Neutral Cost Recovery Is Not a New Idea

As stated by Rep. Jack Kemp in 1985, “Neutral cost recovery is designed to provide the present value of investment expensing without some of its practical problems.”

5 min read

As stated by Rep. Jack Kemp in 1985, “Neutral cost recovery is designed to provide the present value of investment expensing without some of its practical problems.”

5 min read

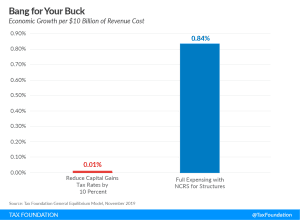

The Tax Foundation’s General Equilibrium Model suggests that allowing businesses to immediately deduct or “expense” their capital investments in the year in which they are purchased delivers the biggest bang for the buck in spurring economic growth and jobs compared to other tax policies.

7 min read

State recovery plans should lessen the burden on businesses by shifting from capital stock taxes and other taxes that are charged regardless of profitability. Louisiana does well to target its Corporation Franchise Tax, a burdensome tax that would target businesses that may already be struggling.

2 min read

Improving the tax treatment of structures is one of the most cost-effective tax policy changes available to lawmakers as they consider how to remove investment barriers in the tax code to hasten the economic recovery. Policymakers must weigh the trade-offs among long-run economic output goals, revenue constraints, and the existing stock of structures.

13 min read

The HEROES Act, the $3 trillion relief package proposed by House Democrats, is the first bid to provide additional phase 4 aid for businesses and individuals amid the coronavirus pandemic.

7 min read

Revenue shortfalls and deficits can be addressed best by considering when to consider the deficit as the primary priority and reevaluating how revenue can be raised most efficiently through sound tax policy principles.

5 min read

Although the U.S. has a progressive tax system and a relatively low tax burden compared to the OECD average, average-wage workers still pay about 30 percent of their wages in taxes.

15 min read

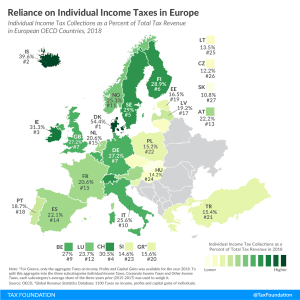

While the current crisis has caused consumption to drop dramatically, it is generally true that income taxes are more volatile than consumption taxes in an economic downturn and income taxes tend to be more harmful to economic growth than consumption taxes and property taxes.

3 min read

The HEROES Act, proposed by House Democrats as a next round of fiscal relief during the coronavirus outbreak, contains about $1.08 trillion in aid to states and localities. That would bring the pandemic total to $1.63 trillion—an amount so large that it might overwhelm their ability to spend it and could reward fiscal irresponsibility.

8 min read

The HEROES Act would provide more than $1 trillion to state and local governments. Here’s how funding would be distributed and provisional estimates of how much aid each state would receive.

5 min read

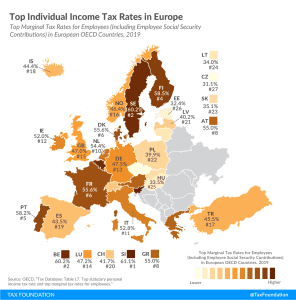

A higher tax burden on labor often leads to lower employment rates and wages. That’s important for policymakers to remember as they look for ways to help their economies recover from coronavirus-induced shutdowns. If their goal is to encourage employment, policies that lower the tax burden on labor could prove a powerful tool.

20 min read

The COVID-19 pandemic and accompanying economic downturn will wreak havoc on state and local tax revenues, with projections of a 15-20 percent decline in state revenues. Our new report provides a framework for how to design an effective state and local relief package.

35 min read

Other countries have shown that providing deductions in line with invested capital costs can have positive impacts both on investment and on debt bias.

7 min read

Alabama and Missouri are considering excluding the CARES Act Economic Impact Payments from being taxed and exclude them from state income tax calculations.

2 min read

Gov. Hogan vetoed a proposed first-in-the-nation digital advertising tax that would have imposed rates of up to 10 percent on digital advertising served to Marylanders.

3 min read

What challenges should we expect to face as the U.S. economy begins to re-open? When is the right time for legislators to start focusing on long-term recovery vs. short-term needs? What policies should federal legislators pursue to clear a path to recovery?

1 min read

Policymakers will have to consider design options for accelerating NOL deductions to ensure the refunds are simple, provide targeted relief to struggling firms, and are consistent with long-run revenue needs.

17 min read

When considering long-term policies for increasing long-run levels of investment and economic growth, full expensing and neutral cost recovery are better targeted than policies like a capital gains cut.

6 min read