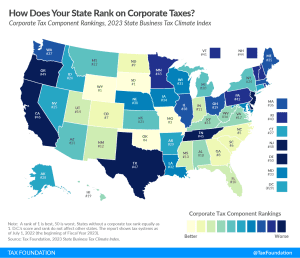

Graduated corporate rates are inequitable—that is, the size of a corporation bears no necessary relation to the income levels of the owners.

7 min read

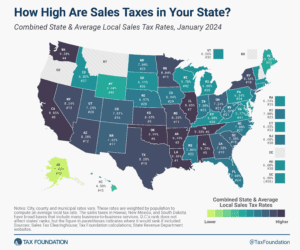

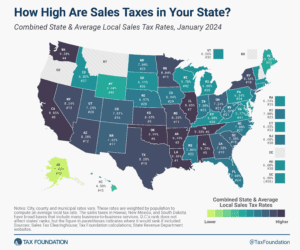

Retail sales taxes are an essential part of most states’ revenue toolkits, responsible for 32 percent of state tax collections and 13 percent of local tax collections (24 percent of combined collections).

9 min read

Facts & Figures serves as a one-stop state tax data resource that compares all 50 states on over 40 measures of tax rates, collections, burdens, and more.

2 min read

In recognition of the fact that there are better and worse ways to raise revenue, our Index focuses on how state tax revenue is raised, not how much. The rankings, therefore, reflect how well states structure their tax systems.

111 min read

The mix of tax sources states choose can have important implications for both revenue stability and economic growth, and the many variations across states are indicative of the different ways states weigh competing policy goals.

29 min read

Most of the 2023 state tax changes represent net tax reductions, the result of an unprecedented wave of rate reductions and other tax cuts in the past two years as states respond to burgeoning revenues, greater tax competition in an era of enhanced mobility, and the impact of high inflation on residents.

20 min read

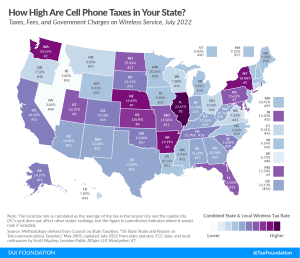

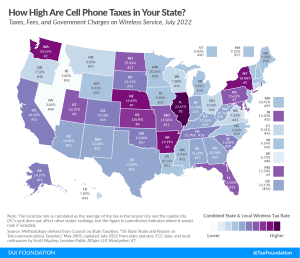

While the wireless market has become increasingly competitive in recent years, resulting in steady declines in the average price for wireless services, the price reduction for consumers has been partially offset by higher taxes.

41 min read

The logic that has prevailed for local sales taxes should apply equally to other taxes that localities impose on multijurisdictional businesses, including local tourism taxes. The evidence is clear that central administration of local taxes reduces compliance costs without sacrificing local revenue.

15 min read

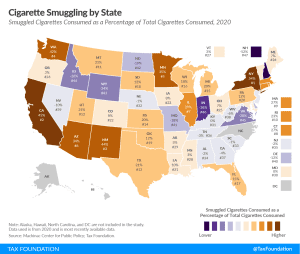

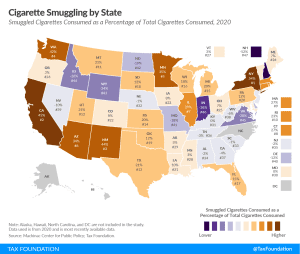

People respond to incentives. As tax rates increase or products are banned from sale, consumers and producers search for ways around these penalties and restrictions.

19 min read

In times of high inflation, states should consider adopting permanent full expensing because it boosts long-run productivity, economic output, and wages.

7 min read

All corporate income taxes fall on capital investment, but the structure should not make matters worse, and policymakers should take care not to distort investment decisions through the use of targeted incentives for select firms or activities instead of a lower rate for all businesses.

2 min read

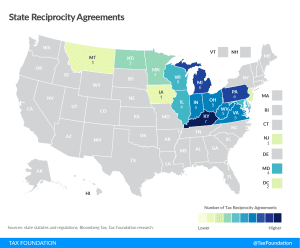

Remote and flexible work opportunities are here to stay, whether states like it or not. With enhanced opportunities to take their job with them wherever they please, more workers can factor tax burdens into their decision of where to live.

15 min read

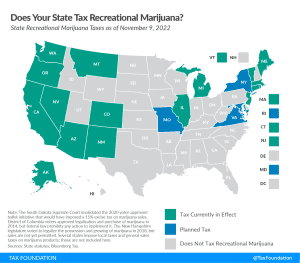

Recreational marijuana taxation is one of the hottest policy issues in the U.S. Currently, 19 states have implemented legislation to legalize and tax recreational marijuana sales.

5 min read

While there are many ways to show how much is collected in taxes by state governments, our Index is designed to show how well states structure their tax systems by focusing on the how more than the how much in recognition of the fact that there are better and worse ways to raise revenue.

129 min read

From income tax changes to cannabis legalization and taxation, here’s what voters decided on Election Day.

1 min read