In the midst of corporate earnings season on Wall Street, the major domestic oil companies continue to report record profits. If the media attention to the sizeable profits from the third quarter of 2005 is any indicator, the new earnings reports will be met with equal vigilance.

Scrutiny over third-quarter profits sparked action from lawmakers to increase taxes on the oil industry. Legislation was drafted to create a federal windfall profits taxA windfall profits tax is a one-time surtax levied on a company or industry when economic conditions result in large and unexpected profits. Historically, such taxes have targeted oil and energy companies when costs have risen, especially from war or other crises. , and states, such as California, are now considering instituting their own windfall profits taxes. On the federal level, several provisions aimed at the oil industry have gained traction. For instance, measures to disallow some use of foreign taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. credits and “last in, first out” (LIFO) accounting methods have received support in Congress. These measures represent an indirect attempt to raise taxes on the domestic energy industry.

In the past week, quarterly earnings were announced for the three largest integrated oil and gas producers in the nation. The most recent media attention is directed towards the earnings report from Exxon Mobil. (NYSE:XOM) These earnings come on the heels of last week’s announcements by ConocoPhillips (NYSE: COP) and Chevron (NYSE: CVX) Based on preliminary SEC filings, these companies reported combined annual corporate gross earnings of $108.2 billion, throughout the course of 2005.

It is important to remember that net income reported on financial statements, is the result of subtracting income-based taxes from corporate gross earnings. Before shareholders receive a return on their investment, the government takes its significant share off the top.

During 2005, these three companies paid a combined corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. burden of $44.3 billion on their reported gross earnings. Compared to last year’s combined corporate income taxes of $29.7 billion, their burden for 2005 has increased by 49.2 percent and follows the overall trend of escalating corporate tax collections in the United States. In addition to corporate income taxes, the same companies paid or remitted over $114.5 billion in other taxes in 2005, including franchise, payroll, property, severance and excise taxes.

When the federal statutory corporate income tax rate of 35 percent is added to the weighted average of state corporate income taxes, the resulting rate of 39.3 percent means that corporations in the United States are currently at an international competitive disadvantage. In fact, as recent research has indicated, the top combined state and federal statutory corporate income tax in the U.S. is higher than any other country in the OECD.

Furthermore, the average effective tax rate on the major integrated oil and gas industry is estimated to equal 38.3 percent. This exceeds the estimated average effective tax rate of 32.3 percent for the market as a whole.

The magnitude of these tax payments made by US corporations raises the question of tax incidenceTax incidence is a measure of who bears the legal or economic burden of a tax. Legal incidence identifies who is responsible for paying a tax while economic incidence identifies who bears the cost of tax—in the form of higher prices for consumers, lower wages for workers, or lower returns for shareholders. . In other words, who bears the burden of taxes on the domestic oil industry? Every dollar a corporation spends, whether on taxes or anything else, eventually comes out of the pockets of individuals, specifically three groups of individuals: the corporation’s shareholders, in the form of decreased capital gains and dividends; its workers, in the form of lower wages; or its customers, in the form of higher prices.

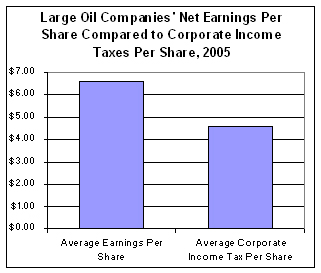

If corporate income taxes are passed on to the shareholders, we estimate the corporate income tax per share of Conoco Phillips stock was $7.11 in 2005. If that amount is averaged together with the tax per share of Chevron stock of $5.18 and $3.80 tax per share of Exxon Mobil stock, the combined tax per share for an investor holding these three companies averaged $4.58 for 2005.

If the corporate income tax burden is entirely borne by their employees, the tax ranges from $198,179 per Chevron employee, to $276,732 per employee at ConocoPhillips in 2005. It is important to note that these calculations are exclusively based on corporate income taxes paid and neglect the vast assortment of additional taxes previously noted.

Conversely, if the corporate income taxes are passed on to American consumers, we all share in the burden by paying higher prices on products—most notably a higher price of gasoline at the pump. The debate over who ends up paying the bulk of corporate taxes is far from conclusive, but the undisputed and most significant fact is that corporations do not pay taxes; people do.

Table 1. ConocoPhillips, Chevron and Exxon Mobil’s 2005 Profits in Perspective

| Company | Income Before Income Taxes ($ billions) | Corporate Income Tax ($ billions) | Net Income ($ billions) | Effective Corporate Tax Rate | Earnings Per Share | Corporate Income Tax Per Share | Corporate Income Tax Per Employee |

|---|---|---|---|---|---|---|---|

| ConocoPhillips | $23.5 | $9.9 | $13.5 | 42.1% | $9.71 | $7.11 | $276,732 |

| Chevron | $25.2 | $11.1 | $14.1 | 44.0% | $6.58 | $5.18 | $198,179 |

| Exxon Mobil | $59.4 | $23.3 | $36.1 | 39.2% | $5.76 | $3.80 | $271,269 |

| Total | $108.2 | $44.3 | $63.8 | 41.0% | $6.59 | $4.58 | $249,336 |

| Source: U.S. Securities and Exchange Commission, Hoover’s Inc., Tax Foundation. | |||||||